All you Need to Know about SMSF Bare Trust and Limited Recourse Borrowing

INTRODUCTION

Purchasing property through a Self-Managed Super Fund (SMSF) is a primary motivator for many property investors looking to take control of their retirement savings. An SMSF allows investors to directly manage their superannuation funds, providing opportunities to diversify into property investments. This investment strategy has grown in popularity due to its potential for long-term capital growth and rental income, making it an attractive option for those seeking to bolster their retirement portfolios.

However, establishing and maintaining an SMSF is not without its challenges. The SMSF is the most scrutinized superannuation structure in Australia, and the Australian Taxation Office (ATO) holds trustees to high standards of compliance. As a trustee, you are expected to have a thorough understanding of the rules and regulations governing SMSF investments. This responsibility can be daunting, especially when it comes to purchasing property.

This guide aims to demystify the complexities of buying property through an SMSF, whether you choose to do so with or without a loan. It will cover key aspects such as the benefits and risks of SMSF property investments, the legal and tax obligations of trustees, and the specific requirements for using a Bare Trust and Limited Recourse Borrowing Arrangement (LRBA).

SMSF BORROWING RULES

Prior to 2007, the SIS (Superannuation Industry Supervision) Act 1993 prohibited a Self-Managed Superannuation Fund (referred to as a ‘Super Fund’ in this document) from borrowing money to purchase assets. However, amendments to the SIS Act were introduced to allow Super Funds to invest in any kind of asset and to borrow, charging those assets, as long as there is no recourse for the borrowing against the Super Fund.

In simpler terms, this means that super funds can now invest in a wide variety of assets and can also borrow money to buy these assets. The key condition is that the loan must be secured only by the asset purchased with it, ensuring that if the loan can’t be repaid, the lender can only claim the asset bought with the loan and cannot take any other assets in the super fund.

New section’s 67A & 67B of the SIS Act permit a Super Fund to borrow money if:

- the money borrowed is applied for the purchase of an asset;

- the asset is held on trust so that the Super Fund acquires a beneficial interest;

- the Super Fund has the right to acquire legal ownership by making payment;

- the rights of the lender against the Super Fund for default are limited to the security.

KEY REQUIREMENTS

To ensure compliance and take advantage of borrowing for asset purchases, a Super Fund must adhere to the following key requirements:

- The Super Fund may select any property, residential or commercial. The purchase must be an ‘arm’s length transaction’ (i.e., the property is purchased from a ‘stranger’). There is an exception for ‘business assets’ (i.e., property leased to a tenant who conducts a business in the property). In this case, the property may be purchased from a ‘related party’ of the Super Fund.

- The legal title to the property must be held on a trust by an independent trustee. It is also known as Bare Trust

- The beneficial title to the property will be held by the Super Fund.

- The lender’s recourse will be limited to the property, thereby providing the Super Fund absolute protection for its other assets. Certain lenders will also require a personal guarantee from all members of the Super Fund.

- All rents will be paid directly to the Super Fund.

- The Super Fund will make loan repayments to the lender.

- Super Funds can deal with the property however and whenever they like, in the same way as you can deal with ‘normal’ investment properties (e.g., lease, repair, or sell).

- The Super Fund can pay out or reduce the mortgage at any time (subject to the terms of the relevant loan).

- When the mortgage is paid out in full, title to the property may be transferred to the Super Fund by the Property Trustee, or the Property Trustee may continue as the registered proprietor.

- It is important that the structure clearly complies with all the above requirements. Failure to do so may result in the Super Fund being declared ‘non-compliant’ within the meaning of the SIS Act.

