SMSF Property Renovations Under LRBA: Know Your Do’s & Don’ts

Introduction

Each year, new and existing SMSF trustees face uncertainty about what renovations can and cannot be done on a Self-Managed Superannuation Fund (SMSF) property under a Limited Recourse Borrowing Arrangement (LRBA). Many looks for reliable resources to navigate these complexities, ensuring they remain compliant while optimising their property investments. With ongoing changes in market conditions and regulatory interpretations, property owners often hesitate to undertake even necessary improvements out of fear of non-compliance. Over time, Investax has received numerous inquiries from trustees looking for clarity on what modifications they can make without breaching superannuation rules.

We hope this article provides the answers you need. Serving as an annually updated guide, this resource is designed to help trustees understand what is permissible under LRBA. Whether you are considering repairs, maintenance, or strategic upgrades, knowing the rules will allow you to enhance your SMSF investment while staying compliant.

What Can You Do? Permissible Renovations Under LRBA

The key principle to keep in mind when making changes to an SMSF property under LRBA is that borrowed funds can only be used for repairs and maintenance, not for improvements. However, there are still several ways to enhance the property within these guidelines.

1. Repairs and Maintenance

Maintaining and repairing an SMSF investment property is crucial for preserving its value and ensuring it remains a viable income-generating asset. While improvements that significantly change the property’s character are not allowed under an LRBA, trustees can still undertake essential repairs and maintenance work to keep the property in top condition.

- Replacing damaged flooring or roofing.

- Fixing plumbing or electrical issues.

- Repainting walls and repairing external structures.

- Replacing old fixtures with modern equivalents.

Important Note: Any repair must maintain the property’s existing character and functionality without significantly enhancing its value or structure.

2. Commercial Property Extensions

Expanding an SMSF-owned commercial property can be a great way to increase rental income and enhance the usability of the space. While major redevelopments may not be allowed, certain extensions that do not fundamentally change the nature of the property can be undertaken.

Example: A car wash facility owned by an SMSF needs additional space for customer parking. The trustee can extend the paved area to accommodate more vehicles without altering the core purpose of the property.

- Expanding the existing structure to add more wash bays in a car wash facility (provided the fundamental character remains the same).

- Adding internal partitioning for better workspace utilisation.

Important Note: Extensions must not change the fundamental nature of the property. A simple extension that increases rental yield without altering the core function is typically permissible.

3. Adding a Granny Flat

Granny flats have become a popular way to maximise rental income and accommodate additional tenants. The good news for SMSF trustees is that constructing a granny flat on an LRBA property is possible, provided it does not result in a fundamental change to the asset.

Example: An SMSF trustee owns a four-bedroom house under an LRBA and wants to add a two-bedroom granny flat in the backyard. Since the property remains a single residential dwelling, this is allowed. However, if the granny flat was on a separate title, it would be classified as a new asset and would not be permitted.

- Constructing a detached granny flat on the property is allowed, as long as it remains a part of the overall residential premises.

- The granny flat must be secondary to the main property and should not fundamentally change the nature of the asset.

Important Note: If the granny flat results in a separate dwelling on a new title, it may be considered a new asset, which is not permissible under LRBA rules.

4. Farm Property Upgrades

SMSFs investing in farmland can undertake certain upgrades to maintain the land’s agricultural productivity. While expanding the farm or adding new revenue-generating structures is not allowed, repairs and replacements of essential farming infrastructure are permissible.

Example: A cattle farm owned by an SMSF has an old fence that is falling apart. The trustee can replace the fence with a modern equivalent to maintain the farm’s function. However, building a new barn or adding additional cattle yards would be considered an improvement and would not be allowed using borrowed funds.

- Replacing fencing and installing new bores, windmills, or tanks to maintain functionality.

- Rebuilding a shed or other essential farming structures that do not alter the nature of the farm.

Important Note: Additional facilities, such as constructing a new residence on the farm, could be considered an improvement and may not comply.

