Land Tax in Every State of Australia

As the end of the financial year approaches in Australia, property owners, and buyers should prepare for increased costs, higher land tax, and stricter scrutiny of tax claims by state and federal governments seeking additional revenue.

The Australian Taxation Office (ATO) is particularly focusing on deductions for working from home, understated rental income, over-claimed expenses, and incorrectly claimed property improvements. Homebuyers in Australia will experience significantly higher costs as the state government reduces concessions on off-the-plan properties.

Additionally, there will be tougher record-keeping requirements for working-from-home expenses, increased scrutiny of interest expense claims, and a focus on capital gains. Several states will also impose higher land taxes from July 1, affecting property owners. When it comes to understanding land tax in Australia, the guidance of an accountant or financial advisor is a must. Their in-depth knowledge and experience will help you to navigate complex tax regulations, optimize tax strategies, and avoid costly errors and financial setbacks. This article emphasizes on the various land taxes applicable in different states of Australia.

What is Land Tax?

Land tax is a yearly charge assessed on any property you own that is above the land tax threshold at the conclusion of the calendar year. Other exemptions and concessions could apply, and your primary residence is exempt.

Land Tax in Australia:

In Australia, land tax is based on the value of the land and is collected yearly or every three months in the ACT. The tax systems are set by each state, and while they are mostly the same, they are different in:

- The taxing date

- Valuation methods

- The ownership entity

- Tax rates and thresholds

- Exemptions

Knowing the land tax in Australia is important for property owners as it enables them to accurately calculate and plan for their tax obligations, avoid penalties for non-compliance, and make informed decisions regarding property investment, ownership, and management. You can always take help from an accountant or financial advisor to get expert guidance on tax planning, ensure compliance with regulations, and maximize deductions and tax liabilities Now, let’s talk about the different land taxes in every state of Australia:

New South Wales

General Land Tax Rate

Max. rate | 1.6% over the general threshold of $969,000 and up to the premium threshold of $5,925,000

Max. rate | 2% for high-value properties over the premium threshold of $ 5,925,000

Surcharge Land Tax Rate

An additional 4% applies to all residential land owned by foreign persons

Taxing Date

Midnight on 31 December each year.

Queensland

Threshold

As a company or trustee, you are liable for land tax if the total taxable value of all your freehold land is $350,000 or more. A trustee of a special disability trust is treated as an individual for land tax, with a threshold of $600,000 or more. The taxable value of your land is based on your annual land valuation issued by the Valuer-General. You may be able to apply for exemptions to reduce your total taxable value.

General Land Tax Rate

Max. rate | 2.75%

| Total taxable value | Rate of tax |

| $0–$349,999 | $0 |

| $350,000–$2,249,999 | $1,450 plus 1.7 cents for each $1 more than $350,000 |

| $2,250,000–$4,999,999 | $33,750 plus 1.5 cents for each $1 more than $2,250,000 |

| $5,000,000–$9,999,999 | $75,000 plus 2.25 cents for each $1 more than $5,000,000 |

| $10,000,000 or more | $187,500 plus 2.75 cents for each $1 more than $10,000,000 |

Surcharge Land Tax Rate

An additional 2% applies to all taxable land at $350,000 or more owned by absentee individuals, foreign corporations, and trustees of foreign trusts The rates below apply to the total taxable value of land owned by a company or trustee.

Taxing Date

Midnight on 30 June each year.

Victoria

General Land Tax Rate

Max. rate | 2.55%

Absentee Owner or Surcharge Rate

An additional 2% applies to all land owned by absentee owners

Max. rate | 4.55%

Vacant Residential Land Tax Rate

An additional 1% applies to all residential land in Melbourne’s middle and inner suburbs left vacant for more than 6 months in a calendar year.

Threshold:

The tax-free threshold for general land tax rates will be cut from $300,000 to $50,000, therefore subjecting more properties and property owners to land tax. A temporary fixed charge of $500 will be levied on general taxpayers with total landholdings between $50,000 and $100,000. A temporary fixed charge of $975 will be levied on general taxpayers with total landholdings between $100,000 and $300,000. For general (non-trust) taxpayers with total landholdings above $300,000 and trust taxpayers with total landholdings above $250,000, land tax rates will increase by $975 plus 0.1% of the taxable value of their landholdings.

