Federal Budget 2024

Federal Budget 2024

The Treasurer handed down the 2024 Federal Budget on Tuesday 14 May 2024, promising to reduce household expenses for regular Australians, contributing to a projected 0.75% decline in inflation. At this stage, Australians are primarily concerned with what the government is doing to normalize the cost of living and reduce grocery bills. As a pre-election budget, the government faces the dual challenge of providing relief from the rising cost of living while avoiding further inflationary pressures.

If the Consumer Price Index (CPI) returns to the target range by the end of 2024, as the government anticipates, the Reserve Bank of Australia (RBA) may consider lowering interest rates. However, the RBA currently projects that inflation will not return to the target range of 2-3% until the second half of 2025, reaching the midpoint in 2026.

In this article, we will cover the changes mostly related to tax and cost-of-living measures taken by the government.

HELP Indexed cuts & Family

We have already covered the stage 3 tax cut in detail in our previous article “Revised Stage 3 Tax Cuts” which was legislated by the government. It wil trigger from 01 July 2024.

Australian resident individual income tax rates

| 2024 income year | From the 2025 income year | ||

| Tax rate | Thresholds | Tax rate | Thresholds |

| 0% | $0 – $18,200 | 0% | $0 – $18,200 |

| 19% | $18,201 – $45,000 | 16% | $18,201 – $45,000 |

| 32.5% | $45,001 – $120,000 | 30% | $45,001 – $135,000 |

| 37% | $120,001 – $180,000 | 37% | $135,001 – $190,000 |

| 45% | $180,001+ | 45% | $190,001+ |

Foreign resident individual income tax rates

| 2024 income year | From the 2025 income year | ||

| Tax rate | Thresholds | Tax rate | Thresholds |

| 32.5% | $0 – $120,000 | 30% | $0 – $135,000 |

| 37% | $120,001 – $180,000 | 37% | $135,001 – $190,000 |

| 45% | $180,001+ | 45% | $190,001+ |

Increase in The Medicare levy low-income thresholds will be in place for singles, families, and seniors and pensioners from 1 July 2023.

| Category of taxpayer | No Medicare levy payable at or below: | Reduced Medicare levy payable within: | Full Medicare levy payable at or above: |

| Individual taxpayer | $26,000 | $26,001 – $32,500 | $32,501 |

| Individual taxpayer eligible for the SAPTO | $41,089 | $41,090 – $51,361 | $51,362 |

| Families eligible for the SAPTO | $57,198 | $57,199 – $71,497 | $71,498 |

| Families not eligible for the SAPTO with no dependent child or student | $43,846 | $43,847 – $54,807 | $54,808 |

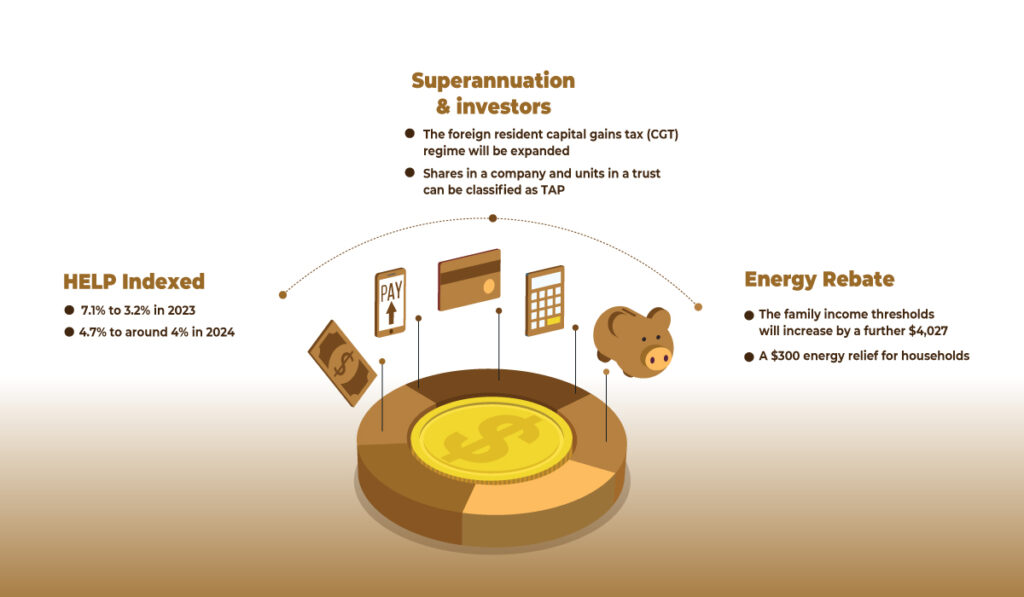

For each dependent child or student, the family income thresholds will increase by a further $4,027. The increases to the thresholds take account of recent movements in the CPI so that low-income taxpayers generally continue to be exempt from paying the Medicare levy.

