Is the Second Job worth it After Paying Tax?

Many of our clients, as well as our family and friends, have turned to the gig economy and

second jobs as a means to supplement their income in order to keep up with the growing

demands of their home loan Interest. We are witnessing a noticeable trend where an

increasing number of individuals are seeking additional sources of income to cope with the

escalating interest rates and overall expenses.

According to the most recent data released by the Australian Bureau of Statistics, there has been a 2.1% uptick in the proportion of individuals engaged in multiple job roles since December 2022. This equates to a total of 947,300 people in Australia, constituting 6.6% of the entire working population.

The motivations driving individuals to pursue secondary employment are diverse. While some are motivated by the need to manage surging costs, others are driven by the desire to initiate new business ventures while maintaining a stable income flow from their primary vocation.

Is it worth getting a second job?

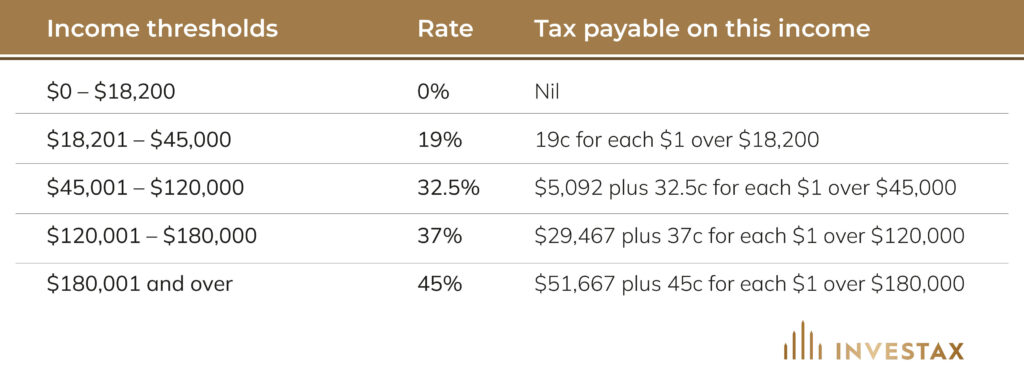

In Australia, the more you earn, the more tax you pay due to the progressive income tax

system. This also affects access to social benefits, which decrease as you earn more. When

considering a second job, it’s crucial to evaluate your overall situation: how much you might

earn, the costs of making that income, and the impact on your total earnings.

One thing to be careful about when taking up a second job in the gig economy is that many

of these roles classify you as an independent contractor. This means you’re responsible for

managing your own taxes. For example, if you drive for Uber, you’ll need to have an ABN

(Australian Business Number) and be registered for GST (Goods and Services Tax).

However, this comes with extra costs, and you’ll need to set aside 1/11th of your earnings to pay the

GST to the Tax Office every three months. To manage this, it’s important to set aside money

for both the GST and income tax so you can pay them on time. The benefit here is that you

can deduct expenses related to your second job to reduce your taxable income.

If you’re considering a second job, make sure that the tax-free threshold applies correctly to

your main job for PAYG (Pay As You Go) withholding purposes. This will help you manage

your tax situation more effectively.

Centre Link Benefit & Child Care Subsidy –

Careful consideration must extend beyond second income tax management; it should also

encompass vigilance regarding your social benefits, including Centrelink benefits and

childcare subsidies. While these benefits are typically determined based on the prior year’s

tax, the introduction of a second income could lead to a scenario where a substantial

amount needs to be returned to Centrelink. This unexpected financial burden has the

potential to strain cashflow for taxpayers.

As income increases due to the additional employment, the progressive nature of the tax

system means that a greater portion of your earnings might go towards taxes.

Consequently, this rise in income could potentially lead to a reduction in certain central link

benefits and child care subsidies, as these programs are often means-tested. Therefore,

when contemplating a second job, it’s imperative to meticulously assess the overall financial

implications, including potential alterations to government assistance, to make an informed

decision that aligns with your financial goals.

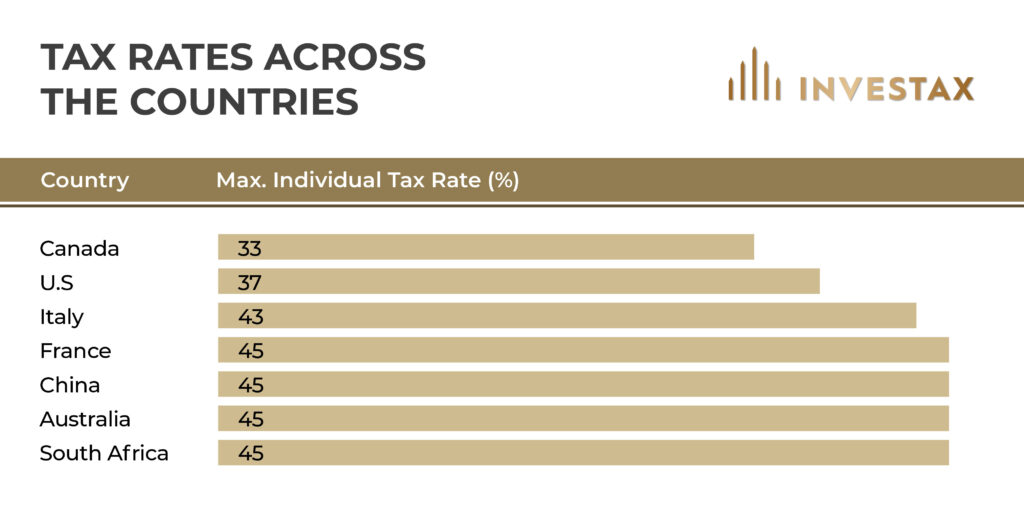

Do we pay more taxes than other countries?

The answer depends on how you interpret the data. Australia relies significantly on income tax, which makes up 40% of our total tax revenue. This places us as the fourth highest in personal tax among OECD nations, although in 2019 we were even higher at second place. But when considering the money we take home, there’s a different measure. The Employee tax on labour income shows that, after deducting tax and adding back benefits, the average single worker in Australia takes home 77% of their gross wage, compared to the OECD average of 75.4%.

For an average family with one working spouse and two children, the take-home pay in Australia averages at 84.1%, slightly lower than the OECD average of

85.9%. Essentially, Australia has higher taxes, but a good portion comes back as means- tested benefits. Unlike other nations, Australia doesn’t have social security contributions, which make up around 27% of taxes in OECD nations.

Due to our progressive tax system, higher earners feel the impact of taxation more. The top 11.6% of Australian earners contribute to 55.3% of the total personal income tax revenue. With the upcoming income tax cuts starting in July 2024, our reliance on personal income tax should decrease in comparison to corporate and other taxes.

So, do we individually pay more taxes than people in other countries? If you earn a high income, the answer is likely yes. If not, the answer is no. In conclusion, the decision to embark on a second job journey in Australia requires a meticulous examination of various facets. If you earn more money, you might have to deal with extra taxes and potential changes to benefits like Centrelink payments. So, if you’re considering taking on a second job, it’s important to understand these tax issues and how your extra income could affect your government support.

Reference for The Employee tax on labour income –

https://www.oecd.org/tax/tax-policy/taxing-wages-australia.pdf

General Advice Warning

The material on this page and on this website has been prepared for general information purposes only and not as specific advice to any particular person. Any advice contained on this page and on this website is General Advice and does not take into account any person’s particular investment objectives, financial situation and particular needs.

Before making an investment decision based on this advice you should consider, with or without the assistance of a securities adviser, whether it is appropriate to your particular investment needs, objectives and financial circumstances. In addition, the examples provided on this page and on this website are for illustrative purposes only.Although every effort has been made to verify the accuracy of the information contained on this page and on our website, Investax Group, its officers, representatives, employees and agents disclaim all liability [except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this website or any loss or damage suffered by any person directly or indirectly through relying on this information.