Can an SMSF reimburse a member for establishment costs if the member used their personal funds to set up the SMSF?

Yes, an SMSF can generally reimburse a member for establishment costs that were initially paid out of their personal funds—provided that the reimbursement is for legitimate trustee expenses and there are no restrictions in the fund’s trust deed preventing it. These establishment costs typically include expenses such as the preparation of the trust deed, incorporation […]

Can I Buy a Car in My Trust and Claim a Tax Deduction for It?

Yes, you can purchase a car in the name of your trust. However, whether you can claim a tax deduction for it is not a straightforward answer. It depends on how the car is used and the nature of your trust’s activities. What Does Your Trust Do? 🔹 Investment Trust (Property or Shares): If your trust […]

It is important to note that the land tax amount is not deductible in the year you pay it. Instead, deductions must be taken in the respective income years to which the land tax liabilities related to. It’s crucial to understand that your liability for land tax is determined by the usage of the property within a given year, regardless of when the tax assessment is actually issued.

When you pay land tax for past years (known as paying “in arrears”), you can’t deduct this payment from your income for the year in which you make the payment. Instead, you can only claim a deduction for the land tax in the years that the tax was originally due for.

For an example – Imagine it’s 2024, and John receives a bill for land tax for the years 2022 and 2023 that he hasn’t paid yet. Even though John pays this bill in 2024, he can’t claim the deduction on his 2024 tax return. Instead, he should claim the deduction for the 2022 land tax on his 2022 tax return, and the deduction for the 2023 land tax on his 2023 tax return, because those are the years the tax relates to, even though he paid it later.

You are eligible to deduct expenses including interest on loans, local council, water and sewerage rates, land taxes, and emergency services levies incurred during the period of renovating a property intended for rental. It’s important to note, however, that your eligibility for these deductions ceases once your intentions for the property change, such as deciding to use it for personal purposes instead.

According to GSTR 2012/6 Airbnb doesn’t fall under commercial residential premises. The definition of ‘commercial residential premises’ in section 195-1 includes the following seven paragraphs, none of which indicate anything similar to Airbnb. This distinction is crucial for understanding the regulatory and tax implications associated with offering or operating Airbnb properties.

- a hotel, motel, inn, hostel or boarding house.

- premises used to provide accommodation in connection with a school;

- a ship that is mainly let out on hire in the ordinary course of a business of letting ships out on hire.

- a ship that is mainly used for entertainment or transport in the ordinary course of a business of providing ships for entertainment or transport.

- a marina at which one or more of the berths are occupied, or are to be occupied, by ships used as residences.

- a caravan park or a camping ground; or

- anything similar to residential premises described in paragraphs (a) to (e).

Check out our Comprehensive Guide To Converting Your Long-Term Investment Property To Airbnb Or Short-Term Rental for further information.

Reference – https://www8.austlii.edu.au/au/other/rulings/ato/ATOGSTR/2012/GSTR20126.pdf

The goods and services tax (GST) does not apply to residential rents, so Airbnb hosts do not have to pay it. This also means that you can’t get a GST credit for the costs that go along with it. This is applied even if your sales are more than $75,000, which is the GST threshold.

Please check feel free to check out our Tax Consequence guide for Airbnb.

Yes, you can purchase a car in the name of your trust. However, whether you can claim a tax deduction for it is not a straightforward answer. It depends on how the car is used and the nature of your trust’s activities.

What Does Your Trust Do?

🔹 Investment Trust (Property or Shares):

If your trust is primarily used for passive income activities, such as holding rental properties or shares, then there is no clear business connection to justify claiming tax deductions for the vehicle. In this case, the car is likely to be used for personal purposes, which means deductions are generally not allowed.

🔹 Active Business Trust:

If the trust actively operates a business—such as a consulting firm, construction company, or retail store—then there may be a valid business reason for purchasing the vehicle. In this case, tax deductions may be available, provided the car is genuinely used for business purposes.

Fringe Benefits Tax (FBT) Considerations

Owning a personal-use vehicle in a trust can sometimes create additional tax reporting requirements because Fringe Benefits Tax (FBT) may apply.

If the trust provides a car to a trustee, employee, or beneficiary for personal use, the trust may be liable for FBT. This tax applies when a vehicle is used for non-business purposes, and it can significantly impact the overall tax benefit.

Starting your investment journey, whether as an employee or a business owner, requires careful consideration of two critical aspects: tax planning and asset protection. These are not just checkboxes on a list; they are foundational pillars that seasoned investors prioritise from the outset. The goal is not merely to accumulate assets but to do so in a way that ensures their longevity and protection.

Asset protection is all about creating a secure environment for your investments. It’s the practice of arranging your assets in a way that minimizes the risk of loss, whether through legal challenges, business debts, or other financial liabilities. The essence of asset protection lies in the foresight to anticipate potential risks and to structure your investments in a way that those risks are mitigated before they can even arise.

Transferring existing property and assets to a trust or company for asset protection purposes is possible, but it must be done carefully and in compliance with the law. Such transfers can have tax consequences, including capital gains tax (CGT) and stamp duty. CGT may apply if the transfer results in a capital gain, and stamp duty may be levied depending on your jurisdiction. Additionally, anti-avoidance provisions are in place to prevent tax evasion through asset transfers. It’s crucial to seek legal and tax advice before proceeding to understand the implications and ensure compliance with tax laws and regulations. Each case is unique, and a tailored approach is essential to address both asset protection and tax considerations.

The 5-year clawback period, often associated with bankruptcy law, refers to a period of time preceding a debtor’s bankruptcy filing, typically starting from the date of the bankruptcy filing. During this period, a bankruptcy trustee has the authority to review, and potentially reverse certain transactions made by the debtor, such as preferential payments to specific creditors or fraudulent asset transfers. The purpose is to prevent debtors from attempting to shield assets from creditors by engaging in questionable financial transactions shortly before declaring bankruptcy.

While it is possible to transfer properties and assets to a trust or a company, doing so with the intent to evade legitimate creditors or legal claims can have serious legal consequences. Transfers made with the intent to hinder, delay, or defraud creditors are typically considered fraudulent and can be challenged by creditors or the court. Australia, like many jurisdictions, has laws in place to prevent fraudulent asset transfers. It’s essential to consult with legal professionals to ensure any asset protection or restructuring measures are done within the bounds of the law and do not violate legal obligations to creditors or the court.

No, asset protection strategies cannot provide absolute protection from all types of legal claims or creditors. Certain legal claims, such as child support, alimony, or government obligations, may not be shielded by asset protection measures. Additionally, fraudulent or improper transfers intended to evade legitimate creditors can be challenged and deemed ineffective. Asset protection is best used as a proactive strategy to minimize risks rather than as a guarantee against all possible legal challenges. Consultation with legal and financial experts is crucial for tailored asset protection planning.

Asset protection is entirely legal when done within the boundaries of the law and regulatory requirements. It involves prudent financial planning and the use of legal mechanisms to protect assets from unforeseen risks. Engaging in fraudulent activities or hiding assets to evade legitimate creditors is illegal and can result in severe legal consequences.

Asset protection refers to strategies and legal mechanisms investors and businesses use to safeguard their assets from potential creditors, lawsuits, or financial risks. It’s crucial because it helps protect your hard-earned assets from being seized or depleted in the event of legal disputes, bankruptcy, or unforeseen financial challenges, ensuring the preservation of your wealth.

A Bare Trust is essential when a Self-Managed Super Fund (SMSF) borrows money to buy a property, creating a structure that separates the property from other assets in the SMSF. This setup, known as a Limited Recourse Borrowing Arrangement (LRBA), ensures that the lender’s recourse is limited only to the property purchased with the borrowed funds, safeguarding the remaining SMSF assets. By law, a Bare Trust is required to facilitate this protective arrangement, as it legally holds the property on behalf of the SMSF.

Beyond regulatory compliance, a Bare Trust adds a critical layer of asset protection. Should any issues or claims arise related to the loan or property, only the property within the Bare Trust is at risk, protecting the other assets within the SMSF from potential legal or financial complications. This structure not only adheres to SMSF borrowing laws but also aligns with the long-term goals of SMSF investors seeking both growth and security in their property investments.

