6-Year Exemption Rule:

Recently, we received a call from one of our clients. He works in the Sydney CBD and

purchases a home in Western Sydney in July 2017. He resided there for some time, but due

to the commute, he decided to move closer to work and rented out his primary place of

residence (PPOR) in March 2018. He doesn’t own any other investment properties, making

his PPOR his sole investment property.

He’s informed about the 6-year absence rule for capital gain exemption. He plans to return

to the property in 2024 after his contract with his current employer concludes. He’s curious

about the duration he needs to stay in the property to re-establish the PPOR status to utilize

the 6-year absence rule, as he might not want to reside there long-term.

Challenges –

- Potential inability to return before the 6-year period concludes.

- Possible forfeiture of the 6-year exemption due to timing.

- Reluctance to reside in the property long-term if commuting proves inconvenient.

Key Points –

If you used the property to produce income (like rent), it can still be treated as your main

residence. This is sometimes referred to as the ‘6-year rule[1].

Solutions –

Upon verifying that the client possesses ample evidence confirming the property was his

primary residence for an 8-month duration, our Investax property tax specialist shared

crucial insights about the 6-year absence rule to guide the client.

To reinstate the 6-year absence rule for capital gain exemption, the client should relocate to

the property before the 6-year period ends.

If the property is rented out for over 6 years, a full exemption under the main residence rules isn’t granted upon its disposal. In such instances, the client qualifies for a partial exemption. To determine the partial exemption, the client should consider the market value of the property when it first generated rental

income.

Addressing the third challenge, we have advised the client to genuinely occupy the premises

first to establish it as his main residence. The duration one must reside in a property to re-

establish PPOR status isn’t explicitly dictated by the ATO. Unlike various Australian State

Revenue offices, the ATO doesn’t mandate a specific stay duration to confirm a PPOR status.

As long as an individual resides in the property for a reasonable span, it’s recognized as their

PPOR, and the 6-year absence rule becomes applicable.

As per the ATO Guideline[6], Generally, a dwelling is considered to be a main residence if:

- you and your family live in it.

- your personal belongings are in it.

- it is the address your mail is delivered to.

- it is your address on the electoral roll.

- services such as gas and power are connected.

The length of time you stay in the dwelling and whether you intend to occupy it as your

home may also be relevant.

Typically, a period of 6 months or more is considered a reasonable duration to demonstrate

genuine intention for the state government to approve the First Homeowners Grant.

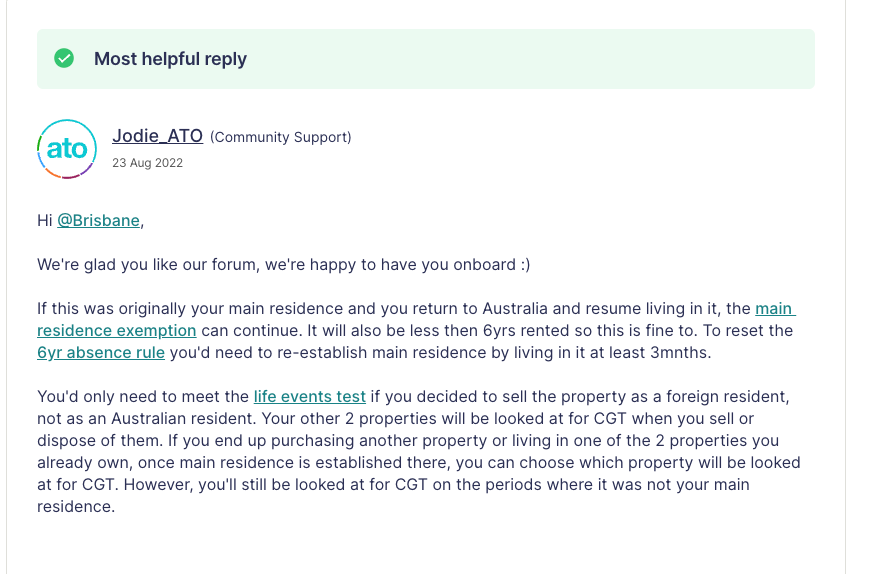

However, this is not specifically mentioned on the ATO website. Interestingly, we found an

answer from the ATO community indicating that a period of 3 months or more is also

deemed reasonable[7] .

We must exercise caution, as this information may not be universally applicable, especially

since the ATO hasn’t included it in any of their official publications.

Action Plan for the Readers:

You must be reading this case study because you either find yourself in a similar situation or

you may be considering applying something similar in the future. We have created an action

plan for you to ensure you are well-informed.

- Self-Assessment: Begin by evaluating your current property situation. Consider

factors like the duration you’ve lived in your primary place of residence (PPOR), any

periods of absence, and the reasons for such absences. - Understand the 6-Year Rule: Familiarise yourself with the 6-year absence rule for

capital gain exemption. This rule allows homeowners to be absent from their

primary residence for up to six years without losing the capital gains tax exemption. - Document Everything: Maintain thorough records of your stay in the property such

as Drivers License address, Electricity bill, phone bills, bank statement address etc. - Re-establishing PPOR Status: If you’ve rented out your property, consider the

implications of moving back in. Understand the duration required to re-establish the

PPOR status and the benefits it offers. - Consult with Investax property accounting team: Reach out to Investax’s property

tax specialists for personalised advice tailored to your situation. We can provide

insights on how to best leverage the 6-year rule and other tax exemptions. - Stay Updated: Tax regulations and property laws can change. Regularly check the

Investax website and subscribe to their newsletter for the latest updates and case

studies. - Consider Future Plans: If you’re thinking of purchasing additional properties or

changing your current residence’s status, discuss your plans with Investax property

tax specialist. Our team can guide you on the potential tax implications and benefits. - Attend Investax Workshops: Investax often hosts workshops and seminars on

property investment and tax strategies. Participate in these to gain deeper insights

and network with other property investors. - Feedback and Queries: After reading the case study, if you have any specific

questions or require clarifications, use our contact form or complimentary

consultation form to reach out. - Continuous Engagement: Stay engaged with Investax for ongoing support, especially

during tax season, to ensure you’re maximizing your property investment benefits.

Sources

- ato.gov.au – Treating former home as main residence

- ato.gov.au – Your main residence – home – Australian Taxation Office

- ato.gov.au – Main residence exemption for foreign residents

- ato.gov.au – Capital gains tax property exemption tool

- community.ato.gov.au – 6 year rule – ATO Community – Australian Taxation Office

- Ato.gov.au-Eligibility for main residence exemption

- community.ato.gov.au – 6 year rule, non-tax resident, what does this all mean!?