A $300 energy relief for households is one of the key measures the government highlighted in this budget to alleviate financial pressure on the general public. More than 10 million households will receive a credit of $300 on their energy bills credited as automatic quarterly instalments across 2024-25.

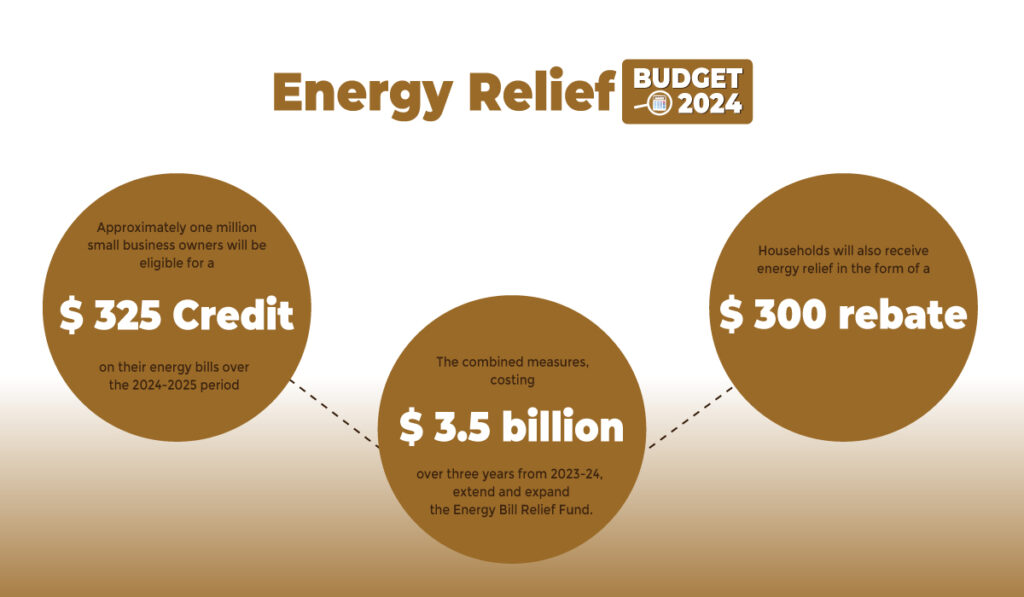

Eligible Small businesses will also receive energy relief in the form of a $325 rebate.

The energy relief will cost the government $3.5 billion and will be rolled out to individuals and small businesses over three years, starting from 2023-24.

Paid Parental Leave was one of the important highlights of this budget. The government has announced that, starting from 1 July 2025, it will pay superannuation on Commonwealth government-funded Paid Parental Leave for births and adoptions. Eligible parents will receive an additional payment based on the Superannuation Guarantee (12% of their Paid Parental Leave payments) as a contribution to their superannuation fund. This is in addition to recent changes that provided families with an extra two weeks of leave, bringing the total to 22 weeks. This leave will further increase to 24 weeks in July 2025 and 26 weeks in July 2026.

Capping the indexation of HELP debt will reduce financial stress for many young Australians. Over three million Australians with HELP debt faced a significant financial burden when the CPI indexation rate spiked to 7.1% in 2023. By changing the calculation of HELP indexation from 1 June 2023, the indexation rate has been reduced from:

- 7.1% to 3.2% in 2023, and

- 4.7% to around 4% in 2024.

This change addresses the issue that made HELP debt a heavy burden for Australians in 2023.

Superannuation & investors

Foreign Residents Under current law, are subject to CGT when they sell an asset that is classified as ‘taxable Australian property’ (TAP). The rules seek to ensure that non-residents are subject to Australian CGT on the disposal of assets that have a sufficient with Australian land and assets that have been used in business activities in Australia.

Shares in a company and units in a trust can be classified as TAP if the taxpayer and certain related parties hold at least a 10% interest in the entity and where more than 50% of the gross market value of the assets held by the entity is attributable to real property located in Australia and similar assets.

The measure is intended to ensure that Australia can tax foreign residents on direct and indirect sales of assets with a close economic connection to Australian land, bringing the treatment more in line with the tax treatment that already applies to Australian residents.

The foreign resident capital gains tax (CGT) regime will be expanded by below key points:

- Clarifying and broadening the types of assets on which foreign residents are subject to CGT

- Amending the point-in-time principal asset test to a 365-day testing period

- Requiring foreign residents disposing of shares and other membership interests exceeding $20 million in value to notify the ATO, prior to the transaction being executed.

Small Business and Employers

Energy Relief has been extended to benefit small business owners. Approximately one million small business owners will be eligible for a $325 credit on their energy bills over the 2024-2025 period. This measure aims to alleviate some of the financial pressures faced by small businesses. The relief will be automatically applied to their quarterly energy bills, ensuring a straightforward and hassle-free process for those eligible. This initiative is part of the broader government effort to support small businesses and reduce operational costs in an uncertain economic climate.