A bare trust in a Self-Managed Super Fund (SMSF) is a popular structure used to hold an asset, typically a property, when a SMSF implements a Limited Recourse Borrowing Arrangement (LRBA) strategy. A bare trust is a fundamental form of trust arrangement where a trustee is designated to hold property or assets solely on behalf of a clearly identified beneficiary. In this instance, the Self-Managed Super Fund (SMSF) is the ultimate beneficiary. In this type of trust arrangement, the trustee’s role is notably minimal and straightforward, primarily involving the safeguarding and eventual transfer of the trust property to the beneficiary once the loan is paid off, upon the beneficiary’s request.

The trustee, in this context, does not possess discretionary powers or extensive duties beyond this basic obligation. The essence of a bare trust lies in the absolute entitlement of the beneficiary’s’ to both the capital and the income generated by the trust’s assets. For CGT purposes, any disposal of the assets of the trust by a bare trustee will be treated as a disposal by the beneficiary i.e. the SMSF.

Source – ATO – Absolute entitlement

Yes, there are rules and restrictions to be aware of:

• The property held in the Bare Trust must meet the sole purpose test of providing retirement benefits to SMSF members.

• The Bare Trust cannot hold more than one property

• The Bare Trust must not be used for any purpose other than holding the property for the SMSF.

• The SMSF is the only entity that can benefit from the property held in the Bare Trust.

A Bare Trust, often used in Self-Managed Super Fund (SMSF) property investments, is a legal arrangement where a trustee holds property or assets on behalf of the SMSF. It is a transparent trust structure where the SMSF holds the beneficial ownership of the property, while the Bare Trustee holds the legal title.

Choosing a company or trust structure for your business over a sole trader or partnership offers several advantages. These structures provide limited liability, protecting your personal assets from business debts, making them appealing for risk management. Trusts, particularly discretionary trusts, offer tax efficiency through income distribution among beneficiaries. They also serve well for asset protection and estate planning, allowing for the orderly transfer of assets. Companies, with separate tax rates and perpetual existence, are attractive to investors and convey professionalism, while also facilitating business continuity and scalability. Depending on your specific business goals, legal requirements, and financial situation, consulting with experts such as accountants or legal advisors can help determine the most suitable structure for your needs.

When Australian residents (for tax purposes) sell property valued at $750,000 or more and don’t provide a clearance certificate by settlement, 12.5% of the property purchase price must be withheld by the purchaser and paid to the ATO. This is known as the Foreign Resident Capital Gains Withholding (FRCGW) amount.

To avoid this withholding, Australian residents must obtain a ‘clearance certificate’ to prove they are not foreign residents. It is the vendor’s responsibility to secure the clearance certificate and provide it to the purchaser at or before settlement. To prevent any unforeseen delays and ensure the certificate is valid when presented to the purchaser, vendors should apply for the clearance certificate through the online form as early as possible in the sale process.

The main reasons a clearance certificate hasn’t been obtained before the settlement date are because clients:

- Don’t allow enough time to make an application before settlement (the standard processing time is 28 days).

- Have tax records that aren’t up to date.

- Haven’t needed to lodge tax returns for several years (e.g., when returns were not necessary).

If this happens to you, you must lodge a tax return to claim the credit that was withheld, even if your income is below the threshold to lodge. Obtain the ‘payment confirmation’ from the purchaser. When completing the tax return, be sure to:

- Declare your Australian assessable income, including any capital gain or loss from the disposal of the asset.

- Claim a ‘Credit for foreign resident capital gains withholding amounts’ taken from the sale proceeds.

The withheld amount will be refunded in full if:

- There are no tax debts.

- There’s no CGT payable on the sale of the property.

No, you cannot claim a full Capital Gains Tax (CGT) exemption if you purchase a home with an existing lease agreement. Your primary residence is typically exempt from capital gains tax (CGT). For CGT purposes, this exemption applies from the time you acquire your home, as long as you move in as soon as practicable.

There are specific circumstances that can affect when your property qualifies as your main residence for CGT purposes:

- Delays Due to Illness or Unforeseen Circumstances: If moving in is delayed due to illness or other unexpected events, your home remains exempt from CGT, provided you move in as soon as the cause of the delay is resolved (e.g., upon recovery from illness).

- Property Rented to Someone Else: If you cannot move in immediately because the property is rented out, it will not be considered your main residence until you actually move in.

- Owning Two Homes: If you buy a new home before selling your old one, you can designate both properties as your main residence for up to 6 months.

Example:

Emily signed a contract to buy a house in February. She took possession when settlement occurred in March.

We have provided two different scenarios below to explain what is considered practicable after settlement.

Scenario 1: Moving in as soon as practicable due to interstate work assignment

In early March, Emily’s employer assigned her to an interstate project for 5 months. She moved into the house when she returned in August.

Emily’s interstate assignment was unforeseen at the time she bought the house. She moved in as soon as practicable after the settlement of the contract. Therefore, she can treat the house as her main residence from the date she acquired it.

Scenario 2: Not practicable due to tenancy agreement

Alternatively, the house had an existing tenancy agreement that would not end until September, 6 months after the settlement. Due to this tenancy agreement, Emily could not move into the house until the lease ended in September.

In this case, Emily cannot treat the house as her main residence until she moves in. The property will only be exempt from CGT from the time she actually moves in, as it was not practicable for her to move in due to the existing tenancy agreement.

For Capital Gains Tax (CGT) purposes, your home qualifies for the main residence exemption from the time you acquire it, provided you move in as soon as practicable.

If you acquire a new home before you dispose of your old one, you can treat both properties as your main residence for up to 6 months under certain conditions.

You can claim this exemption if all of the following are true:

- You lived in your old home as your main residence for a continuous period of at least 3 months in the 12 months before you disposed of it.

- You did not use your old home to produce income (such as rent) during any part of that 12 months when it was not your main residence.

- The new property becomes your main residence.

If it takes longer than 6 months to dispose of your old home, the main residence exemption applies to both homes only for the last 6 months before you dispose of your old home. For the period before this, when you owned both homes, you can choose which home to treat as your main residence. The other property will be subject to CGT for that period.

Reference :

ATO – Moving to a new main residence

Transferring 50% Property: Navigate Capital Gian Tax Impact

When you sell, transfer, or gift a portion of your investment property to your spouse or partner, you are subject to capital gains tax. However, an exception exists: if the transfer involves your Principal Place of Residence (PPOR), you are exempt from capital gains tax obligations.

Empty Home Revival: Selling After 6 Years – Unleash CGT

If you are not treating any other property as your Principal Place of Residence (PPOR), you can continue to treat this property as your primary residence indefinitely after you have stopped residing in it.

Empower Your Quest: CGT Concession in Small Business

You are considered a CGT Concession Stakeholder in a company or trust if you are:

- A significant individual in that company or trust.

- The spouse of a significant individual and have a small but more than zero percent stake in the company or trust.

You can own this stake either directly or through other entities. To calculate your stake, use the same method as the significant individual test.

You’re a significant individual in a company or trust if you own at least 20% of it. This 20% can include both your direct ownership and indirect ownership through other entities.

Special Note – A spouse of a significant individual must have a participation percentage greater than zero in the business entity.

Small Business CGT Concession and Roll-Over Rules:

CGT Event J5 occurs if, after choosing a roll-over for a capital gain, you haven’t acquired a new asset or improved an existing one by the end of the allotted time. Additionally, this event happens if:

- The new or improved asset isn’t actively used in your business anymore (like if you’ve sold it, it’s now part of your trading stock, or it’s no longer used in your business operations).

- If the new asset is a share in a company or a trust interest, and it fails the 80% test (unless this failure is only temporary).

- You or a related entity aren’t significant stakeholders in the company or trust.

- The stakeholders in the company or trust don’t have a significant (at least 90%) investment in your business. When CGT Event J5 happens, you’ll have to recognize a capital gain. This is the same amount you initially didn’t have to pay tax on because of the small business roll-over. The capital gain is counted at the end of the time you were supposed to get or improve the asset.

Example: CGT event J5

In September 2020, Luke made a capital gain of $80,000 on an active asset. He met the maximum net asset value test.

Luke disregarded the whole capital gain under the small business roll-over.

In September 2022 (the end of the 2-year period), Luke did not have any replacement or capital improved assets. CGT event J5 happens, and Luke makes a capital gain of $80,000 in September 2022.