5. Rebuilding After Damage

Natural disasters and accidents can severely damage investment properties, leaving trustees wondering if they can rebuild. Fortunately, SMSFs can restore a damaged property to its original state using either insurance proceeds or other non-borrowed funds, ensuring the asset continues to generate income.

- If a property is destroyed due to unforeseen circumstances like fire or storm damage, rebuilding a comparable structure is permitted.

- Insurance payouts, rather than borrowed funds, can be used to rebuild a property to its former state.

Important Note: Using borrowed funds to build a substantially different structure (e.g., replacing a single dwelling with multiple units) is not allowed.

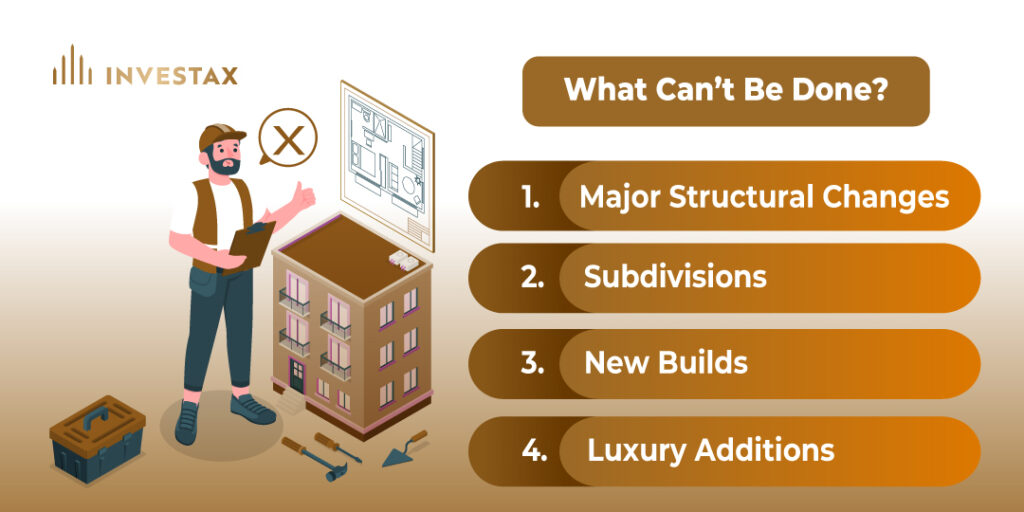

What Can’t Be Done?

While the focus of this article is on what can be done, it’s equally important to be aware of restrictions:

- Major Structural Changes – Extensions that change the fundamental character of the asset (e.g., converting a residential house into a commercial premises).

- Subdivisions – Splitting a single block into multiple titles under LRBA is not permissible.

- New Builds – Constructing a new dwelling on an existing property is considered an improvement and is not allowed under LRBA rules.

- Luxury Additions – Adding features like a swimming pool, home automation systems, or additional buildings that enhance the property’s value rather than restoring its functionality.

Conclusion

We have seen many SMSF property owners hesitant to make any changes to their investment properties, even when those changes could significantly improve rental returns. This hesitation is often due to uncertainty about what is permissible under LRBA rules. By understanding the clear guidelines around repairs, maintenance, and minor extensions, trustees can make informed decisions that enhance their investment without breaching regulations.

If you’re unsure about what upgrades you can undertake on your SMSF property, reach out to Investax today. Our SMSF tax specialists can provide expert guidance, ensuring your renovations comply with ATO regulations while optimising the value of your investment.

General Advice Warning

The material on this page and on this website has been prepared for general information purposes only and not as specific advice to any particular person. Any advice contained on this page and on this website is General Advice and does not take into account any person’s particular investment objectives, financial situation and particular needs.

Before making an investment decision based on this advice you should consider, with or without the assistance of a securities adviser, whether it is appropriate to your particular investment needs, objectives and financial circumstances. In addition, the examples provided on this page and on this website are for illustrative purposes only.Although every effort has been made to verify the accuracy of the information contained on this page and on our website, Investax Group, its officers, representatives, employees and agents disclaim all liability [except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this website or any loss or damage suffered by any person directly or indirectly through relying on this information.