A Comprehensive Guide to Building Wealth through Property Investments

We all know the highest income tax rate for Australians is 47%, but do you know what the wealth tax rate is? It is actually 0% in Australia. You only pay tax if you earn money, not when you are acquiring and increasing your wealth. Given our busy lives, everyone wants to be financially secure and independent. We are all eager to uncover the secrets to wealth. Consider Mark Zuckerberg, the CEO of Meta, which was formerly known as Facebook. Despite drawing a nominal annual salary of just one dollar and forgoing any bonuses, his net worth is above $100 billion, according to Forbes. Property investments is one avenue that many individuals explore to build and diversify their wealth portfolios.

This scenario is not unique; many among the world’s wealthiest individuals report minimal annual earnings. Their secret? They likely have expert accountants who assist them in accumulating wealth while minimizing tax obligations. Meanwhile, most of us toil year after year, handing over a significant portion of our earnings to tax authorities.

However, the true “secret” to affluence isn’t so clandestine. Many wealthy individuals have built their fortunes through acquiring assets, including investment properties, stock portfolios, investing in business ventures, and even intangible assets like brand value. It isn’t merely high salaries that lead to wealth—after all, substantial income often attracts substantial taxes. Instead, wealth is often the result of strategic investments that grow over time and incur taxes only when realized, thus reinforcing one’s financial foundation.

This article aims to delve into an asset class that has stood the test of time: the realm of property investment. It is rare to find an individual who bought a property 20 years ago and claims their net wealth hasn’t at least doubled or quadrupled in Australia. This article sheds light on how both experienced investors and aspiring property enthusiast can leverage property investment to solidify their financial future.

Property Data

As of June 2022, the most recent Australian Census reported a staggering 10,852,208 private dwellings, each representing a potential step towards a more prosperous future. Among these dwellings, 70% were separate houses, 13% were townhouses, and 16% were apartments, revealing the diverse range of opportunities that lie within the realm of real estate.

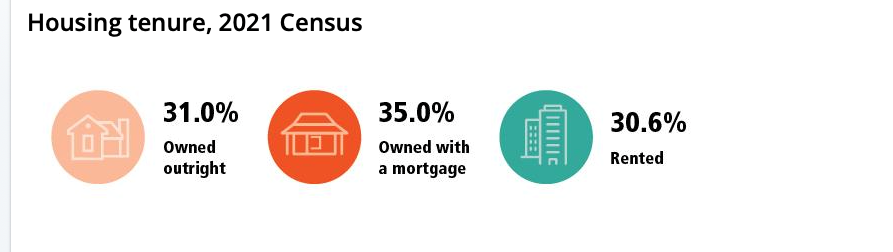

Property ownership statistics further emphasize the significance of real estate in Australia’s wealth landscape. Of the occupied private dwellings, 31% are owned outright, 35% are owned with a mortgage, and 30.6% are rented. The implications are clear: real estate holds the potential to be the cornerstone of financial success, offering a powerful means to accumulate wealth over time.

In the land Down Under, real estate isn’t just bricks and mortar; it’s the steppingstone to financial independence. It stands as the single largest investment an individual can make, and when approached strategically, it becomes an unparalleled tool for creating wealth.

High Rental Income

Understanding the value of real estate investment can be as straightforward as looking at the regular cash flow it generates. Picture this: a consistent and steady stream of rental income flowing into your account, balancing out property expenses. This reliable income doesn’t just offer financial stability; it stands as a solid, less volatile alternative to the unpredictability of stock market investments.

In recent times, the Australian rental market has demonstrated its robustness, with rent values experiencing a 0.6% increase in July alone. The significant uptick in migrant arrivals in 2021-22, with numbers soaring to 395,000 from the previous year’s 146,000, represents a 171 per cent increase attributable to the easing of COVID-19 travel restrictions. This influx, although still not reaching pre pandemic levels, has substantial implications for the property market. Historically, increased migration has correlated with heightened demand for residential property, both for purchase and rental, as newcomers seek accommodation. This demand can drive property prices and rental rates upward, especially in urban areas where migrants tend to congregate.

Migration is expected to have an even greater effect on the Australian property market in the coming years. With rising interest rates and continued migration, it is unlikely that rental income will decrease in 2024. With proper property management, investors can seamlessly reap the benefits of their investments through consistent rental income. This strategy is especially attractive to those seeking a rental yield that exceeds the current interest rate, along with a more manageable Loan to Value Ratio (LVR).

Capital Appreciation

Capital appreciation is a key component of wealth creation in the real estate market, manifesting as a gradual increase in property value over time. This appreciation can be significant, allowing investors to sell their holdings for a far higher price than their initial purchase cost after a period.