Source – ATO/ Small Business Rollover

While you can technically sell a property for $1, several crucial considerations apply. Tax authorities and legal entities typically assess property transactions based on market value, potentially resulting in tax obligations based on the property’s actual worth, despite the nominal sale price. Stamp duty, capital gains tax, and legal and financial implications, particularly if there are existing mortgages or loans, should be thoroughly evaluated.

Capital gains in Australia are subject to taxation under the Capital Gains Tax (CGT) regime. If you’ve owned the asset for over 12 months, you may qualify for a 50% CGT discount on the gain, with the remaining 50% added to your taxable income and taxed at your marginal rate. Capital losses from other investments can offset capital gains, and any excess losses can be carried forward. There are exemptions for primary residences, concessions for small businesses, and different tax rates for superannuation funds. For accurate guidance in navigating the complexities of CGT, it’s advisable to consult a tax professional or accountant, such as Investax Accountants, as tax laws may change over time.

Capital gain is the financial profit realised when you sell or dispose of an asset, such as stocks, real estate, or valuable possessions, for an amount higher than the original purchase price. It represents the difference between the selling price (proceeds) and the cost basis (purchase price and any associated acquisition costs).

CGT is a tax on the profit made from the sale of an asset, including investment properties. If you sell an investment property for more than you paid for it, you may be subject to CGT. However, there are concessions and strategies available to minimize CGT, such as the 50% CGT discount for assets held longer than 12 months and the main residence exemption if the property was your main home for part of the time.

The rule that a company must have a public officer doesn’t come from the main company law, which is the Corporations Act 2001. Instead, it’s a tax rule. According to Section 252 of the Income Tax Assessment Act 1936, every company that does business in Australia or makes money from property in Australia needs to have a public officer. This public officer represents the company for all tax-related matters. The company itself, or someone with the proper authority from the company, must appoint this public officer.

A Director ID Number is a unique number given to an existing or intending director who has verified their identity with the Registrar. It is available via the Australian Business Registry Services (ABRS) website.

- A director ID is issued to a person forever.

- A person will keep their director ID even if they stop being a company director, change their name or move interstate or overseas.

- Director ID is being introduced to provide traceability of a director’s relationships over time, and across companies, to assist regulators and external administrators to investigate a director’s involvement in what may be repeated unlawful activity, including illegal phoenix activity.

- Both existing and new directors will need to apply.

No, you cannot increase your tax-deductible loan by using equity from your investment property to reduce your home loan. This is because you are essentially swapping security rather than creating a new deductible loan. The ATO determines tax deductibility based on the purpose of the borrowed funds, and repaying a home loan is considered a private expense.

Example:

Let’s say you own Property A, which is an investment property, and Property B, which is your home. You decide to refinance Property A to access equity and use those funds to pay down the mortgage on Property B. While the new loan on Property A is secured against an investment property, the funds are being used for a private purpose (paying off your home loan). Because of this, the interest on the refinanced loan would not be tax-deductible.

If you are considering refinancing or restructuring your loans, we recommend seeking professional advice from Investax Property Tax Specilists to ensure you maximise tax benefits while staying compliant with ATO regulations. Feel free to reach out to us for guidance.

Lenders Mortgage Insurance (LMI) is a one-off, non-refundable, and non-transferable premium added to your home loan. It is calculated based on the size of your deposit and the amount you borrow. The larger your contribution to the purchase price of your property, the lower the LMI cost will be.

Here are some key points about LMI:

- LMI is typically required if you borrow more than 80% of your home’s value.

- The insurance is designed to protect the lender, not the borrower.

- Arranging LMI is not your responsibility; your lender will handle it for you.

- Increasing your deposit can significantly reduce or even eliminate the need for LMI.

Refinancing:

Refinancing is the process of replacing an existing loan with a new one, typically to secure better terms or lower interest rates. You should consider refinancing when interest rates drop significantly, as it can potentially reduce your monthly payments, save money on interest over the life of the loan, or shorten the loan term to pay off debt faster. Additionally, refinancing may make sense if your credit score has improved since you originally obtained the loan, as this can lead to more favourable terms. However, it’s essential to weigh the costs associated with refinancing, including application fees, and closing costs, against the potential benefits to determine if it’s a financially sound decision.

To increase your likelihood of loan approval:

- Maintain a good credit score by making timely payments.

- Reduce existing debt and manage credit responsibly.

- Save for a down payment or collateral, if required.

- Provide accurate and complete financial documentation.

- Shop around for lenders and loan options.

- Consider a co-signer if your credit is weak.

- Address any discrepancies or issues on your credit report.

- Demonstrate a stable income and employment history.

Credit score:

A credit score is a numerical representation of your creditworthiness. It’s calculated based on your credit history, including factors like your payment history, credit utilisation, length of credit history, and more. Lenders use your credit score to assess the risk of lending to you. A higher credit score typically means better loan terms and lower interest rates, while a lower score might result in less favourable terms or loan denials. It’s crucial to monitor and maintain a good credit score to access affordable loans and financial opportunities.

Difference between fixed-rate and variable-rate loans:

Fixed-rate loans have a constant interest rate throughout the loan term, providing predictable monthly payments. Variable-rate loans, also known as adjustable-rate loans, have interest rates that can change periodically, typically tied to a benchmark index. Fixed-rate loans offer stability, while variable-rate loans may start with lower rates but come with the risk of higher payments if rates rise. The choice depends on your risk tolerance and market conditions

Why Choose a Mortgage Broker Over a Bank Loan?

You might opt to engage a mortgage broker rather than approaching a bank directly because brokers offer several valuable benefits. These independent professionals have access to numerous lenders and loan products, including those from banks, potentially providing you with more favourable terms and rates. Mortgage brokers simplify the loan shopping process, saving you time and effort by researching and comparing various lender offers. They also offer expert advice tailored to your financial situation and goals, helping you navigate complex mortgage terms and conditions. Additionally, brokers may negotiate with lenders on your behalf to secure better terms and can be particularly helpful if you have unique financial circumstances or credit challenges. Their flexibility and convenience in scheduling meetings make the application process smoother. While banks are a valid option, working with a mortgage broker can enhance your choices and provide expert guidance to find the best mortgage for your specific needs.

Refinancing is the process of replacing an existing loan with a new one, typically to secure better terms or lower interest rates. You should consider refinancing when interest rates drop significantly, as it can potentially reduce your monthly payments, save money on interest over the life of the loan, or shorten the loan term to pay off debt faster. Additionally, refinancing may make sense if your credit score has improved since you originally obtained the loan, as this can lead to more favourable terms. However, it’s essential to weigh the costs associated with refinancing, including application fees, and closing costs, against the potential benefits to determine if it’s a financially sound decision.

- To increase your likelihood of loan approval:

- Maintain a good credit score by making timely payments.

- Reduce existing debt and manage credit responsibly.

- Save for a down payment or collateral, if required.

- Provide accurate and complete financial documentation.

- Shop around for lenders and loan options.

- Consider a co-signer if your credit is weak.

- Address any discrepancies or issues on your credit report.

- Demonstrate a stable income and employment history.

A credit score is a numerical representation of your creditworthiness. It’s calculated based on your credit history, including factors like your payment history, credit utilisation, length of credit history, and more. Lenders use your credit score to assess the risk of lending to you. A higher credit score typically means better loan terms and lower interest rates, while a lower score might result in less favourable terms or loan denials. It’s crucial to monitor and maintain a good credit score to access affordable loans and financial opportunities.

Fixed-rate loans have a constant interest rate throughout the loan term, providing predictable monthly payments. Variable-rate loans, also known as adjustable-rate loans, have interest rates that can change periodically, typically tied to a benchmark index. Fixed-rate loans offer stability, while variable-rate loans may start with lower rates but come with the risk of higher payments if rates rise. The choice depends on your risk tolerance and market conditions

You might opt to engage a mortgage broker rather than approaching a bank directly because brokers offer several valuable benefits. These independent professionals have access to numerous lenders and loan products, including those from banks, potentially providing you with more favourable terms and rates. Mortgage brokers simplify the loan shopping process, saving you time and effort by researching and comparing various lender offers. They also offer expert advice tailored to your financial situation and goals, helping you navigate complex mortgage terms and conditions. Additionally, brokers may negotiate with lenders on your behalf to secure better terms and can be particularly helpful if you have unique financial circumstances or credit challenges. Their flexibility and convenience in scheduling meetings make the application process smoother. While banks are a valid option, working with a mortgage broker can enhance your choices and provide expert guidance to find the best mortgage for your specific needs.

