Introduction

Selling land through an option agreement can be complex and often confusing for landowners. Across Australia, property developers frequently approach landowners with offers to secure an option to purchase their land in the future. If you’ve received such an offer and are unsure about its financial and tax implications—especially its impact on Capital Gains Tax (CGT)—this case study will help you navigate the complexities with clarity.

Overview

In this case study, we examine Jack’s experience with granting an option to sell his land. Jack purchased the property in 2010 for $400,000. By 2023, rezoning for high-density development had increased demand in his area, drawing interest from potential buyers. On 15 June 2023, Jack granted Maya an option to purchase his land within 12 months for $2,000,000. As part of the agreement, Maya paid Jack $100,000 for the option, while Jack incurred $5,000 in legal fees.

Uncertain about the tax implications, Jack sought professional advice from Investax to understand the potential consequences—whether Maya proceeds with the purchase or decides not to exercise the option. This case study explores the tax treatment and key considerations for landowners in similar situations.

At Investax, our Property Tax Specialists guided Jack through the various tax implications of granting an option, explaining how CGT Event D2 applies, the deductibility of legal fees, and the potential tax outcomes depending on whether Maya exercises the option or lets it lapse.

Granting Option for Property: What It Means

Granting an option refers to a legal agreement in which a property owner (the grantor) gives a buyer (the option holder) the exclusive right—but not the obligation—to purchase the property within a specified period and under agreed-upon terms. In exchange for this right, the buyer typically pays the grantor an upfront option fee.

This arrangement is common in real estate transactions, especially when a buyer needs time to secure financing, obtain approvals, or assess the feasibility of development before committing to the purchase. The option can be exercised (meaning the buyer proceeds with the purchase) or allowed to lapse (meaning the buyer chooses not to buy, and the seller retains the option fee).

From a tax perspective, granting an option is considered a separate transaction from the eventual sale of the property.

Call Option vs. Put Option: Understanding the Difference

The tax implications of an option agreement depend on whether the option granted is a call option or a put option. But what do these terms mean?

A Call Option is an agreement that gives the buyer (option holder) the right to purchase an asset at an agreed price within a specified timeframe. If the buyer exercises the option, the grantor (seller) is legally bound to sell the asset under the agreed terms. In property transactions, a call option typically benefits developers or investors who want to secure the right to buy land but need time for due diligence, financing, or approvals before committing to the purchase.

A Put Option, on the other hand, works in the opposite way—it binds the grantor (seller) to acquire an asset at a predetermined price if the option holder decides to sell. In this scenario, the seller is obligated to purchase the asset if the buyer exercises the put option. This type of option is often used for risk management in financial markets or structured property deals where a seller seeks certainty in a potential sale.

What CGT Event Occurs When Granting an Option?

When you grant an option to another person or entity, or if you renew or extend an existing option, Capital Gains Tax (CGT) Event D2 is triggered. This event occurs because granting an option is considered a separate transaction from the actual sale of the property.

The capital gain or loss from CGT Event D2 is calculated as the difference between the amount received for granting the option and any related expenses incurred. However, it is important to note that the CGT discount does not apply to gains made under CGT Event D2, meaning the entire capital gain is subject to taxation without the usual 50% discount available for assets held longer than 12 months.