The capital appreciation of a property is influenced by a variety of factors, including its location, which is paramount, as properties in sought-after areas near amenities like good schools and business districts typically appreciate more. Economic conditions, such as a strong job market, can boost demand and property values, while interest rates also play a role, with lower rates making mortgages more affordable and increasing demand. The balance of supply and demand in the housing market is crucial, with limited supply and high demand driving up prices.

Infrastructure developments, like new transport links or schools, can enhance an area’s appeal, leading to appreciation. Additionally, government policies,

market trends, property improvements, demographic shifts, and environmental factors can

all significantly impact a property’s value over time.

According to the most recent Home Price Index report issued by PropTrack, The October 2023 report underscores the ongoing capital appreciation within the Australian real estate market. Nationally, home prices have reached a new peak, showing a month-on-month increase of 0.36% and an impressive year-on-year growth of 4.54%. Notably, Sydney’s real estate market has outperformed, with prices increasing by 0.37% in October, now standing 7.71% higher than the previous November’s low and 0.32% above the peak of February 2022.

The trend extends beyond Sydney, with all capital cities, except Darwin, registering price hikes in October. Smaller capitals such as Brisbane and Perth led the monthly gains, both marking a 0.52% rise. Brisbane, in particular, has seen a remarkable recovery, with prices now 7.36% higher than the previous year and a year-to-date increase of 7.73%, indicating a robust pattern of capital appreciation.

While regional markets have generally observed a slower growth rate compared to capital cities—5.95% versus 2.43% year-to-date—their growth has accelerated recently. In October, regional areas experienced a 0.32% increase, reaching record highs alongside capital cities, which saw a 0.37% rise. Notably, regional Queensland and Western Australia led these gains, with property values in both areas achieving new peaks.

For those contemplating long-term investments with an eye on capital appreciation, property investment emerges as a compelling avenue to explore. The consistent trend of property values appreciating over time presents a promising opportunity for individuals seeking to bolster their wealth portfolio.

Commercial Property Investments

Commercial real estate includes shopping centres, offices, Shops, and warehouses. Generally, these properties yield a higher return than residential real estate due to longer lease contracts and higher rental rates. This dynamic sector presents unique opportunities to amass wealth and secure financial stability through strategic acquisitions and astute management.

The undeniable charm of commercial properties lies in their ability to deliver impressive rental yields. Unlike their residential counterparts, commercial spaces often command higher rental income due to their strategic locations and functionality. This makes them an appealing choice for investors aiming to maximize their returns on investment. Whether it’s a bustling office space in a thriving business district or a vibrant retail space in a prime shopping centre, the potential for substantial rental income remains a compelling proposition.

One of the standout features of commercial properties is the potential for long-term tenancy. In the commercial realm, businesses find homes where they can thrive and flourish. Whether it’s a restaurant or a cosy coffee shop, these establishments become integral parts of their communities, fostering strong customer bases over time. Consequently, business owners are unlikely to relocate frequently. This translates into reliable, long-term tenancies for commercial property owners.

Australian Real Estate Investment Trusts (A-REITs)

In the realm of real estate investment, Australian Real Estate Investment Trusts (A-REITs) have emerged as a compelling alternative for those seeking exposure to property assets. These unitised portfolios of property assets are listed on the Australian Stock Exchange (ASX), offering a unique pathway to diversification and financial growth beyond direct property ownership. These investment vehicles grant access to a broad spectrum of real estate assets, spanning commercial, industrial, and retail properties, or even a blend of these assets that would otherwise remain out of reach for individual investors.

The scope of A-REITs extends beyond national borders, with investment options encompassing both local Australian properties and international ventures. Investors who choose to participate can partake in the appreciation of underlying assets’ value, while also reaping the benefits of regular rental income generated by the properties held within the portfolio. The allure lies not only in the potential for capital appreciation but also in the steady stream of rental income – a dynamic duo that positions A-REITs as a versatile and powerful tool for those embarking on a journey towards financial prosperity.

The Art of Property Flipping: Buy, Renovate, and Sell for Profit

Property flipping, a traditional investment strategy, has gained significant traction in the real estate landscape in Australia. This approach involves purchasing a property, revamping it through strategic renovations, and then selling it for a profit – all within a relatively short span of time. Often referred to as “buy, renovate, and sell,” property flipping requires a combination of market insight, renovation skills, and financial acumen to turn an underperforming property into a lucrative venture.

The process commences with identifying properties that possess untapped potential, often in the form of distressed or outdated residences. Savvy renovators leverage their understanding of market trends to acquire properties that can be transformed into desirable living spaces. Once the property is secured, the real magic begins. Renovations are meticulously planned to maximize returns while adhering to budget constraints. Every detail, from the layout and design to the choice of materials, plays a pivotal role in

enhancing the property’s appeal and value.

Successful property flipping hinges on a delicate balance between investment and returns. In a dynamic real estate market, timing is crucial. Flippers must strategically navigate the buying and selling phases to capitalize on favourable market conditions.

Development – Land and Home

Another compelling avenue for wealth creation emerges through the land development. This strategic approach entails the acquisition of developed or undeveloped land, which is then transformed into a valuable asset through a series of calculated steps. Entrepreneurs embarking on this journey have the opportunity to substantially elevate the land’s worth by securing essential permits and constructing vital infrastructure such as roads, sewage systems, and utilities. Entrepreneurs can opt to sell the developed land to homebuilders or commercial developers, capitalizing on the enhanced value for a substantial profit. Alternatively, they can leverage the newfound potential by constructing properties on the

land, paving the way for an additional stream of income.

Land development offers exciting opportunities, but it’s important to know that there are difficulties to face along the way. To succeed in land development, you need to have a good understanding of complex things like local rules about how land can be used, careful planning rules, and how the market for real estate is always changing. Entrepreneurs need to handle these challenges with skill and carefulness to make sure their project goes well.

It’s worth noting that while land development can bring in a lot of money, it requires a lot of money upfront and the ability to wait patiently. The process involves paying close attention to small details and being ready to spend time going through different stages of development.

Pro Tips for the readers who are interested in building wealth through property investment:

- Market Research: Conduct comprehensive research about property location analysis, monitoring economic trends and interest rates, understanding real estate supply and demand dynamics, staying informed about infrastructure developments and government policies, considering potential property improvements, observing demographic shifts, evaluating environmental factors, and learning about real estate market cycles to make informed property investment decisions aimed at maximizing capital appreciation.

- Right Property Agent in Maximising Rental Income: Engaging a skilled property agent can be crucial in enhancing rental income. Such an agent brings to the table expert market knowledge, effective marketing strategies, and adept tenant screening processes. This expertise ensures that the property is not only rented out at the best possible price but also to reliable tenants, which minimizes vacancies and maximizes rental income continuity.

- Financial Analysis: Assess your financial situation and explore various financing options. Determine the Loan to Value Ratio (LVR) that you can comfortably maintain. Consult with your mortgage broker or lender to gain a clear understanding of your current financial standing. This will enable you to optimize your wealth creation journey by choosing the right investment vehicle.

- Investment Strategy: Decide on an investment strategy that aligns with your financial goals, be it long-term capital appreciation, rental income, commercial property investment, or property flipping.

- Tax Planning: Learn about the tax implications of property investment, such as income tax and capital gains tax, and consider the best ownership structure to optimise tax outcomes.

- Continuous Learning: Keep educating yourself about real estate investment through seminars, courses, and industry literature.

- Networking and professional advice: Join real estate investment groups, or online forums to connect with other investors and industry experts. If you are time poor and not sure about the market research data, you can engage a buyer’s agent. Essentially, a buyer’s agent acts as a personal real estate advisor, ensuring time-poor clients make informed decisions quickly in a competitive market.

- Exit Strategy: Have a clear exit strategy in place, whether it’s for flipping properties or selling off investment properties after a certain period.

As the Australian property market continues to demonstrate robust growth, individuals are uniquely positioned to capitalise on high rental yields and steady capital appreciation. Diversifying your investment portfolio to include real estate can be a strategic move to minimize risk and maximise potential rewards. However, it’s crucial to recognize that these ventures come with intricate tax implications, including income tax and capital gains tax.

Navigating this complex landscape requires not only a deep understanding of various tax regulations but also a strategic approach to ownership structures. Making informed decisions in these areas is essential to safeguard your assets and optimize tax outcomes. That’s where Investax Group comes in – as your trusted accounting and advisory partner.

At Investax Group, we specialise in providing personalised tax planning and investment advice tailored to the unique needs of property investors. Our team of expert accountants and advisors is equipped with the knowledge and experience to guide you through the nuances of property investment, ensuring you make the most of every opportunity while staying compliant with tax laws.

Whether you’re taking your first steps in property investment or looking to expand your portfolio, Investax Group is here to support your journey towards financial prosperity. With our guidance, you can confidently navigate the property market, make informed decisions, and build a strong foundation for financial security.

Reference:

- https://www.forbes.com/profile/mark-zuckerberg/?sh=2227f3363e06

- Housing Census: https://www.abs.gov.au/statistics/people/housing/housing-

census/2021 - Overseas Migration –

https://www.abs.gov.au/statistics/people/population/overseas-migration/latest-

release#:~:text=Net%20overseas%20migration,-Net%20overseas%20migration&text=In%20the%20year%20ending%2030,net%20los

s%20of%2085%2C000%20people. - PropTrack Home Price Index – https://www.proptrack.com.au/insights-

hub/proptrack-home-price-index-october-2023/