If you are a foreign property owner in Australia, you are required to lodge a vacancy fee return for your residential property. It must be lodged annually within 30 days after the end of each vacancy year. This obligation applies to foreign investors who applied for property ownership after 9 May 2017 or purchased under a new or near-new dwelling exemption certificate. A foreign owner must lodge the return regardless of whether the property was occupied or rented.

A vacancy year is a 12-month period starting from the occupation day of the property, which is typically the settlement day for an established property or the day a certificate of occupancy is issued for a new one.

The vacancy fee applies if the property is not residentially occupied for at least 183 days or six months in a 12-month period. To be considered occupied, the dwelling must be either lived in by the owner or a relative, leased for a minimum of 30 days at a time, or genuinely available on the rental market at market rent. Short-term rentals (less than 30 days) do not count towards the 183-day requirement. If the return is not lodged on time, a vacancy fee may still apply, even if the property was occupied.

From 9 April 2024, the vacancy fee will be double the original foreign investment application fee. Some exemptions exist, such as if the property was undergoing substantial repairs, deemed unsafe, or if the owner was receiving long-term medical care. Owners must keep records for at least five years and update details if their foreign ownership status changes. Failure to comply can result in civil penalties or infringement notices from the Australian Taxation Office (ATO).

Australian citizens living abroad (expats) are not considered foreign owners, so they are not required to lodge a vacancy fee return.

Permanent residents (PRs) and New Zealand citizens with a Special Category Visa (Subclass 444) are also not classified as foreign owners, meaning they do not need to pay the vacancy fee.

Yes, even though you may not have permanent residency or citizenship in Australia, you will still be treated as an Australian resident for tax purposes. Remember, tax residency differs from immigration residency, so don’t let this confuse you. If you are an Australian resident for tax purposes, you can claim the Tax-Free Threshold, which is $18,200. You are eligible to claim it from this payer if one of the following conditions applies:

- You are not currently claiming the tax-free threshold from another payer.

- You are already claiming the tax-free threshold from another payer, but your total income from all sources is expected to be less than $18,200.

The short answer is yes, but it comes with specific conditions. If you are an overseas student who has arrived in Australia to pursue your studies and are enrolled in a course that lasts more than 6 months, you are generally considered an Australian resident for tax purposes. This status affects how you are taxed and what you need to declare in your TFN declaration to your employer.

Yes, even though you may not have permanent residency or citizenship in Australia, you will still be treated as an Australian resident for tax purposes. Remember, tax residency differs from immigration residency, so don’t let this confuse you. If you are an Australian resident for tax purposes, you can claim the Tax-Free Threshold, which is $18,200. You are eligible to claim it from this payer if one of the following conditions applies:

- You are not currently claiming the tax-free threshold from another payer.

- You are already claiming the tax-free threshold from another payer, but your total income from all sources is expected to be less than $18,200.

The short answer is yes, but it comes with specific conditions. If you are an overseas student who has arrived in Australia to pursue your studies and are enrolled in a course that lasts more than 6 months, you are generally considered an Australian resident for tax purposes. This status affects how you are taxed and what you need to declare in your TFN declaration to your employer.

Yes, you can purchase a car in the name of your trust. However, whether you can claim a tax deduction for it is not a straightforward answer. It depends on how the car is used and the nature of your trust’s activities.

What Does Your Trust Do?

🔹 Investment Trust (Property or Shares):

If your trust is primarily used for passive income activities, such as holding rental properties or shares, then there is no clear business connection to justify claiming tax deductions for the vehicle. In this case, the car is likely to be used for personal purposes, which means deductions are generally not allowed.

🔹 Active Business Trust:

If the trust actively operates a business—such as a consulting firm, construction company, or retail store—then there may be a valid business reason for purchasing the vehicle. In this case, tax deductions may be available, provided the car is genuinely used for business purposes.

Fringe Benefits Tax (FBT) Considerations

Owning a personal-use vehicle in a trust can sometimes create additional tax reporting requirements because Fringe Benefits Tax (FBT) may apply.

If the trust provides a car to a trustee, employee, or beneficiary for personal use, the trust may be liable for FBT. This tax applies when a vehicle is used for non-business purposes, and it can significantly impact the overall tax benefit.

This is an age-old question, and unfortunately, it doesn’t have a straightforward yes or no answer. Generally, novated leases are subject to Fringe Benefits Tax (FBT). When employers provide personal benefits like motor vehicles for personal use, gym memberships, holiday tours, etc., to their employees or their employees’ family members, these are considered fringe benefits. Employers then pay the top marginal tax rate (47%, which includes the 45% top tax rate plus the Medicare Levy of 2%) for these benefits.

Novated leases are often marketed as hassle-free, with claims that employees won’t have to worry about GST, running expenses, and can pay for the lease with post-tax income, as the employer handles the lease payments and FBT. However, complications can arise if you leave employment and are required to pay a significant amount to exit the lease. Additionally, if you wish to own the vehicle after the lease term, you may face a substantial balloon payment from your post-tax salary.

Employers often attempt to reduce FBT by using the Employee Contribution Method (ECM), where a portion of the lease is paid from the employee’s post-tax salary. If too much ECM is applied, the benefits of the lease may diminish, making it less attractive to employees.

For those planning to purchase an electric vehicle, a novated lease can be particularly beneficial, as employers are exempt from FBT, meaning no ECM calculation is required.

To determine if a novated lease is worthwhile for you, consult your accountant. If you don’t have a dedicated accountant, consider reaching out to Investax Tax Specialists for expert advice on these types of questions.

The goods and services tax (GST) does not apply to residential rents, so Airbnb hosts do not have to pay it. This also means that you can’t get a GST credit for the costs that go along with it. This is applied even if your sales are more than $75,000, which is the GST threshold.

Please check feel free to check out our Tax Consequence guide for Airbnb.

Motor vehicle expenses are among the most commonly claimed deductions by General Practitioners (GPs). Self-employed GPs typically claim these expenses for travel between their practice and a hospital, when making house calls, or when transporting bulky medical equipment. The ATO has issued specific guidelines detailing what GPs can and cannot claim for car expenses. Let’s explore a few crucial points:

❌ What You Can’t Claim

- You can’t claim the cost of everyday trips between home and work or their regular practice, even if you live far away and practice outside regular business hours

- You can’t claim a deduction for parking at or near a regular place of work. You also can’t claim a deduction for tolls you incur for trips between your home and regular place of work/practice.

✅ What You Can Claim

- You can claim the cost of using your car when driving directly between separate jobs on the same day. For example, driving from your main workplace as GP to your second job as a university lecturer.

- Alternate Workplaces: to and from an alternate workplace for the same employer on the same day – for example, travelling to different hospitals or medical centres

- Transporting Bulky Tools or Equipment: In limited circumstances, you can claim the cost of trips between home and work if you carry bulky tools or equipment that are essential for your job. This applies if:

- The tools or equipment are essential for your work and not carried by choice.

- The tools or equipment are bulky and awkward to transport, making it necessary to use a car.

- There is no secure storage for the items at your workplace.

Methods to Claim Car Expenses

- Logbook Method:

- Keep a valid logbook to track the percentage of work-related use.

- Maintain written evidence of your car expenses.

- Cents Per Kilometre Method:

- Show how you calculated your work-related kilometres.

- Ensure those kilometres were for work-related purposes.

This is an age-old question, and unfortunately, it doesn’t have a straightforward yes or no answer. Generally, novated leases are subject to Fringe Benefits Tax (FBT). When employers provide personal benefits like motor vehicles for personal use, gym memberships, holiday tours, etc., to their employees or their employees’ family members, these are considered fringe benefits. Employers then pay the top marginal tax rate (47%, which includes the 45% top tax rate plus the Medicare Levy of 2%) for these benefits.

Novated leases are often marketed as hassle-free, with claims that employees won’t have to worry about GST, running expenses, and can pay for the lease with post-tax income, as the employer handles the lease payments and FBT. However, complications can arise if you leave employment and are required to pay a significant amount to exit the lease. Additionally, if you wish to own the vehicle after the lease term, you may face a substantial balloon payment from your post-tax salary.

