5 Lessons from the intelligent property investor

For property investor, In 1949 the book ‘The Intelligent Investor’ was published by Benjamin Graham, an iconic book on investment psychology and long term gratification – both key traits for astute investors.

The book focuses on longer-term and more risk-averse approaches to investing with Graham’s focus on investments, based on research rather than speculations, based on predictions.

Graham comments:

“In the short term the market is a voting machine; in the long term it is a weighing machine.”

Like with any investment, whether it is shares or property, we can’t always pinpoint how the markets will perform over the short term, however, when purchasing an investment wisely, the market should deliver substantial value. Purchasing an asset that will have huge demand over the long term, that you can hold, that has little impact on your lifestyle, will make for a wise investment.

Here are the 5 Lessons from the intelligent property investor:

1. Learn from your mistakes and stay persistent.

In the stock crash of 1929, Benjamin Graham discovered the hard lessons of risk when he lost most of his capital almost overnight. However, he did not give up, but rather studied hard, stayed persistent and ultimately succeeded.

2. Investing is not gambling or speculating.

Graham felt that investment should involve a certainty of the return of investment capital and a worthwhile return over the inflation rate. He focused on undervalued assets with a strategy that stated: “to buy when the commodity is depressed and sell when he is on a high.”

3. Minimising downside risk.

The process of de-risking an investment is essential for a good return-on-investment (ROI) or as Graham put it “using a margin of safety” by purchasing below its true value. This allowed for greater profits on the upside but equally gives you a margin of safety on the downside

4. The margin of safety.

The whole idea of good investing is to purchase when the price is lower than its value and then to hold that asset until that price rises above its original value. Graham’s strategy was using the fear and greed of the market to his advantage; where Warren Buffett’s famous line came from:

“Be fearful when people are greedy and greedy when people are fearful.”

The second was to invest by the numbers to find undervalued assets when the market was despondent, and there were plenty of bargains around.

5. See beyond the horizon.

This again supports the idea, to be a successful investor one must look beyond the short and medium-term horizon by instead having a long-term vision for all investment activity.

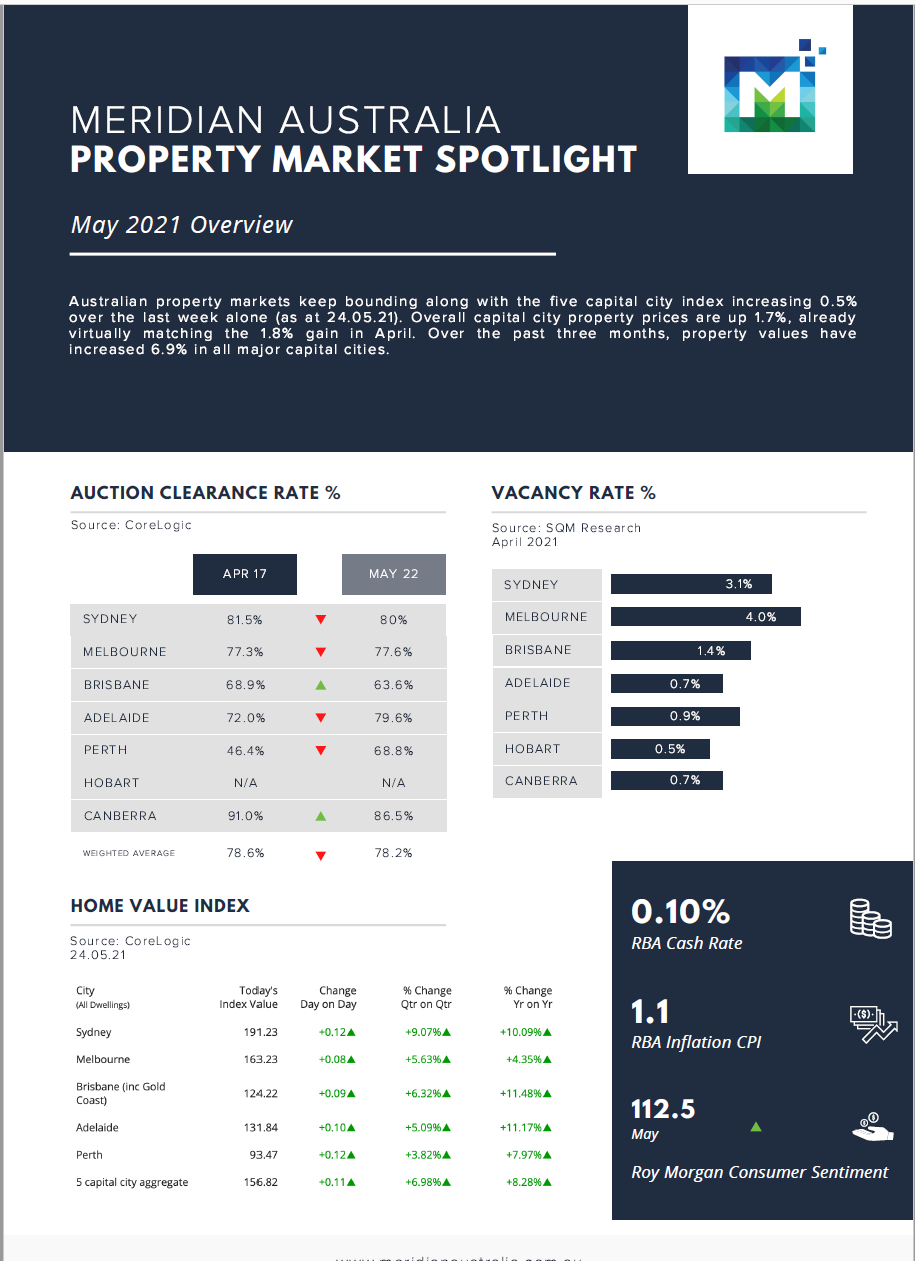

Download the September Property Spotlight Report here

Source: Warren Jacobs – Business Development Manager at Meridian Australia.

General Advice Warning

The material on this page and on this website has been prepared for general information purposes only and not as specific advice to any particular person. Any advice contained on this page and on this website is General Advice and does not take into account any person’s particular investment objectives, financial situation and particular needs.

Before making an investment decision based on this advice you should consider, with or without the assistance of a securities adviser, whether it is appropriate to your particular investment needs, objectives and financial circumstances. In addition, the examples provided on this page and on this website are for illustrative purposes only.

Although every effort has been made to verify the accuracy of the information contained on this page and on this website, Investax, its officers, representatives, employees, and agents disclaim all liability [except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this website or any loss or damage suffered by any person directly or indirectly through relying on this information.