Taxing Date

Midnight on 31 December each year

Australian Capital Territory

General Land Tax Rate

Max. rate | Fixed charge of $1,462 plus valuation charge up to 1.14% on the 5-year average unimproved value. This applies to all land that is residential land and not exempt. Commercial properties are not included here.

Surcharge Land Tax Rate

An additional 0.75% applies to all residential land owned by foreign persons (other than the principal place of residence)

Marginal Rates Applied to Property AUV

| AUV | Percentage (%) |

| Up to $150,000 | 0.54% of the AUV of the property |

| From $150,000 to $275,000 | $810 plus 0.64% of the part of the AUV that is more than $150,000 |

| From $275,001 to $2,000,000 | $1,610 plus 1.12% of the part of the AUV that is more than $275,000 |

| $2,000,000 and higher | $20,930 plus 1.14% of the part of the AUV that is more than $2,000,000 |

Taxing Date

Midnight on 1 July, 1 October, 1 January, and 1 April in each year

Council Rates

Max. rate | Fixed charge of $3,004 plus valuation charge of up to 5.6638% on 5-year average unimproved value (commercial properties) (lower rates apply for residential and rural land)

Tasmania

Threshold

From 1 July 2022, the land tax-free threshold for land tax has increased from $49,999.99 to $99, 999.99 and the upper land-tax bracket has increased from $399,999.99 to $499,999.99. Additionally, the land tax rate for values between $100,000 to $499,999.99 has been reduced from 0.55 percent to 0.45 percent.

General Land Tax Rate

| Total Land Value | Current Tax Scale |

| $0 – $99 999.99 | Nil |

| $100 000 – $499 999.99 | $50 plus 0.45% of value above $100 000 |

| $500 000 and above | $1 850.00 plus 1.5% of value above $500 000 |

Western Australia

General Land Tax Rate

Max. rate: 2.67%

Surcharge Land Tax Rate

Not imposed at this stage

Taxing Date

Midnight on 30 June each year

Metropolitan Region Improvement Tax Rate

0.14% | In addition to land tax for property located in the metropolitan area

South Australia

General Land Tax Rate

Max. rate | 2.4%

Trust Surcharge Land Tax Rate

Max. rate | 2.4%

Surcharge on land owned in trusts where the interests of trust beneficiaries are not disclosed or cannot be identified excluding listed or widely held trusts

Taxing Date

Midnight on 30 June each year

Northern Territory

Property Activation Levy: This levy ceased on 1 July 2022 however the obligation to lodge and pay returns for the 2021-22 period continues.

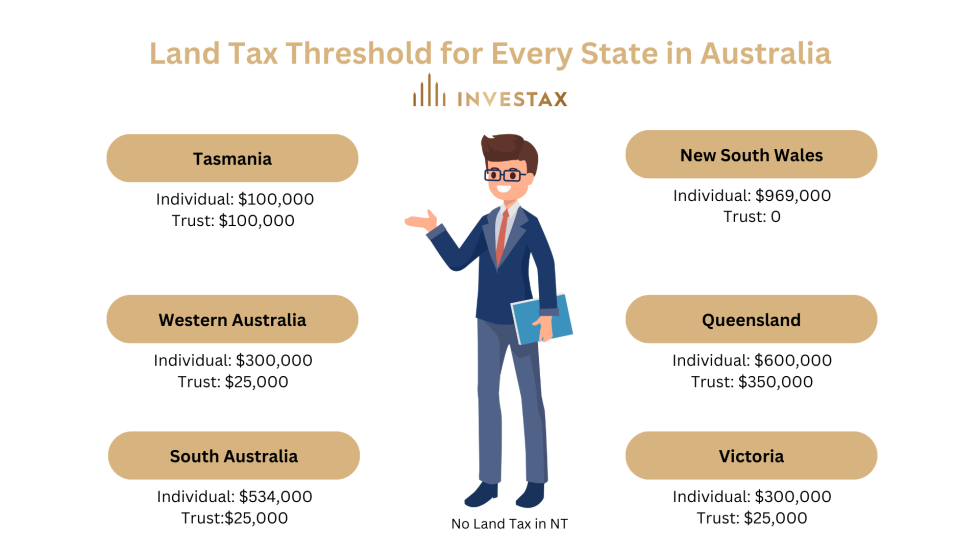

As to summarize, here is a table containing the Land Tax thresholds of all the states of Australia: