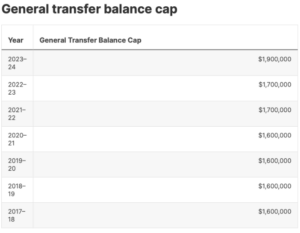

General Transfer Balance Cap in 2024

Source: ATO/General Transfer Balance Cap

Investax Frequently Asked Questions

In the context of your Self-Managed Superfund (SMSF), your transfer balance cap represents the upper limit on the total amount of accumulated superannuation funds you

can move into retirement phase accounts, which enjoy tax-free earnings. This cap is not a one-time figure; it’s a lifetime limit that applies to all transfers you make over the course of

your life into retirement phase pensions.

With the commencement of your retirement phase income stream within your SMSF, your personal transfer balance cap will be equivalent to the prevailing general transfer balance

cap at that juncture.

Please note that since the 1st of July 2021, the general transfer balance cap is indexed with inflation, tracked by the consumer price index, and is adjusted in $100,000 increments. This

indexation can potentially increase your transfer balance cap over time, enhancing the amount you can shift into your SMSF retirement phase account, thereby maximizing your

superannuation’s tax-effective potential.

Source: ATO – Transfer Balance Cap Explanation

For your investment property, the ability to claim a deduction for repairs and maintenance while the property is not rented hinges on specific circumstances:

It’s essential to understand that if the property is intended for your personal use following the repairs and maintenance, to be eligible for a deduction, the property should have

produced rental income in the same financial year in which the repair costs were incurred. Thus, the timing of the rental period relative to the repairs is a critical factor for tax

deduction eligibility.

When it comes to your investment property, if you find yourself needing to undertake repairs and maintenance tasks straight away after the purchase, it’s

important to understand the tax implications. These immediate repairs, often required due to wear or damage that occurred before you acquired the property, are

classified as ‘initial repairs.’; According to tax regulations, specifically Section 25-10, the costs associated with these initial repairs are deemed capital expenditures. As

such, they do not qualify for immediate tax deductions. Instead, they are capitalised and used to form part of the cost base of the property for capital gains tax purposes

when you sell the property.

Refinancing is the process of replacing an existing loan with a new one, typically to secure better terms or lower interest rates. You should consider refinancing when interest rates drop significantly, as it can potentially reduce your monthly payments, save money on interest over the life of the loan, or shorten the loan term to pay off debt faster. Additionally, refinancing may make sense if your credit score has improved since you originally obtained the loan, as this can lead to more favourable terms. However, it’s essential to weigh the costs associated with refinancing, including application fees, and closing costs, against the potential benefits to determine if it’s a financially sound decision.

A credit score is a numerical representation of your creditworthiness. It’s calculated based on your credit history, including factors like your payment history, credit utilisation, length of credit history, and more. Lenders use your credit score to assess the risk of lending to you. A higher credit score typically means better loan terms and lower interest rates, while a lower score might result in less favourable terms or loan denials. It’s crucial to monitor and maintain a good credit score to access affordable loans and financial opportunities.

Fixed-rate loans have a constant interest rate throughout the loan term, providing predictable monthly payments. Variable-rate loans, also known as adjustable-rate loans, have interest rates that can change periodically, typically tied to a benchmark index. Fixed-rate loans offer stability, while variable-rate loans may start with lower rates but come with the risk of higher payments if rates rise. The choice depends on your risk tolerance and market conditions

You might opt to engage a mortgage broker rather than approaching a bank directly because brokers offer several valuable benefits. These independent professionals have access to numerous lenders and loan products, including those from banks, potentially providing you with more favourable terms and rates. Mortgage brokers simplify the loan shopping process, saving you time and effort by researching and comparing various lender offers. They also offer expert advice tailored to your financial situation and goals, helping you navigate complex mortgage terms and conditions. Additionally, brokers may negotiate with lenders on your behalf to secure better terms and can be particularly helpful if you have unique financial circumstances or credit challenges. Their flexibility and convenience in scheduling meetings make the application process smoother. While banks are a valid option, working with a mortgage broker can enhance your choices and provide expert guidance to find the best mortgage for your specific needs.