Jake and Tania Escaped a $200K CGT mistake!

Background: Jake and Tania are accomplished property investors, both employed and presently renting in Sydney. They embarked on their property investment journey through Rentvesting, with the long-term goal of buying their own home when they needed more space. With a two-year-old daughter and another child on the way, they’ve decided it’s time to purchase a family home, preferably one with a backyard for the children to play in. They have narrowed down their search to a few desirable suburbs in Northern Sydney, including Pennant Hills, Thornleigh, and Hornsby, where the median house price in 2024 exceeds $2 million.

After consulting with their mortgage broker, Jake and Tania realised they lacked sufficient funds for a deposit and stamp duty on a new house. Consequently, they have decided to sell two properties from their portfolio. A property in NSW, owned by their Family Trust, is slated for sale within this financial year, before June 30, with a projected capital gain of $500K.

The second property, an underperforming asset in QLD purchased by Jake early in his property investment journey for positive cash flow, is set to be marketed in the first quarter of the 2025 financial year. Having held it for nearly 15 years, Jake has decided it’s time to sell to improve his loan serviceability. Originally purchased for $550K, the property’s current market value stands at $350K.

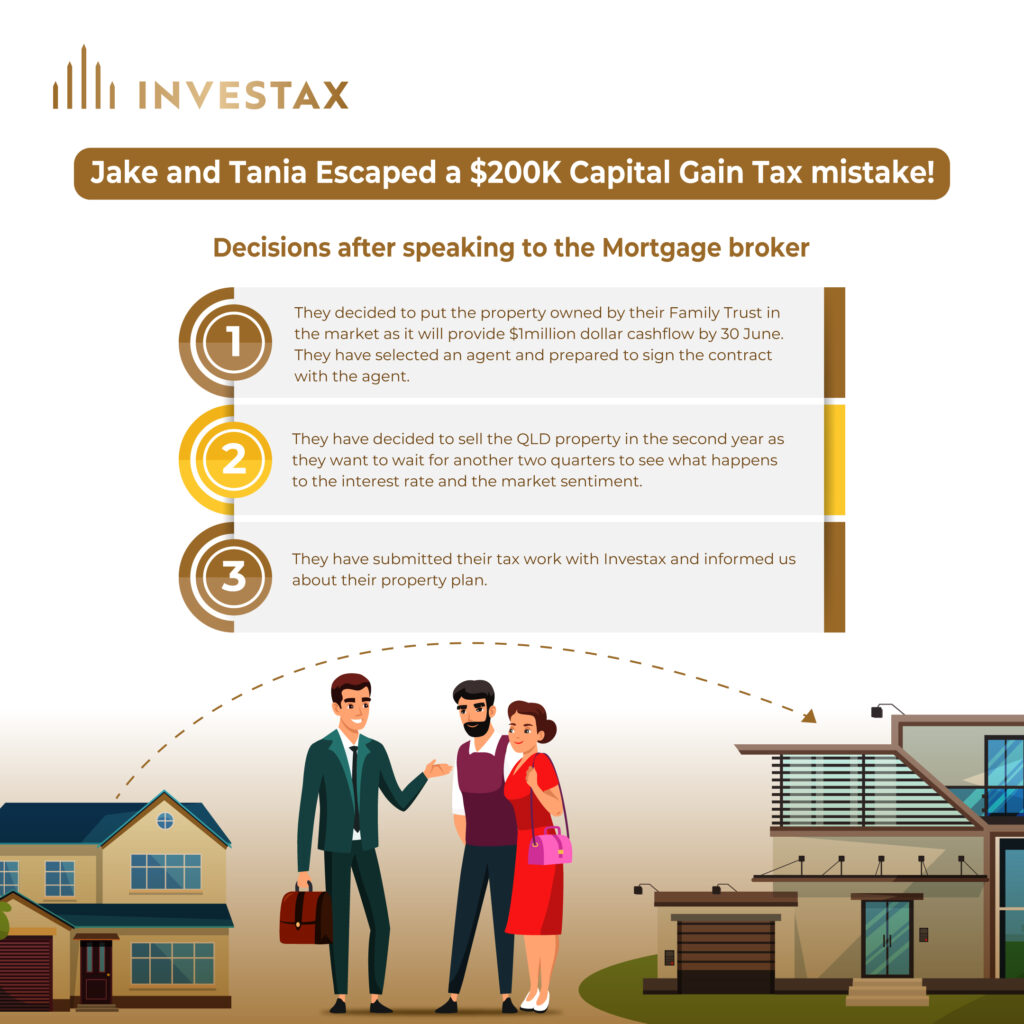

Decisions after speaking to the Mortgage broker

- They decided to put the property owned by their Family Trust in the market as it will provide $1million dollar cashflow by 30 June. they have selected an agent and prepared to sign the contract with the agent.

- They have decided to sell the QLD property in the second year as they want to wait for another two quarters to see what happens to the interest rate and the market sentiment.

- They have submitted their tax work with Investax and informed us about their property plan.

Findings and Strategic Solution for Capital Gain

Upon reviewing their plan, we immediately identified a $200K capital gain tax issue. Selling their NSW property in the 2024 financial year would result in a $500K capital gain. This would subject them to capital gains tax on $250K, after the 50% capital gains discount for holding the property for more than 12 months is applied.

Should they decide to sell their QLD property in the 2025 financial year, they would face a $200K capital loss, which cannot be offset against their salary or any other source of income. They could use this capital loss to reduce their capital gain, but as they would have realized the gain in 2024, no capital gain would be available to offset in 2025.

Unfortunately, we cannot apply the capital loss from a subsequent year to reduce capital gains tax from a previous year. Therefore, it’s essential that the QLD property is sold before the NSW property, allowing the capital loss to offset the capital gain, and thus reduce the capital gains tax liability.

Capital losses can be carried forward indefinitely to offset capital gains in subsequent years. Therefore, if the sale of their NSW property does not occur by the 2024 financial year, it is not a concern. We can carry forward the capital loss to offset any capital gains that may arise in the 2025 financial year or later.

Conclusion

After evaluating their tax situation, Jake and Tania decided to list their QLD property first, aiming to realize their capital loss early. Following the sale of their Family Trust property, they plan to allocate the capital gains to Jake, allowing him to offset the capital losses. If you’re considering selling properties in your investment portfolio, it’s crucial to consult with your accountants.

Once such a mistake occurs, there’s no way to reverse it. Therefore, it’s advisable to seek guidance from a property tax specialist before proceeding with the sale. At Investax, our team offers tailored services to manage your capital gains and losses effectively. Our expert property tax accountants are equipped to provide the necessary tax assessments, enabling you to make informed decisions.

Reference

https://investax.com.au/insight/rentvesting-7-reasons-you-should-consider-rentvesting/