Overview

John and Maria are successful small business owners who provide various products to Australian builders. Their turnover has been around $1 million every year for the last few years. Until 2022, they ran a profitable business and paid taxes every year for the past 10 years. However, in the 2023 financial year, they unfortunately made a loss due to a couple of their builder clients going bankrupt and cancelling their large contracts. John and Maria had already invested a large sum of money in purchasing raw materials from overseas to produce the products for the builders. As a result, they incurred a loss of $100,000 in this financial year.

Challenges

John and Maria lodged their company tax return on May 15, 2023, for the 2022 financial year, with a tax liability of $50,000, which is 25% of their annual profit of $200,000. They are also liable for quarterly PAYG instalments of approximately $13,000, which is an upfront tax for the 2023 financial year. John and Maria contacted Investax for advice on this tax dilemma and how to manage their cash flow issue, given that they will not have a tax liability for the 2023 financial year but still have to pay the 2022 financial year tax and the upfront tax for the 2023 financial year.

Solutions

After speaking to us, John and Maria decided to take the following actions:

- Reduce PAYG Instalments to Nil: To improve cash flow, they decided to review the PAYG instalment to nil since the 2023 financial year will not have any profit to pay upfront tax. They have already paid two quarters of PAYG instalments.

- Apply Loss Carry Back Tax Offset: As per the ATO, loss carry back provides a refundable tax offset for eligible corporate entities for the 2020-21, 2021-22-, and 2022-23-income years. They can claim this offset in their company tax returns for these years. By carrying back losses to previous years with tax liabilities, entities can reduce their tax or receive a cash refund. There’s no need to amend previous years’ returns. If they choose not to carry back losses, they can carry them forward to future years. Entities can use a tool to check eligibility and calculate the maximum claimable amount. This measure supports new investments and can boost business cash flow by providing tax refunds.

For instance, John and Maria, who faced a significant loss of $100,000 in the 2023 financial year, can benefit from the loss carry back provisions. In 2022, they had a tax liability of $50,000 on a profit of $200,000. By opting to carry back their 2023 losses, they can offset their 2022 tax liability, potentially resulting in a cash refund or reduced tax debt. This option can greatly aid their cash flow, providing much-needed financial relief during a challenging period for their small business.

Key Eligibility Criteria for Claiming the Offset

- Eligible Entity: John and Maria operate their small business through a company, which is an eligible entity to claim this tax offset. Another rule is that the entity must be a small business entity in the loss year or would have been a small business entity if the aggregated turnover threshold was $5 billion.

- Franking Account Balance: The ability to claim the loss carry back tax offset is dependent on having a franking account balance in surplus by the amount of the offset. It is crucial to maintain accurate franking account records and avoid common errors to ensure the claim is processed correctly. Errors in completing labels, calculating tax losses, and reporting franking account balances can delay processing or result in incorrect claims. John and Maria also have over $100,000 worth of franking credits in their company’s franking account.

Conclusion

In conclusion, by utilising the loss carry back provisions, John and Maria can offset their 2022 tax liability with their 2023 losses, resulting in a $25,000 refundable tax offset (detailed calculation is provided below). This financial relief is crucial during challenging times for their small business, improving their cash flow and providing much-needed support.

If you are running a small business through a company, you will inevitably face various financial ups and downs. The Loss Carry Back Tax Offset is one of the many tax reliefs the ATO offers for small business owners. It is crucial for a small business entity to engage an accountant who knows the tax terrain properly to help their clients when needed. At Investax, our business tax specialists are here to help you manage these challenges effectively. Contact us today to see how we can assist you in optimizing your tax situation and ensuring the financial health of your business.

