5 Renovation Tips for SMSF Commercial Properties Under LRBA

Introduction

There is often confusion around what renovations and improvements can be made to commercial properties owned within a Self-Managed Superannuation Fund (SMSF) under a Limited Recourse Borrowing Arrangement (LRBA). Over the years, Investax has received numerous queries from clients seeking clarity on how they can enhance their commercial property investments without breaching superannuation rules. This article will highlight the types of renovations that are permissible under LRBA, helping trustees make informed decisions while staying compliant.

What Can You Do? Permissible Renovations for Commercial Properties

When dealing with commercial properties under LRBA, the fundamental rule remains that borrowed funds can only be used for repairs and maintenance, not improvements that change the fundamental nature of the asset. However, there are still multiple ways to enhance a commercial property within these constraints.

1. Internal Reconfiguration

Commercial properties often require layout adjustments to maximise space efficiency. While complete redevelopments are not allowed, trustees of the SMSF can make internal modifications that enhance functionality.

Example: An office building owned under an SMSF requires a better layout for tenants. The trustee can add new partition walls to create separate office spaces, provided the structural integrity and purpose of the building remain unchanged.

- Repartitioning office spaces to improve workflow.

- Adding internal walls to optimise rental spaces.

- Reconfiguring customer service areas within retail stores.

2. Building Extensions

Commercial properties often need additional space to cater to tenant needs. Expanding usable areas without changing the fundamental nature of the property is generally permissible.

Example: A mechanic workshop under an SMSF needs more service bays to accommodate growing demand. The trustee extends the rear of the building to add extra bays, keeping the primary function unchanged.

- Expanding warehouse storage areas.

- Adding service bays in automotive workshops.

- Extending floor space in a retail setting for better stock management.

3. Tenant Fit-Outs and Basic Upgrades

Many commercial properties require periodic upgrades to remain competitive. Basic improvements that do not alter the core nature of the asset are allowed.

Example: A café tenant requests an upgrade to lighting and flooring. As these changes enhance the space without modifying the property structure, they are permissible.

- Installing new lighting systems.

- Upgrading flooring with modern equivalents.

- Improving plumbing and electrical systems to meet compliance standards.

4. Energy Efficiency Improvements

With sustainability becoming a key focus, SMSF trustees may want to enhance the energy efficiency of their commercial properties. Upgrades that do not alter the asset’s fundamental nature are allowed.

Example: A factory owner installs solar panels on the roof to reduce electricity costs. Since this does not change the building’s primary function, it is permitted.

- Installing solar panels.

- Upgrading to energy-efficient heating and cooling systems.

- Retrofitting LED lighting for sustainability compliance.

5. Repairs and Maintenance

Routine upkeep is essential for maintaining the value and functionality of commercial properties. Necessary repairs using borrowed funds under LRBA are fully compliant.

Example: A warehouse under an SMSF has a leaking roof. The trustee can replace the damaged roof with a modern equivalent, ensuring it remains in good condition.

- Replacing old roofing materials.

- Fixing broken windows and roller doors.

- Repainting exterior walls to prevent wear and tear.

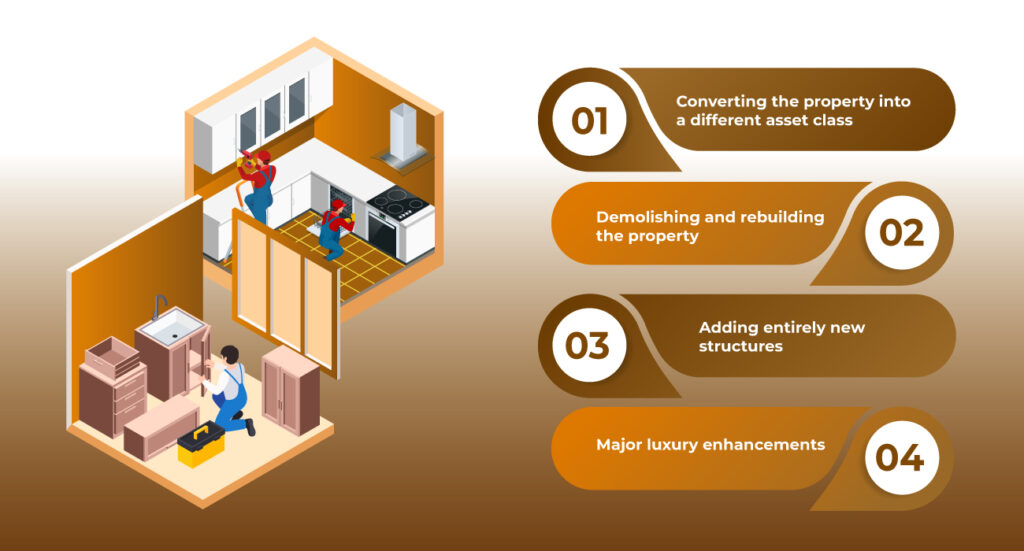

What Can’t Be Done?

While many renovations and repairs are allowed under LRBA, there are strict limitations on modifications that alter the nature of the asset. SMSF trustees should avoid:

- Converting the property into a different asset class – e.g., changing an office into residential apartments. This is considered a fundamental change in the nature of the asset, which is not permissible under LRBA regulations.

- Demolishing and rebuilding the property – significant redevelopments are not permitted. If a commercial warehouse is completely demolished and rebuilt as a modern shopping centre, this would constitute an entirely new asset, violating SMSF borrowing rules.

- Adding entirely new structures – e.g., constructing a separate building on the site. For example, building an additional office block next to an existing one would be seen as an improvement beyond allowable maintenance or repairs.

- Major luxury enhancements – such as high-end interior redesigns that significantly increase asset value. Renovations that are purely aesthetic and significantly enhance the property’s market value, such as marble flooring, high-tech security systems, or premium office fit outs, fall outside the scope of permitted works under LRBA.

Conclusion

We have seen many SMSF property owners hesitant to make any changes to their commercial properties, even when those changes could significantly improve rental returns. This hesitation is often due to uncertainty about what is permissible under LRBA rules. By understanding the clear guidelines around repairs, maintenance, and minor extensions, trustees can make informed decisions that enhance their investment without breaching regulations.

If you’re unsure about what upgrades you can undertake on your SMSF commercial property, reach out to Investax today. Our SMSF tax specialists can provide expert guidance, ensuring your renovations comply with ATO regulations while optimising the value of your investment.

General Advice Warning

The material on this page and on this website has been prepared for general information purposes only and not as specific advice to any particular person. Any advice contained on this page and on this website is General Advice and does not take into account any person’s particular investment objectives, financial situation and particular needs.

Before making an investment decision based on this advice you should consider, with or without the assistance of a securities adviser, whether it is appropriate to your particular investment needs, objectives and financial circumstances. In addition, the examples provided on this page and on this website are for illustrative purposes only.Although every effort has been made to verify the accuracy of the information contained on this page and on our website, Investax Group, its officers, representatives, employees and agents disclaim all liability [except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this website or any loss or damage suffered by any person directly or indirectly through relying on this information.