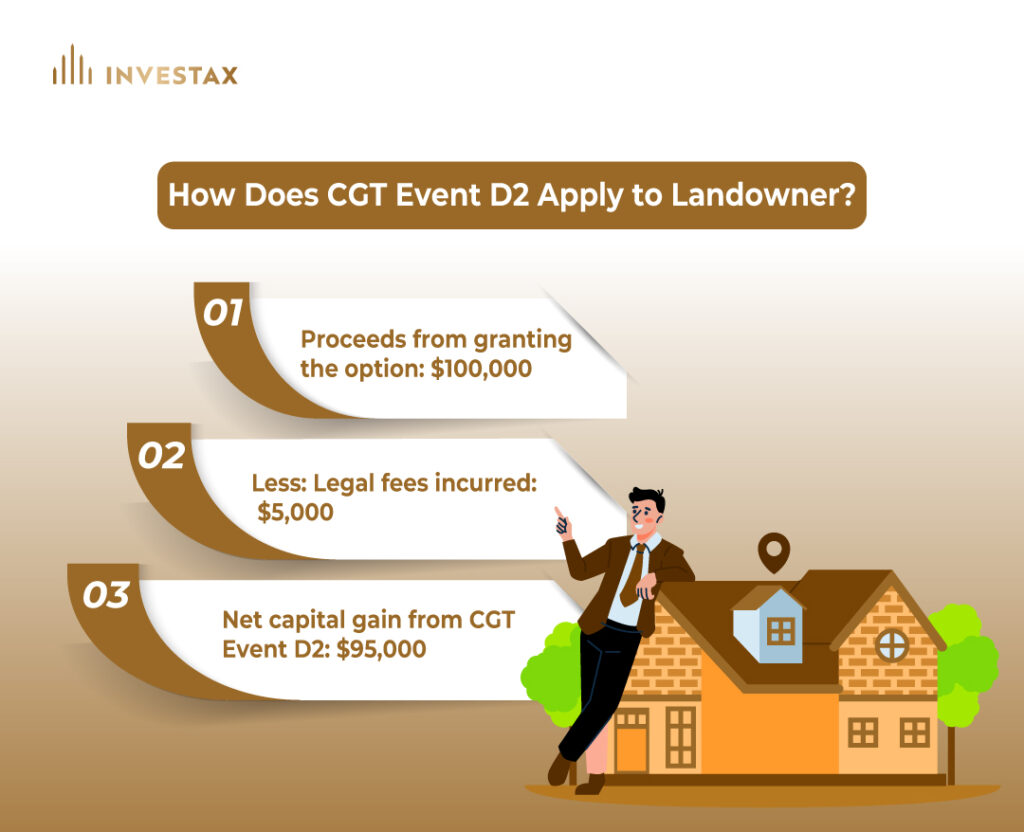

How Does CGT Event D2 Apply to Landowner?

In Jack’s case, on 30 June 2023, he granted Maya an option to purchase his land for $2,000,000 within 12 months. In return, Maya paid Jack $100,000 for the option. Jack also incurred $5,000 in legal fees related to the transaction.

Under CGT Event D2, Jack’s capital gain is calculated as follows:

- Proceeds from granting the option: $100,000

- Less: Legal fees incurred: $5,000

- Net capital gain from CGT Event D2: $95,000

Since CGT Event D2 does not qualify for the CGT discount, Jack must include the full $95,000 in his taxable income for the 2023 income year. This gain will be taxed at his marginal tax rate, potentially increasing his overall tax liability for the year.

Important Note – CGT discount does not apply to gains made under CGT Event D2.

What Happens to the CGT Event D2 If You Exercises the Option?

If the option granted is later exercised, any capital gain or loss previously reported under CGT Event D2 must be disregarded. This means that the gain Jack initially recorded from granting the option will no longer be taxable as a separate transaction. Instead, the $100,000 option fee will be included as part of the total capital proceeds from the sale of the property in the year the sale occurs.

In Jack’s case, on 1 May 2024, Maya exercised the option to purchase his land. As a result, Jack must disregard the $95,000 capital gain he originally reported in the 2023 income year from granting the option.

Since Jack has not yet lodged his 2023 tax return (as the lodgement deadline is 15 May 2024), he does not need to make any amendments—he can simply exclude the CGT Event D2 gain when preparing his tax return. However, if he had already lodged his 2023 return and reported the capital gain from granting the option, he would need to request an amendment to his income tax assessment to exclude that amount.

Conclusion

Granting an option to sell your land can have significant tax implications, and understanding how CGT Event D2 applies is crucial for making informed financial decisions. As seen in Jack’s case, the tax treatment of option agreements can vary depending on whether the option is exercised or not. While granting the option triggered an immediate capital gain under CGT Event D2, this gain was later disregarded when Maya exercised the option, shifting the taxation to the actual sale of the property.

Navigating these complexities requires careful tax planning to ensure compliance with ATO regulations while optimising your financial position. At Investax, our Property Tax Specialists have extensive experience guiding landowners through the tax implications of option agreements, ensuring they understand their obligations and potential strategies to minimise tax liabilities.

If you’re considering granting an option or have already done so and need expert advice on how it affects your Capital Gains Tax, contact Investax Property Tax Specialists today. Our team is here to help you make confident, tax-efficient decisions.

Reference

General Advice Warning

The material on this page and on this website has been prepared for general information purposes only and not as specific advice to any particular person. Any advice contained on this page and on this website is General Advice and does not take into account any person’s particular investment objectives, financial situation and particular needs.

Before making an investment decision based on this advice you should consider, with or without the assistance of a securities adviser, whether it is appropriate to your particular investment needs, objectives and financial circumstances. In addition, the examples provided on this page and on this website are for illustrative purposes only.

Although every effort has been made to verify the accuracy of the information contained on this page and on our website, Investax Group, its officers, representatives, employees and agents disclaim all liability [except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this website or any loss or damage suffered by any person directly or indirectly through relying on this information.