Households will also receive energy relief in the form of a $300 rebate. This initiative is part of a broader effort to reduce living costs for Australians. The combined measures, costing $3.5 billion over three years from 2023-24, extend and expand the Energy Bill Relief Fund.

$20k Small business instant asset write-off extended until 30 June 2025. Under current law, the small business instant asset write-off threshold is (less than) $1,000 for the 2025 income year. However, the Government has announced that it will temporarily set the instant asset write-off threshold for small business entities at (less than) $20,000 for the 2025 income year.

If the business is registered for GST, the cost of the asset needs to be less than $20,000 after subtracting the GST credits that can be claimed for the asset. If the business is not registered for GST, it is less than $20,000 including GST. The write-off applies per asset, so a small business can deduct the cost of multiple assets.

The rules only apply to assets that fall within the scope of the depreciation provisions. Expenditure on capital improvements to buildings that falls within the scope of the capital works rules is not expected to qualify.

Assets valued at $20,000 or more (which cannot be immediately deducted) can continue to be placed into the small business simplified depreciation pool and depreciated at

15% in the first income year and 30% each income year thereafter if the asset has been acquired by a small business entity that chooses to apply the simplified depreciation rules.

The Film Producer Tax Offset is a refundable tax offset for Australian expenditure in making Australian films when certain conditions are met.

The amount of the offset is:

- 40% of the company’s qualifying Australian production expenditure (QAPE) on a feature film

- 20% of the company’s total QAPE on a film that is not a feature film.

The minimum duration requirement differs depending on the format of the production.

ATO Counter Fraud Strategy will receive a financial boost to combat fraudulent activities, including GST fraud. The government has announced it will provide $187 million over four years, starting from 1 July 2024, to the ATO. This funding aims to enhance the ATO’s ability to detect, prevent, and mitigate fraud against the tax and superannuation systems.

Funding includes:

- $78.7 million for upgrades to information and communications technologies to enable the ATO to identify and block suspicious activity in real time.

- $83.5 million for a new compliance taskforce to recover lost revenue and intervene when attempts to obtain fraudulent refunds are made.

- $24.8 million to improve the ATO’s management and governance of its counter- fraud activities, including improving how the ATO assists individuals harmed by fraud.

- $0.4 million over four years from 1 July 2024 to the Department of Finance to undertake a Gateway Review process over the life of the proposal to ensure independent assurance, oversight and delivery of the measure.

The Government will also strengthen the ATO’s ability to combat fraud by extending the time the ATO has to notify a taxpayer if it intends to retain a business activity statement (BAS) refund for further investigation. The ATO’s mandatory notification period for BAS refund retention will be increased from 14 days to 30 days to align with time limits for non-BAS refunds.

The Federal Budget for 2024 has unfolded various initiatives aimed at alleviating the financial pressures faced by Australians, from tax cuts to subsidies and beyond. With a keen focus on supporting individuals, families, and small businesses through strategic fiscal policies, this budget reflects a critical balancing act between stimulating economic activity and managing inflationary pressures.

However, the complexity and breadth of tax-related changes may leave many seeking clarity on how these adjustments directly affect their personal and business finances. Whether you’re trying to understand the new tax thresholds, the expanded CGT regime for foreign residents, or the implications of the energy relief measures for your business, expert guidance is essential.

Investax Group Business and Property Tax Specialists are well-equipped to provide detailed insights and personalised advice tailored to your unique circumstances. Our team keeps up to date with the latest tax laws and financial strategies to ensure you can maximise your benefits under the new budgetary measures. If you have any questions or need assistance navigating the tax changes brought about by the 2024 Federal Budget, do not hesitate to contact us at Investax Group. We are here to help you turn these updates into opportunities for financial improvement and security.

Contact Investax Group today and ensure that your tax planning is as effective and efficient as possible.

General Advice Warning

The material on this page and on this website has been prepared for general information purposes only and not as specific advice to any particular person. Any advice contained on this page and on this website is General Advice and does not take into account any person’s particular investment objectives, financial situation and particular needs.

Before making an investment decision based on this advice you should consider, with or without the assistance of a securities adviser, whether it is appropriate to your particular investment needs, objectives and financial circumstances. In addition, the examples provided on this page and on this website are for illustrative purposes only.Although every effort has been made to verify the accuracy of the information contained on this page and on our website, Investax Group, its officers, representatives, employees and agents disclaim all liability [except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this website or any loss or damage suffered by any person directly or indirectly through relying on this information.

Reference:

https://ministers.treasury.gov.au/ministers/jim-chalmers-2022/media-releases/new-power-bill-relief

https://investax.com.au/insight/stage-3-tax-cuts-effective-1st-july-2024

media Release – Paid Parental Leave