Employers often attempt to reduce FBT by using the Employee Contribution Method (ECM), where a portion of the lease is paid from the employee’s post-tax salary. If too much ECM is applied, the benefits of the lease may diminish, making it less attractive to employees.

For those planning to purchase an electric vehicle, a novated lease can be particularly beneficial, as employers are exempt from FBT, meaning no ECM calculation is required.

To determine if a novated lease is worthwhile for you, consult your accountant. If you don’t have a dedicated accountant, consider reaching out to Investax Tax Specialists for expert advice on these types of questions.

You pay tax on Employee Share Scheme when the shares become unrestricted and vested. Many employees are confused about this because they don’t get taxed when the shares are initially issued. However, when the shares become unrestricted (usually when they vest), that’s when the tax obligation kicks in. Let’s break this down further.

When you receive restricted shares under an Employee Share Scheme (ESS), you typically don’t pay tax immediately because you don’t yet have full ownership rights. These shares are subject to certain conditions, such as staying employed for a few years or meeting performance goals before they “vest.” Once the shares vest, they become unrestricted, and you gain full control. At this point, they’re considered part of your income, and that’s when you’re required to pay tax.

My Payroll Said It Won’t be Taxed when they are Issued? The answer lies in the fact that the shares were not fully yours. Since they were restricted, there was no taxable event, and the value of these shares wasn’t included in your assessable income. But now that they’ve vested, their value is considered taxable income—even if you didn’t sell a single share.

Why does it feel unfair? It’s especially hard to swallow the tax bill if you haven’t sold any of your shares. That’s because you receive the shares, not cash, when participating in the ESS. Yet, when it’s time to pay the tax, you have to come up with cash out of pocket. You can’t just transfer a portion of your shares to the ATO to cover your tax liability.

The takeaway? When you are issued shares under an Employee Share Scheme, try to understand the tax outcome and consult an experienced accountant like Investax. Remember, it’s your income, your tax, and you’re the one who has to ensure you have the cash flow to pay it. Don’t be that person who repeatedly says, “But I don’t have the money!” Plan ahead for the tax bill, and if you do sell your shares, set aside the amount for your marginal tax to cater for the future liability. This is especially important if you haven’t done any prior tax planning with an experienced accountant.

Australian taxpayers who earn above a certain income threshold and do not have adequate private health insurance are required to pay the Medicare Levy Surcharge

| MLS income thresholds and rates for 2024–25 | ||||

| Threshold | Base tier | Tier 1 | Tier 2 | Tier 3 |

| Single threshold | $97,000 or less | $97,001 – $113,000 | $113,001 – $151,000 | $151,001 or more |

| Family threshold | $194,000 or less | $194,001 – $226,000 | $226,001 – $302,000 | $302,001 or more |

| Medicare levy surcharge | 0% | 1% | 1.25% | 1.5% |

| MLS income thresholds and rates for 2023–24 | ||||

| Threshold | Base tier | Tier 1 | Tier 2 | Tier 3 |

| Single threshold | $93,000 or less | $93,001 – $108,000 | $108,001 – $144,000 | $144,001 or more |

| Family threshold | $186,000 or less | $186,001 – $216,000 | $216,001 – $288,000 | $288,001 or more |

| Medicare levy surcharge | 0% | 1% | 1.25% | 1.5% |

Your income for MLS purposes is the sum of the following items for you (and your spouse, if you have one):

- Taxable income

- Reportable fringe benefits

- Total net investment losses, which include:

- Net financial investment losses

- Net rental property losses

- Reportable super contributions, which include:

- Reportable employer super contributions (RESC) as shown in your PAYG Payment Summary

- Deductible personal super contributions

Additionally:

- If you have a spouse, their share of the net income from a trust on which the trustee is required to pay tax (under section 98 of the Income Tax Assessment Act 1936) and which has not been included in their taxable income.

Your MLS income is calculated by combining your taxable income with all the figures mentioned above.

Super Guarantee Update:

As of 1 July 2024, the Superannuation Guarantee (SG) rate has increased to 11.5%. Employers must account for this change to ensure superannuation guarantee payments are correctly calculated. The SG rate is scheduled to further increase to 12% in July 2025.

Concessional Contribution Update:

The concessional super contributions cap has risen from $27,500 to $30,000 per year, effective from 1 July 2024. This is the maximum amount of before-tax contributions, including employer superannuation guarantee payments, that can be contributed annually without incurring additional tax, subject to any unused concessional cap amounts from previous years.

Non-Concessional Contribution Update:

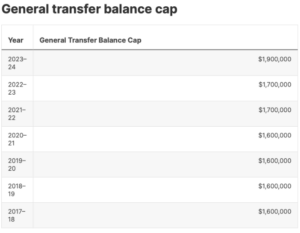

The non-concessional super contributions cap has increased from $110,000 to $120,000 per year. If your total super balance is equal to or exceeds the general transfer balance cap ($1.9 million from 2023–24) at the end of the previous financial year, your non-concessional contributions cap is nil ($0) for the current financial year.

When claiming tax deductions, proper documentation is crucial. While bank statements can provide a record of transactions, they often do not include the detailed information required by the Australian Taxation Office (ATO) to substantiate your claims under section 900-115 of the Income Tax Assessment Act 1997.

To meet the substantiation requirements, you must obtain documents from the supplier that cover the following information:

- The name or business name of the supplier.

- The amount of the expense, expressed in the currency in which it was incurred.

- The nature of the goods or services.

- The day the expense was incurred.

- The day the document is made out.

The document must be in English. However, if the expense was incurred in a country outside Australia, the document can be in the language of that country.

According to the case of Copley and Commissioner of Taxation [2024] AATA 8 (Copley), the Tribunal considered the substantiation requirements under section 900-115 of the Income Tax Assessment Act 1997 (Cth) (ITAA 1997) and the sufficiency of bank account statements in proving allowable deductions.

In this case, the Commissioner of Taxation issued amended assessments disallowing deductions claimed by the taxpayer under section 8-1 of the ITAA 1997.

The central issues before the Tribunal were whether the:

- expenses were incurred in gaining or producing the taxpayer’s assessable income;

- expenses were of a private or domestic nature; and

- taxpayer could substantiate the expenses pursuant to the record keeping requirements in Division 28 and Division 900 of the ITAA 1997.

Senior Member Dr. M Evans-Bonner held that the taxpayer did not satisfy the burden of proving that the amended assessments were excessive or incorrect. The decision was based on the fact that the taxpayer failed to meet the substantiation requirements outlined in subsection 900-115(2) of the ITAA 1997, which stipulate the need for specific records such as receipts and invoices to support the expenses claimed.

The Tribunal concluded that bank account transaction statements are insufficient for substantiation purposes as they do not comply with the requirements set out in subsection 900-115(2) of the ITAA 1997. The Copley case underscores the importance of keeping detailed records, such as receipts and invoices, to substantiate expenses claimed as tax deductions.

If you need further assistance understanding substantiation requirements or any other tax-related matters, feel free to contact an Investax Group Tax Specialist for expert guidance and support.

Reference –

Copley and Commissioner of Taxation

Understanding the Nature of Legal Fees for Tax Purposes

The deductibility of legal fees hinges on the nature or character of the expense. This determination is guided by the benefit that is sought through incurring the expense.

- Capital vs. Operational Purpose:

- Legal fees incurred to create an asset or secure an enduring benefit are considered capital expenditures. These are not deductible under section 8-1 of the Income Tax Assessment Act 1997 (ITAA 1997), as established in the Sun Newspaper Ltd case (1938). For instance, John purchased a property and incurred legal fees to secure the title deed. Since this legal expense aims to create an asset with an enduring benefit, it is considered a capital expense and is not deductible.

- Conversely, legal fees incurred for operational purposes may be deductible. For example, John, a contractor, sued a client to recover unpaid wages for work completed. Since the sole purpose of the legal action is to recover assessable income, the related legal fees and costs should be deductible.

- Employment-Related Legal Fees:

- Lost Wages: If the sole purpose of the legal action is to recover unpaid wages, bonus, contract payment, or leave payments that are assessable to the client, then the legal fees and related costs should be deductible. For instance, John lost his employment unfairly, and his employer didn’t pay his annual leave and long service leave. He sued his employer for unfair dismissal to retrieve his annual leave and long service leave. Since the purpose of the legal action is to recover assessable income, the legal fees should be deductible.