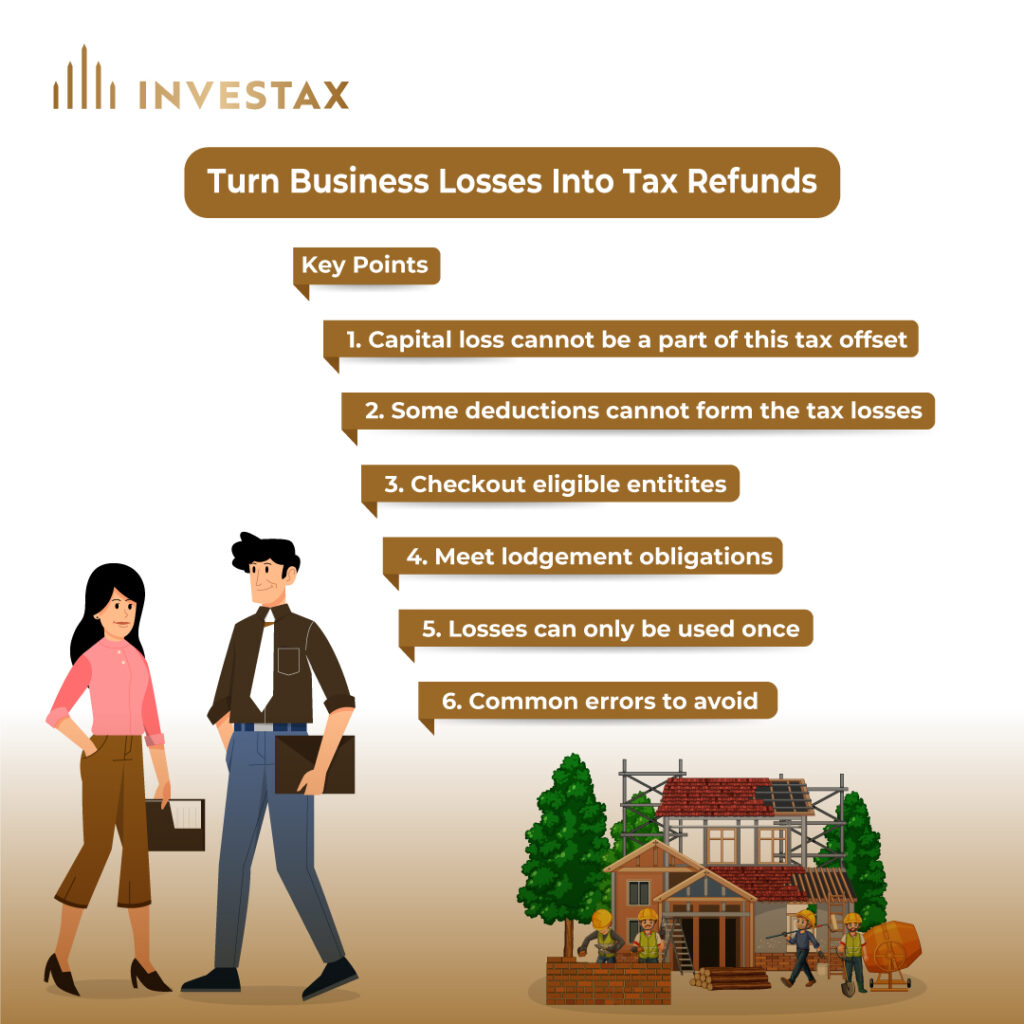

Pro Tips:

- Capital Loss – Capital Loss Cannot be a part of Tax Loss to claim the loss carry back tax offset.

- Deductions That Cannot Form the Tax Losses – As per the ATO, below expenses that would otherwise be allowable cannot be claimed as deductions where they would give rise to a tax loss. They are:

- payments of pensions, gratuities or retirement allowances to employees, former employees, or their dependents

- Donations

- personal superannuation contributions.

- payments made under conservation covenants

- Eligible Entities – Company, Corporate Limited Partnership or a Public Trading Trust are eligible entities.

- Lodgement Obligations – All tax returns and BAS returns for the company must be up to date for the past five years. You must also lodge your current tax return for the company on time to claim the offset.

- Losses can only be used once – You can only use the losses once. This means you cannot carry forward the losses in the future income year.

- Common Errors to Avoid

- Incorrectly completing labels for tax loss amounts and net exempt income.

- Failing to include the tax offset amount at the correct labels in the tax return.

- Incorrectly reporting franking account balances due to missed entries, incorrect handling of deferred debits, or misclassifying franked dividends.

- Miscalculating tax losses and the tax offset, including using the wrong tax rate or tax payable amount in the calculations.

Working out John and Maria’s Tax Offset:

Provided Information:

- John and Maria incurred a tax loss of $100,000 in the 2023 financial year.

- The income tax rate is 25%.

- At the end of the 2023 financial year, their franking account balance is $100,000.

- In the 2022 financial year, they had an income tax liability of $50,000 and no exempt income.

Calculation Steps:

Step 1: Calculate the amount of loss carried back

- Loss carried back to the 2022 financial year: $100,000

- Additions (none): $0

- Total losses carried back: $100,000

- Calculate tax benefit: $100,000 × 25% tax rate = $25,000

Step 2: Compare with previous year’s tax liability

No adjustment is required as the tax liability in the 2022 financial year ($50,000) is greater than the $25,000 from step 1d.

Step 3: Loss carried back to one earlier income year

Result of step 3: $25,000

Step 4: Compare with franking account balance

The amount of the refundable tax offset is limited to the lower of the calculated tax benefit and the franking account balance. Here, $25,000 is less than the franking account balance of $100,000.

Outcome: John and Maria can claim a refundable tax offset of $25,000 from their loss carry back for the 2023 financial year.

Reference

ATO – Loss Carry Back

Eligibility

General Advice Warning

The material on this page and on this website has been prepared for general information purposes only and not as specific advice to any particular person. Any advice contained on this page and on this website is General Advice and does not take into account any person’s particular investment objectives, financial situation and particular needs.

Before making an investment decision based on this advice you should consider, with or without the assistance of a securities adviser, whether it is appropriate to your particular investment needs, objectives and financial circumstances. In addition, the examples provided on this page and on this website are for illustrative purposes only.

Although every effort has been made to verify the accuracy of the information contained on this page and on our website, Investax Group, its officers, representatives, employees and agents disclaim all liability [except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this website or any loss or damage suffered by any person directly or indirectly through relying on this information.