How to Buy Property Through Your SMSF: A Step-by-Step Guide for Investors

As we step into 2025, purchasing property through a Self-Managed Super Fund (SMSF) continues to be a popular strategy for property investors, particularly since the Australian Tax Office (ATO) allowed SMSFs to borrow for this purpose. With ongoing economic shifts and an evolving property market, many investors are drawn to the control and security that SMSFs offer, enabling them to include tangible assets in their retirement plans. The Australian property market has demonstrated resilience, even in the face of global economic uncertainties, inflationary pressures, and regulatory changes. This stability, coupled with the potential for strong returns, has encouraged more investors to explore SMSFs as a vehicle for property investment.

In this article, we’ll explore the process of purchasing property through an SMSF in 2025, outlining key steps, regulations, and considerations to help you make informed decisions about leveraging your retirement funds for property investment.

Self-managed superannuation fund quarterly statistical report June 2024

On 26 September 2024, the ATO released its statistical report on self-managed superannuation funds (SMSFs) for the period ending 30 June 2024. This report provides comprehensive insights into the SMSF sector, including data on the SMSF population, asset allocation trends, and quarterly establishment figures.

Key highlights from the report include:

- There were 625,609 SMSFs with a total of 1,152,792 members as of 30 June 2024.

- The estimated net assets of SMSFs totalled $990.4 billion, with listed shares comprising 28% of total assets and cash and term deposits making up an additional 16%.

- Australian property accounted for 16% of SMSF assets.

- The gender distribution among SMSF members was 53% male and 47% female.

- 85% of SMSF members were aged 45 or older.

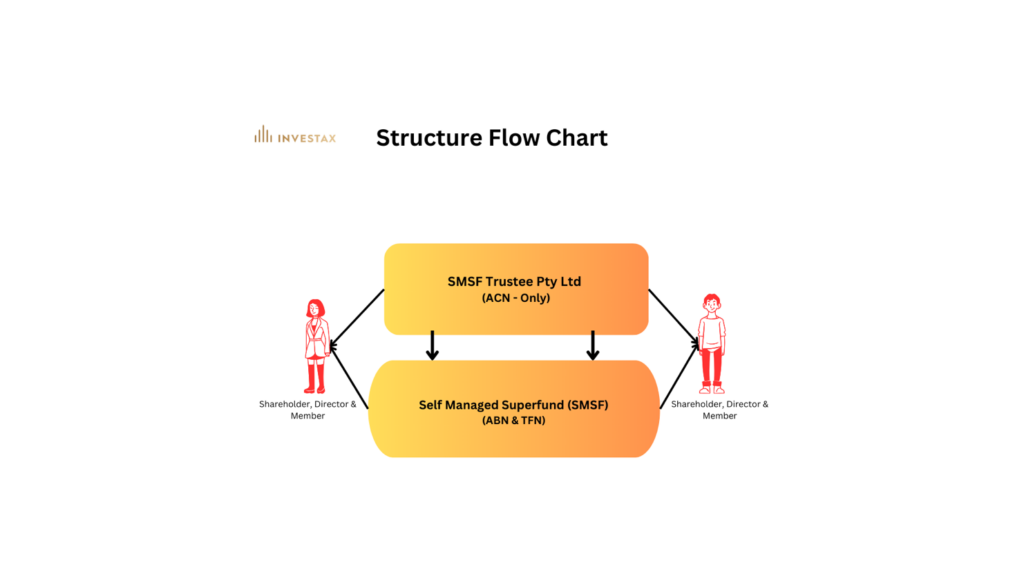

Required Structures

The first structure you’ll need is a Self-Managed Super Fund (SMSF). Many clients aren’t aware that an SMSF is, in fact, a trust, which means it requires a trustee to operate. While it’s possible to establish an SMSF with individual trustees, Investax generally recommends opting for a corporate trustee instead. A corporate trustee can offer several key advantages, including added asset protection, simplified ownership changes, and improved compliance flexibility. For a more in-depth look at these benefits, we invite you to read our article, “7 Reasons to Have a Corporate Trustee.”

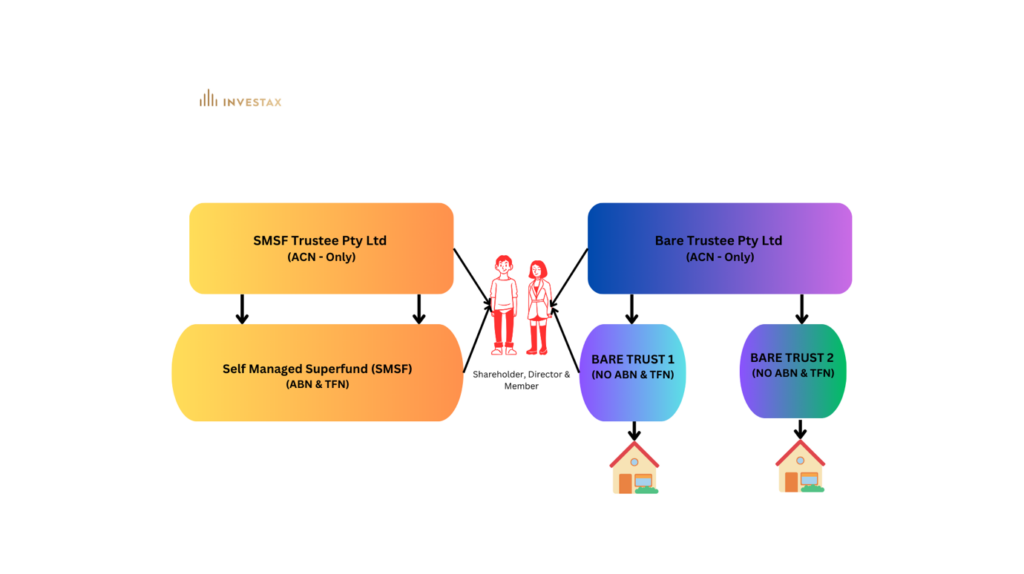

If you plan to borrow money to purchase a property within your SMSF, the basic SMSF structure alone will not suffice; an additional structure, known as a Bare Trust, is required. Like all trusts, a Bare Trust also requires a trustee, and in most cases, banks require that this trustee be a corporate entity for added security and compliance.

Why is a Bare Trust required?

A Bare Trust is required only when a Self-Managed Super Fund (SMSF) is borrowing money to purchase a property. This arrangement, known as a Limited Recourse Borrowing Arrangement (LRBA), applies regardless of whether the loan is from a bank or a personal source, such as an equity loan from another property, a loan from one’s own business, or a loan from relatives. In these cases, a Bare Trust is necessary to execute the property contract, ensuring that the property is held separately from other SMSF assets as required by law. A Bare Trust is required to safeguard the SMSF’s other assets. By holding the property in trust specifically for the SMSF, this arrangement separates the property from other SMSF assets. This separation provides an extra layer of protection, ensuring that, in the event of litigation or lender claims related to the property, the other assets within the SMSF remain shielded from potential risks. This approach reflects a protection policy designed specifically for SMSFs.

Who Holds What? Understanding Asset Ownership in SMSF Property Purchases

- SMSF Trustee Pty Ltd holds the beneficial interest in the property for the benefit of the SMSF Members.

- Bare Trustee Pty Ltd holds legal title of the property for the benefit of the SMSF Trustee. It is also the purchasing entity on the contract of sale.

- The SMSF is registered with the ATO not the Bare Trust.

- Bare Trust will not have any ABN or TFN

- The SMSF bank account will receive rental income from properties and cover expenses such as interest and other property-related costs. All transactions and financial activities related to the property are managed exclusively through the SMSF bank account.

- Bare Trustee Pty Ltd can be the Trustee for multiple Bare Trusts

Restrictions

- A Bare Trust can hold only one property as per the Limited Recourse Borrowing Arrangement (LRBA).However, you can use the same trustee to manage multiple Bare Trusts.

- You cannot take equity out of a property to purchase another property.

- Substantial renovations that change the nature of the original asset are not permitted.

- Purchasing off-the-plan property is only allowed if both the land and building are covered under the same contract.

No Loan, No Need for a Bare Trust

If your SMSF is purchasing a property without taking out a loan, there’s no need to set up a Bare Trust. The purpose of a Bare Trust is to separate the property from other SMSF assets in cases where borrowing is involved, providing an additional layer of protection. However, when purchasing outright with SMSF funds, this legal separation isn’t required, as there’s no lender involved or debt to secure. In these cases, the property can be held directly within the SMSF, simplifying the structure and reducing the costs associated with establishing and maintaining a Bare Trust.

Conclusion

In 2025, purchasing property through your SMSF remains a powerful strategy to diversify your retirement portfolio and capitalise on the resilience of the Australian property market. However, with evolving regulations and economic conditions, navigating the complexities—such as establishing a Bare Trust, meeting borrowing restrictions, and ensuring compliance—requires careful planning. Making informed decisions from the outset is crucial to safeguarding your SMSF assets and maximising tax benefits. If you’re considering an SMSF property investment in 2025, get in touch with the SMSF tax specialists at Investax. Our expert team is here to guide you through every step, ensuring your investment strategy aligns with your long-term financial and retirement goals.

General Advice Warning

The material on this page and on this website has been prepared for general information purposes only and not as specific advice to any particular person. Any advice contained on this page and on this website is General Advice and does not take into account any person’s particular investment objectives, financial situation and particular needs.

Before making an investment decision based on this advice you should consider, with or without the assistance of a securities adviser, whether it is appropriate to your particular investment needs, objectives and financial circumstances. In addition, the examples provided on this page and on this website are for illustrative purposes only.Although every effort has been made to verify the accuracy of the information contained on this page and on our website, Investax Group, its officers, representatives, employees and agents disclaim all liability [except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this website or any loss or damage suffered by any person directly or indirectly through relying on this information.