- Reinstatement: If an employee incurs legal fees after termination and one of the purposes is to seek reinstatement to their former position, these expenses are generally of a capital nature. According to the Australian Taxation Office (ATO), such fees are not deductible because they aim to secure an enduring benefit (i.e., reinstatement of employment). For instance, if John also sought reinstatement to his job as part of the legal action, the legal fees related to seeking reinstatement would be considered capital expenses and thus not deductible. For further guidance, refer to paragraph 5 of Taxation Determination TD 93/29.

Even if you are not a business owner, you may still be liable for Pay as You Go (PAYG) instalments if you had a tax liability in the previous financial year. This can occur due to several reasons beyond just your employment income.

For instance, you might be an employee with wages, but you also have other sources of income, such as:

- An investment property that earns positive rental income.

- A share portfolio that earns dividend income annually.

- A substantial amount of cash savings that earn interest income.

- Trust distributions from a related trust.

- You are liable for the Medicare Levy Surcharge because you do not have appropriate hospital cover for yourself and your family, and your income is above the threshold.

In these cases, your employer only withholds tax on your employment income. However, when you file your tax return, you will need to account for the additional income from these other sources. This often results in a tax payable situation due to the positive income earned on top of your wages.

To manage this, the ATO may require you to make PAYG instalments throughout the year to cover your expected tax liability, helping you avoid a large tax bill at the end of the financial year. If you anticipate lower income this year compared to last year, you may consider varying your last quarter PAYG instalment to improve your cash flow. Feel free to reach out to Investax Group tax specialists if you need any help with this.

Division 293 tax is an extra tax on superannuation contributions. It applies to people whose total income and super contributions add up to more than $250,000 in a year. This tax reduces the tax break they get on their super contributions by making them pay an additional 15% tax on top of the regular 15% tax that super contributions usually attract.

Division 293 tax is an extra 15% tax. It is applied to the smaller amount between the excess income over $250,000 and the taxable super contributions. Check Sarah’s example below for further explanation.

Your ‘Division 293 Notice of Assessment’ will only be sent to you once the ATO receives the contribution information from your super fund.

The income component of the Division 293 tax calculation is based on the same income calculation used to determine the Medicare levy surcharge (MLS), disregarding any reportable superannuation contributions. The components of this income calculation are:

- Taxable income (assessable income minus allowable deductions)

- Total reportable fringe benefits amount

- Net financial investment loss

- Net rental property loss

- Net amount on which family trust distribution tax has been paid

- Super lump sum taxed elements with a zero-tax rate

- Assessable first home super saver released amount

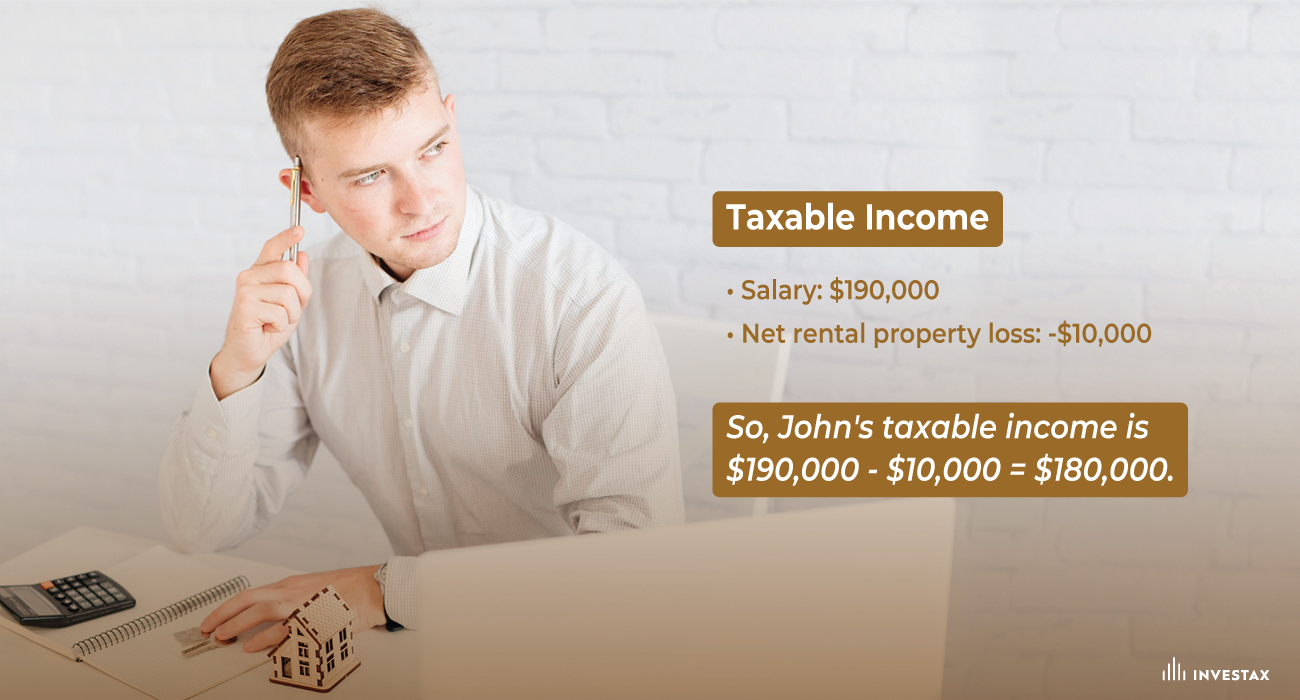

Example for John:

John earns a salary of $190,000, and his employer contributes $25,000 into superannuation for him. John also has a net rental property loss of $10,000.

Taxable Income:

- Salary: $190,000

- Net rental property loss: -$10,000

So, John’s taxable income is $190,000 – $10,000 = $180,000.

Division 293 Income:

- Taxable income: $180,000

- Net rental property loss: +$10,000

- Employer super contributions: +$25,000

John’s Division 293 income is $180,000 + $10,000 + $25,000 = $215,000, which is within the limit of $250,000. Therefore, John’s entire concessional contributions (CCs) would be taxed at 15%, and Division 293 tax does not apply.

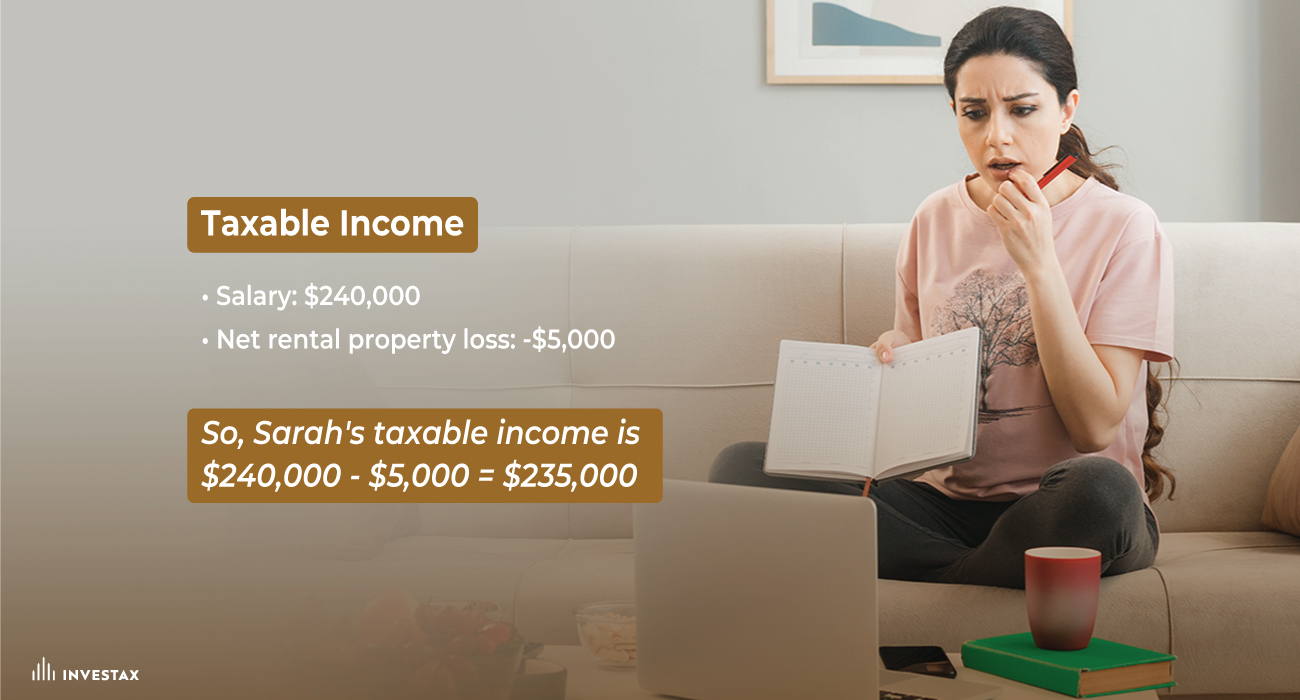

Example for Sarah:

Sarah earns a salary of $240,000, and her employer contributions for the year are $30,000. Sarah also has a net rental property loss of $5,000.

Taxable Income:

- Salary: $240,000

- Net rental property loss: -$5,000

So, Sarah’s taxable income is $240,000 – $5,000 = $235,000.

Division 293 Income:

- Taxable income: $235,000

- Net rental property loss: +$5,500

- Employer super contributions: +$27,500

So, Sarah’s Division 293 income is $235,000 + $5,500 + $27,500 = $268,000. Since Sarah’s income exceeds the threshold of $250,000, she will pay 15% contributions tax on her employer contributions and will also be liable for Division 293 tax. Division 293 taxable contributions are the lesser of Division 293 super contributions ($27,500) or the amount above the $250,000 threshold ($18,000). Sarah will pay additional 15% tax on $18,000.

She can choose to pay this tax personally, or she can choose to release the tax from her super fund.

ATO Reference – Div 293

If you are unemployed, claiming deductions for self-education expenses—including related travel and accommodation costs—can be challenging. Usually, you need to be employed and the courses should be related to your job to qualify for these deductions.

The ATO in TR 2023/D1 should corroborate this at paragraph 67 when it states:

“67. To be deductible, the expenses must be relevant to your income-earning activities at the time you incur the expense. A deduction is not available if, at the time you incur the expense, you are not undertaking income-earning activities to derive assessable income, either by employment, carrying on a business or by other means”.

Apart from that, the ATO ruling doesn’t seem to suggest it’s possible to argue that the self-education costs are deductible due to the legacy of a previous role.

Yes, you may be able to claim car expenses if you travel for work-related purposes. This includes using your car to perform tasks directly related to your job, such as visiting clients, attending meetings, or traveling between different work locations. Keep accurate travel records, including travel distances and related expenses, to support your claims. Remember that personal trips, such as commuting from home to your regular workplace, are generally not eligible for tax deductions.

Our expertise in various asset classes, including shares, managed funds, index funds, and cryptocurrencies, is the cornerstone of our services. We possess an in-depth knowledge of the regulatory landscape and the ever-evolving world of cryptocurrencies and blockchain technology. Additionally, we have a deep understanding of various share transactions, ranging from standard activities such as dividends and dividend reinvestment plans (DRP) treatment to more complex transactions like share buybacks and their impact on the cost base for dividend reinvestment plans (DRP).

Furthermore, we provide guidance to clients on various ownership structures, such as Discretionary Family Trusts and company structures, especially when managing large portfolios. Our expertise is designed to ensure that you receive comprehensive support and insights across a broad spectrum of financial assets, allowing you to make informed decisions and optimize your investments.

The frequency of your tax payments in Australia depends on various factors, including your income source, business structure, and tax obligations. Here’s a breakdown:

1. Individuals: Most individuals in Australia pay their income tax through the Pay as You Go (PAYG) system, which deducts tax from their wages or salary. This is done on each payday, meaning tax is paid regularly throughout the year. If you have additional income sources, such as investments, you may need to make quarterly or annual payments. At the end of the financial year, you are required to file an annual tax return. You have the option to complete it independently or enlist the services of an accountant, such as Investax Group, to assist in filing your annual tax return.

2. Businesses: Business owners have different tax payment schedules depending on their business structure. If you operate as a sole trader, you will have an annual tax liability, which is typically charged on a quarterly basis through PAYG instalments. On the other hand, if your business operates under a company or trust structure, you will have an annual tax return liability. If your business’s income exceeds $75,000, you will also be required to register for GST, and if you have employees, you must register for PAYG withholding tax. In the case of GST, your tax liability frequency (monthly or quarterly) will be determined by your GST turnover and PAYG withholding tax obligations. Additionally, if your business provides personal benefits to employees, you will be liable for Fringe Benefit Tax (FBT), and an annual FBT return must be submitted each year.

3. Property Owners: If you earn rental income from investment properties, you’ll need to declare this income in your annual tax return.

4. Self-Managed Superannuation Funds (SMSFs): SMSFs generally pay tax on investment income at the concessional rate of 15%. This tax is paid throughout the year, and the fund’s obligations include annual tax returns and potentially quarterly PAYG instalments.

It’s essential to keep accurate records of your income and expenses to ensure you meet your tax obligations promptly and accurately. Consulting with a tax professional like Investax Group can provide personalized guidance on your specific payment schedule and obligations based on your financial situation and business structure.

Investax offers a proactive tax reminder service to our existing clients, sending out 3-4 reminders throughout the year to ensure you stay informed about important tax deadlines. Our clients typically benefit from extended deadlines, often until the following May. To receive these essential reminders, we recommend subscribing to our newsletter to stay up-to-date with crucial tax information and deadlines.

At Investax, we prioritize delivering high-quality service to our clients, and our annual tax return process reflects this commitment. We do not offer on-the-spot tax returns, eliminating the need for in-person meetings. Instead, you can initiate the process by simply forwarding us your relevant information. Our standard turnaround period year-round is typically 4-6 weeks. This timeframe encompasses several crucial quality assurance steps as we meticulously attend to each client’s tax return. These steps involve collecting data, confirming details with our accounting team, reviewing previous files (for new clients), processing data by senior accountants, communication with clients to resolve queries or missing information, thorough review by a Client Manager, sending a draft tax return for your review and feedback, addressing any concerns, finalizing the tax return for review by a Senior Manager and Tax Agent, providing a digital copy for your signature, and invoicing. We maintain a ‘first in, first out’ approach to ensure fairness to all clients. While we understand this process may require patience, our dedication to delivering comprehensive and accurate tax returns without cutting corners remains unwavering. Your trust in Investax allows us to provide you with the best service possible, and we appreciate your understanding of the 4–6-week turnaround period.

Absolutely, we are committed to staying abreast of the dynamic healthcare industry landscape, including its intricate regulations and ever-evolving tax laws. In fact, we’ve gone a step further by actively contributing to your knowledge base. Our team has authored numerous informative articles addressing crucial topics, such as recent payroll changes relevant to medical practices. Furthermore, we’ve provided insights into the optimisation of medical practices through the implementation of various ownership structures like Discretionary Family Trust and Company. Our dedication to industry-specific expertise ensures that not only are your financial strategies aligned with the latest requirements, but we also empower you with valuable insights to navigate the intricate landscape of the medical field effectively.

Our services for medical practitioners encompass a range of solutions, including tax planning, wealth creation strategy in line with tax planning, best practice for practice management, bookkeeping, accounting, retirement planning, and more. We aim to provide comprehensive support to help you achieve your financial goals.

The frequency of your tax payments in Australia depends on various factors, including your income source, business structure, and tax obligations. Here’s a breakdown:

1. Individuals: Most individuals in Australia pay their income tax through the Pay as You Go (PAYG) system, which deducts tax from their wages or salary. This is done on each payday, meaning tax is paid regularly throughout the year. If you have additional income sources, such as investments, you may need to make quarterly or annual payments. At the end of the financial year, you are required to file an annual tax return. You have the option to complete it independently or enlist the services of an accountant, such as Investax Group, to assist in filing your annual tax return.

