A Guide To Buying an Investment Property

Choosing to invest in property is a big decision however it shouldn’t be a daunting one. It is important to ensure that you understand the steps involved and engage professionals to guide you through the process. A large percentage of Australians own property, however only 9% of people own an investment property, which equates to approximately 2.2 million people [1].

Buying an investment property can be an effective strategy for building wealth and securing your future. It can help improve cash flow, offers tax benefits and is seen as more stable than other investments.

Many Australians don’t take the first step towards purchasing an investment property as they believe it’s unaffordable and completely out of reach. According to the Australian Taxation Office, 39% of all people with an investment property earn less than $50,000 p.a and 73% earn less than $100,000 p.a. in their regular day jobs [1].

Investment Property and What you need to consider

Property may be a less volatile investment, but it is not without risk. It requires detailed planning, research, knowledge and importantly the right people behind you. There are a range of factors that will impact on your decision to buy an investment property. Let’s take a look at a few that you should put at the top of your list.

1. Review your personal cash flow and budget | Know your goals

Knowing your property investment goals and setting targets is an important aspect of investing in property. Your investment goals may differ but you need to understand why you want to invest in property. It is important to be clear about these and talk to experts such as your accountant and financial advisor. Consider the following:

- Are you looking to have a passive income in the future?

- Do you want to use the investment property as a vessel to create capital to pay off your own home?

- Do you want to own one investment property or develop a portfolio of 10?

- When you want to retire

- How much income you will need to retire

- What is achievable on your current salary

An important step is understanding how much cash you have to invest in property and whether you can afford the cash flow impact on owning an investment property. This can be as simple as listing all your assets including income and working out your expenses.

Work out how much you have as a deposit (making sure you don’t over-commit), or how much you will need to save for a deposit. Normally a lender likes you to have 20% deposit

2. Know Your Finances. Pre-Approval and using a Mortgage Broker

The next step is understanding your financial capacity and if the goals you have set are possible now, or what needs to change, financially, to make them feasible in the future. An investment property can be purchased outright using cash or more commonly purchased using a loan, known as a mortgage. If you like many other Australian’s will be using a mortgage to service the repayments for the investment property, you will need to work out your borrowing capacity from the bank.

Yes, there are many online calculators available, however, to get an accurate borrowing capacity figure that takes into consideration your goals and objectives, we recommend speaking with your Mortgage Broker. They will also able to organise a pre-approval, this is an indicative approval on the amount you can borrow.

This will provide you with a price range of affordability based on your financial position. It is recommended that you get pre-approval for an amount so you can go searching for a property with certainty based on how much you can spend. This will also dictate where you can purchase and what type of property you can purchase e.g. a house or apartment, new or old.

Also, you should consider how you will structure your Loan, should you go for interest only or principle and interest? Should you lock the rates in on a fixed term or leave it variable or go half/half? The answers to these questions may depend on the economic environment at the time and as always, seek counsel from the professionals before making a commitment!

3. Talk to your accountant

You need to understand the tax implications of buying an investment property and your accountant is the best person to talk to about this. Ask them to clarify the following:

- Negative gearing implications and depreciation allowances on new buildings. They will be able to advise if you are better off buying in a new or old building

- If you are buying a property with someone else ask whose name should be on the contract as this may have impacts on any future tax benefits, land tax and stamp duty.

- How much they believe you can afford to spend each week on an investment mortgage and the tax impact on this amount.

Purchasing properties through a trust has become an increasingly popular consideration as part of an investment strategy because it can offer excellent tax benefits and asset protection. There are a number of factors. For example:

- if you purchase an investment property through a family trust, you can’t subtract property losses from your taxable income.

- there are no land tax thresholds in certain States

4. Find a conveyancer or lawyer

Most property investors enlist the services of a conveyancer or solicitor to handle the purchase process on their behalf. While you are able to act on your own when making a property purchase, the process of documentation and settling can be complicated – and may seem daunting. Bringing in support and assistance from a qualified expert familiar with legal documents and legislation can make the process easier.

5. Find The Right Market and Property

Once you have your finances in order and you understand what you are hoping to achieve then you will need to start looking for the right investment property. This step is crucial in ensuring you have the best chance at achieving capital growth and strong rental yields for the investment property. It is important to understand the underlying fundamentals that determine property growth, from a macro and micro level.

To do this you need to rank your key investment criteria such as:

- does it need to be near public transport, schools, shops, work and what is the walk score?

- what do you value as important for the exterior and interior of the investment?

- type of building, size of complex, parking, number of bedrooms and bathrooms, flooring, the properties aspect, quality of kitchen, backyard and outdoor entertaining and,

- whether you want to renovate or not

These steps help you clarify exactly what you are looking for and will enable you to assess potential investment properties against your must-have criteria. Selecting the right first property is vital as this will be the base of your property portfolio.

Data from the ATO shows that a large 71% of investors in the property market only hold one property, and only 10% of hold more than two. This comes down to many factors, however, it is usually because the wrong property was selected, which didn’t allow the purchaser to continue building their portfolio, either due to little to no capital growth or poor rental yields.

6. Do you engage a Property Manager or self-manage?

After purchasing your investment property, the next key decision you will need to make is whether you will employ a property manager to help you, or whether you’ll manage it yourself.

Although many investors are financially-savvy when it comes to finding tenants, dealing with day-to-day property issues or legal jargon they are left in the dark. An experienced property manager can help make sure you receive a reliable income stream, excellent capital growth and the best returns possible – as well as a guarantee of exceptional customer service. You receive regular and thorough property inspection reports, copies of all important documents and regularly review rent rates and the local market to help you achieve the best outcome.

A property manager costs approximately 7-10% of your total rental income, however the services and expertise offered by a good property manager is worth much more than this fee, plus in many cases the agent’s service fee is tax deductible. Your property manager will keep a record of your monthly income and expenses and be able to provide you with a report for your end-of-year accounting. There are a few other accounting implications and requirements so make sure you discuss this with your accountant.

These are some of the most important considerations when you consider investing in property. To find out more about structuring and asset protection we recommend that you seek advice from your accountant or financial planner.

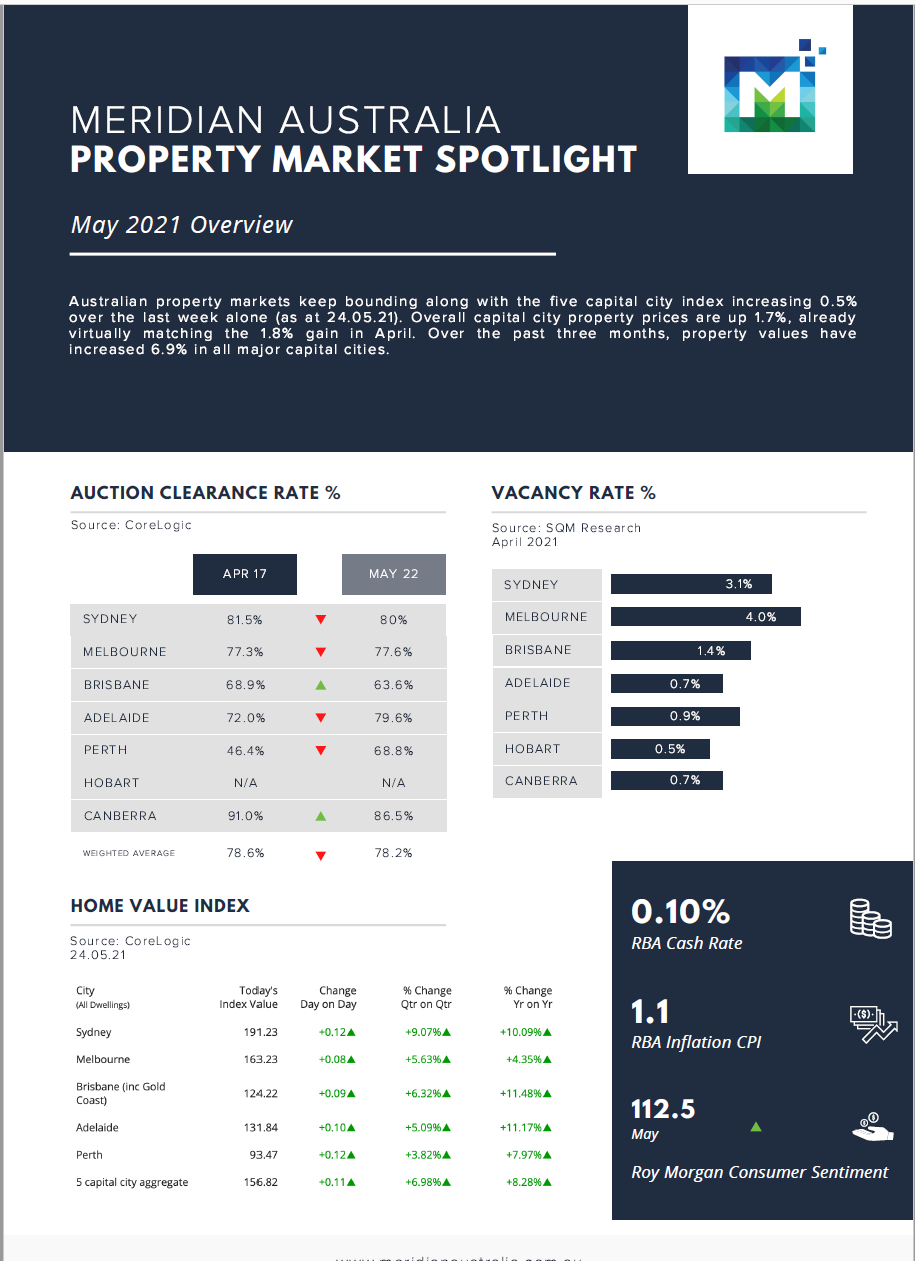

Download the January 2022 Property Spotlight Report here

Source: Warren Jacobs – Business Development Manager at Meridian Australia.

Source: ATO

General Advice Warning

The material on this page and on this website has been prepared for general information purposes only and not as specific advice to any particular person. Any advice contained on this page and on this website is General Advice and does not take into account any person’s particular investment objectives, financial situation and particular needs.

Before making an investment decision based on this advice you should consider, with or without the assistance of a securities adviser, whether it is appropriate to your particular investment needs, objectives and financial circumstances. In addition, the examples provided on this page and on this website are for illustrative purposes only.

Although every effort has been made to verify the accuracy of the information contained on this page and on this website, Investax Group, its officers, representatives, employees, and agents disclaim all liability [except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this website or any loss or damage suffered by any person directly or indirectly through relying on this information.