BORROWING STRUCTURE

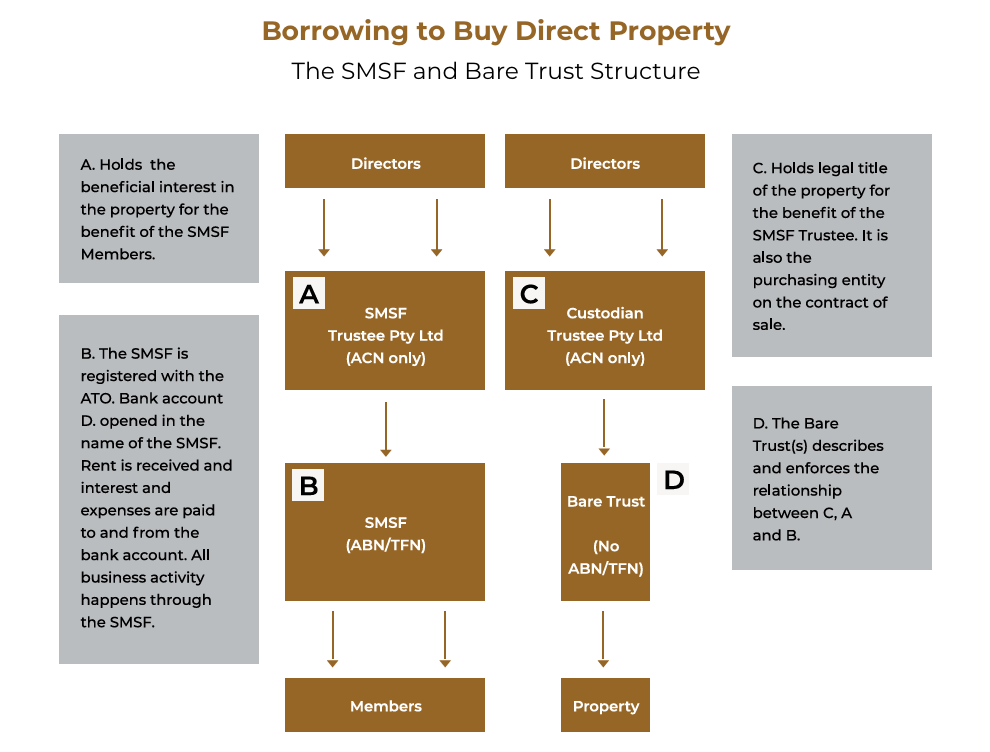

To successfully complete the property purchase, you will need to establish several structures.

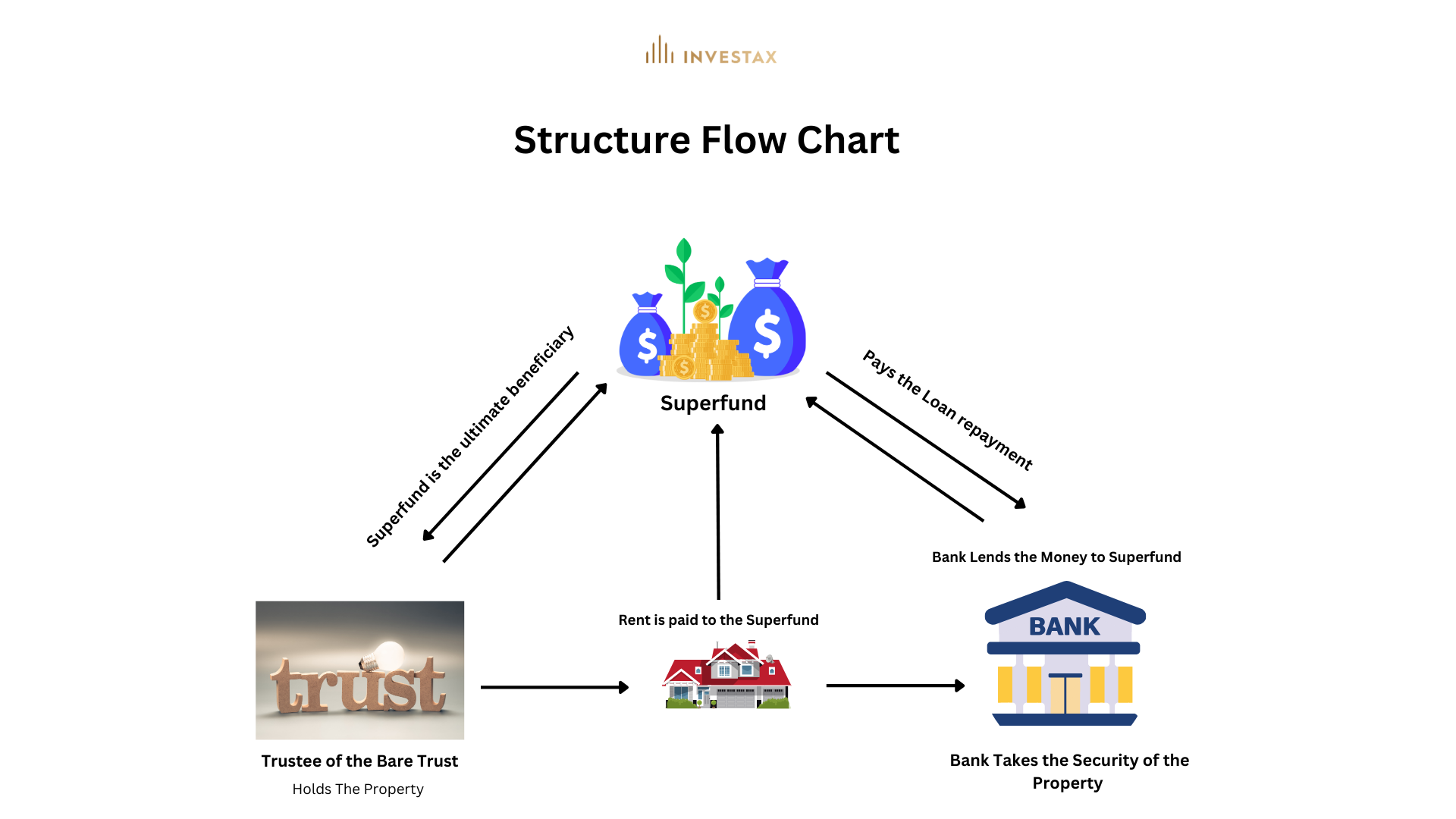

Relationship Between the Parties

- The super fund appoints a trustee to purchase the property on its behalf

- Super fund borrows money from the lender/bank

- The super fund makes loan repayments to the lender/bank

- Rent is paid to the super fund

- The trustee of the Bare trust holds the property

- The trustee agrees to:

- transfer the property to the super fund once the loan is repaid

- offer the property to the bank/lender as security for the loan

SMSF LOAN

This type of loan allows you to purchase residential or commercial property, with the Super Fund covering the deposit and any other costs, such as stamp duty. It complies with Government Legislation (SIS Act – s67A, 67B). As a ‘Limited Recourse Loan,’ the lender can only claim the property held as security and cannot access any other Super Fund assets.

Loan-to-Value ratios (LVRs) are available up to 80% for residential properties and up to 65% for commercial properties. The loan terms can extend up to 30 years for residential properties and up to 15 years for commercial properties.

We can assist you in navigating the wide range of Super Fund lending products available in the market today. Typically, an SMSF loan adheres to specific industry standards. Should you need a referral to a reputable broker, we are well-connected and can provide recommendations upon request.

LOAN RESTRICTIONS

It is important to remember that there are loan restrictions associated with this borrowing arrangement, including the ‘type/s’ of security lenders will accept:

- One Holding Trust can Hold one property on a ‘stand-alone’ basis. no other assets inside or outside the Super Fund can be utilised.

- Refinance is restricted to the initial loan terms

- No increase in the loan amount post settlement.

- No construction;

- No vacant land;

LEGAL STRUCTURES

SMSF – Many Australians are not aware that a Super Fund is a trust, and a trust is essentially a collection of clauses that inform the trustee of what can or cannot be done. If the SMSF trust deed doesn’t allow the trustee to acquire a bank loan or purchase a property, then it cannot proceed. Therefore, it is crucial to have a robust trust deed that covers all the necessary rules and regulations for purchasing a property with a limited recourse borrowing arrangement. If your SMSF deed is outdated, it may not cover the current rules and regulations.

The Property/Bare Trust Deed – It is a crucial component within the legal structure, requiring extreme care to avoid adverse GST, taxation, or stamp duty consequences. The SIS Act mandates that when an asset is acquired with loan proceeds, the asset “is held on trust” with the Super Fund being the beneficial owner at all times. Once the loan is fully repaid, the asset can then be transferred to the Super Fund.

At Investax, we source our deeds from industry-leading experts in establishing Super Fund deeds. Our providers continually update their documents to comply with the regulatory standards set by the SIS Act. Our trust deed providers guarantee that our Super Fund deeds will pass legal vetting by any lender. However, in the rare instance that a particular lender’s requirements change without notice, they will promptly make the necessary amendments free of charge.

PROFESIONAL HELP

Establishing and managing an SMSF involves complex financial and legal requirements, making it crucial to seek professional advice. If someone is advising you to set up an SMSF, it is essential that they are a registered financial planner or advisor with an Australian Financial Services License (AFSL) or work for an AFSL licensee. This ensures they have the necessary qualifications, expertise, and regulatory compliance to provide sound advice, helping you navigate the intricacies of SMSF management and ensuring your fund operates within the legal framework.

It is crucial to have the following specialists by your side when purchasing property with a loan in your Self-Managed Superfund:

- A specialist property tax accountant

- A registered financial planner

- An experienced mortgage broker

- An experienced conveyancer or property lawyer

WHY INVESTAX?

Choosing Investax Group as your property tax specialists ensures you receive unparalleled expertise and comprehensive service for all your superfund tax return needs, establishment of bare trusts, and superfund trusts. Our partnership with leading financial planners and lawyers guarantees you the best possible service and trust deed for your Self-Managed Super Fund (SMSF) investments.

At Investax, we understand the complexities of purchasing property through an SMSF and the stringent compliance requirements set by the Australian Taxation Office (ATO). Our team is dedicated to guiding you through every step, from the initial setup to ongoing management, ensuring your investments are structured optimally and legally sound. With our specialized knowledge in property tax accounting and our network of trusted professionals, you can be confident that your SMSF property investments are in expert hands, maximizing your financial benefits and safeguarding your retirement savings. Choose Investax Group for a seamless, compliant, and profitable SMSF property investment experience.

General Advice Warning

The material on this page and on this website has been prepared for general information purposes only and not as specific advice to any particular person. Any advice contained on this page and on this website is General Advice and does not take into account any person’s particular investment objectives, financial situation and particular needs.

Before making an investment decision based on this advice you should consider, with or without the assistance of a securities adviser, whether it is appropriate to your particular investment needs, objectives and financial circumstances. In addition, the examples provided on this page and on this website are for illustrative purposes only.Although every effort has been made to verify the accuracy of the information contained on this page and on our website, Investax Group, its officers, representatives, employees and agents disclaim all liability [except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this website or any loss or damage suffered by any person directly or indirectly through relying on this information.