2. Businesses: Business owners have different tax payment schedules depending on their business structure. If you operate as a sole trader, you will have an annual tax liability, which is typically charged on a quarterly basis through PAYG instalments. On the other hand, if your business operates under a company or trust structure, you will have an annual tax return liability. If your business’s income exceeds $75,000, you will also be required to register for GST, and if you have employees, you must register for PAYG withholding tax. In the case of GST, your tax liability frequency (monthly or quarterly) will be determined by your GST turnover and PAYG withholding tax obligations. Additionally, if your business provides personal benefits to employees, you will be liable for Fringe Benefit Tax (FBT), and an annual FBT return must be submitted each year.

3. Property Owners: If you earn rental income from investment properties, you’ll need to declare this income in your annual tax return.

4. Self-Managed Superannuation Funds (SMSFs): SMSFs generally pay tax on investment income at the concessional rate of 15%. This tax is paid throughout the year, and the fund’s obligations include annual tax returns and potentially quarterly PAYG instalments.

It’s essential to keep accurate records of your income and expenses to ensure you meet your tax obligations promptly and accurately. Consulting with a tax professional like Investax Group can provide personalized guidance on your specific payment schedule and obligations based on your financial situation and business structure.

Most of our clients prefer the convenience of electronically submitting their annual tax return information. We have opted not to offer in-person tax return services to ensure the highest quality of service and efficiency for all our clients. You are welcome to visit our office and drop off your tax documents in person if you prefer.

While we specialise in property-related tax and accounting expertise, our services extend beyond property owners. We cater to a diverse clientele, including small business owners and professionals aiming to build and manage wealth. Our team has the knowledge and experience to assist a wide range of clients in achieving their financial goals.

Yes, we serve both individuals and businesses. Whether you need personal tax return assistance or complex business accounting, we have the expertise to assist you. At Investax, every client, regardless of size, is welcomed as long as you are on the path to wealth creation or have the ambition to build your financial prosperity.

We appreciate your interest in our services. At Investax, we understand that pricing transparency is important to our clients. However, as an accounting company, our services are highly tailored to the unique financial circumstances of each client. Therefore, providing a fixed price on our website wouldn’t accurately reflect the individualised nature of our work.

The annual cost estimate for our Tax Return services depends on several factors, such as the number of investment properties you own, the complexity of your share portfolio, recent investment property acquisitions, the presence of discretionary family trusts, hybrid trusts or companies holding assets, and whether you have a business entity. These variables make it challenging to offer a one-size-fits-all pricing structure.

We believe in providing you with a fair and accurate pricing estimate that aligns with your specific needs and goals. To do this, we offer a complimentary consultation lasting 15 minutes, where we can discuss your unique financial situation, requirements, and expectations. During this complimentary consultation, we will provide you with a pricing estimate tailored to your circumstances.

We encourage you to take advantage of this complimentary consultation to better understand how our services can benefit you and obtain a pricing estimate that suits your needs. There’s no obligation, and it’s a great opportunity to get to know us better. Please feel free to reach out to us to schedule your complimentary consultation, and we’ll be happy to assist you further. Your financial success is our priority, and we look forward to working with you to achieve your goals.

Investax provides a comprehensive suite of financial services to support your wealth creation journey. This includes personalized Investment and bsuiness Structure planning, tax optimization strategies for individuals, asset protection, retirement planning, estate structuring, and access to a dedicated finance team for loans and financial solutions.

Starting your wealth creation journey as an individual employee requires a thoughtful and disciplined approach. Start by establishing specific financial goals, whether it’s saving for retirement, purchasing a home, or creating an emergency fund. Having clear objectives will give you a sense of direction. Next, create a detailed budget that outlines your income, expenses, and savings targets. Explore investment options that align with your risk tolerance and financial goals. Prioritize paying off high-interest debts like credit cards, as they can hinder your wealth creation efforts. Consulting with a financial advisor can provide valuable guidance on investment choices, asset allocation, and long-term financial planning.

For a Business Owner:

Commencing your wealth creation journey as a business owner involves a distinct set of considerations. First and foremost, ensure your business is profitable and well-managed, as it can be a significant source of wealth. It’s essential to maintain clear separation between your personal and business finances to effectively manage both. Collaborate with tax professionals to optimize your tax strategy and leverage deductions and credits available to business owners. Reinvesting profits into your business for growth is a strategic approach to generate more revenue and contribute to your wealth. While your business is a valuable asset, consider diversifying your wealth by investing in opportunities outside of your business.

Wealth creation is the process of steadily accumulating financial assets and resources over time with the aim of boosting one’s net worth and attaining financial security and prosperity. It involves strategic tax and financial planning, prudent investments with flexible ownership structure for future exit and tax planning, disciplined savings, and generating income to systematically build and expand one’s wealth.

A property accountant is a financial professional with specialized expertise in managing and optimizing property-related financial matters, including tax planning, investment structuring, and financial management for property investors and developers. Investax stands out as your preferred property accountant for several reasons:

1. Comprehensive Services: Investax offers a wide range of services tailored to property investors and developers, including tax advisory, annual tax returns, tax planning, and specialized structuring advice for property-related assets.

2. Geographical Coverage: While based in Sydney, Investax serves clients across Australia, from Queensland’s cray fishing businesses to Melbourne’s major property developers, high net worth individuals Canberra, and Perth. Our virtual face-to-face meetings ensure accessibility no matter where you are in Australia.

3. Asset Protection: Investax specializes in asset protection strategies, helping you safeguard your property investments and assets while optimizing tax efficiency.

4. Retirement Planning: Our dedicated financial advisers provide personalized retirement planning services, ensuring your financial future is secure, whether you’re an individual or business owner.

5. Finance Assistance: Investax has partnered with a dedicated finance team to assist clients with mortgage and business loan needs, providing comprehensive financial support.

6. Client-Centric Approach: We understand the value of quality service and prioritize virtual consultations for your convenience. Investax is committed to providing the highest level of personalized support to help you achieve your property and financial goals.

In summary, a property accountant like Investax specializes in property-related financial matters and offers a comprehensive suite of services, geographical coverage across Australia, asset protection expertise, retirement planning, finance assistance, and a client-centric approach. Investax’s dedication to meeting your specific needs makes us the preferred choice for property accounting services.

Investax offers its professional services to clients across Australia. While our main office is located in Sydney, New South Wales, we proudly serve clients from various regions, including Queensland, Victoria, Canberra, and Perth. We understand the importance of convenience and accessibility for our clients, especially in this digital age. As a result, we prioritize virtual face-to-face meetings, ensuring that you can access our high-quality services from the comfort of your location, whether you’re in Brisbane, Melbourne, Canberra, Perth, or elsewhere in Australia.

First and foremost, we appreciate your visit to our website and your interest in seeking information. If you wish to refer a family member or friend, please don’t hesitate to send us an email directly to either [email protected] or [email protected]. Alternatively, you can find our contact details on our “Contact Us” page for your convenience.

Investax provides a wealth of resources to assist clients in various aspects of their financial journey. Our website features comprehensive occupation guides tailored to different professions, offering insights and strategies for tax optimization. Additionally, our Investax Insight section boasts a vast library of news articles covering topics such as property investment, asset protection, finance, and financial planning to keep clients informed and up to date. To streamline the tax return process, we offer an annual checklist that clients can use to gather and organize their tax information efficiently. For those seeking a deeper understanding of ownership structures, Investax offers e-books specifically focused on Trust and SMSF structures, allowing clients to learn at their own pace and make informed decisions regarding their financial future.

In addition to our extensive resources, we offer the opportunity for clients to engage in personalized consultations. Through our Complimentary Consultation form, you can easily connect with a relevant expert to address various aspects of your financial and taxation requirements. Whether you’re looking for guidance on property investment, asset protection, finance, or financial planning, our team is here to assist you in achieving your financial goals.

Absolutely! Investax has a team of financial advisers dedicated to helping clients with retirement planning. Whether you’re an individual looking to secure your financial future or a business owner planning for retirement, our experts can provide personalized strategies to achieve your retirement goals.

Investax provides a comprehensive range of tax services tailored to various entities, including individuals, businesses, companies, trusts, and Self-Managed Superannuation Funds (SMSFs). Our services encompass annual tax return preparation, tax advisory, tax planning, and specialized tax structuring to help you minimize tax liabilities.

Investment property owners can generally claim tax deductions for repairs and maintenance, but not for improvements, which can only be depreciated over time. This distinction often confuses property owners, especially at tax time. Simply put, a repair is about fixing wear and tear, accidental damage, or natural deterioration to restore the property’s function without changing its character.