Overview

At Investax, our clients frequently ask, “If I receive money from overseas, do I pay tax?” or “If my parents transfer some cash to me, do I pay tax?” This case study aims to shed light on these commonly asked questions. The example provided is not from one of our clients but is based on an actual Federal Court case between the taxpayers, Rusanova, and the Commissioner of Taxation.

In this case, an Australian resident Russian couple received over $1.6 million in unexplained bank deposits and more than $67,000 in interest. The funds involved a Russian father-in-law who was a seafood exporter, a series of Australian companies, and a generous friend who loaned money in $20,000 tranches.

Background

Between 2012 and 2016, an Australian resident husband and wife had an estimated $1,636,000 deposited into their bank accounts. The ATO became curious when neither spouse had lodged tax returns in the mistaken belief that they had not earned any income.

The money deposited, they said, was a gift from the wife’s father and therefore not assessable income. Curiously, there were no records produced to support the deposits and not a single text or email notifying that money had been remitted or acknowledging its receipt.

In addition, a friend of the couple deposited money into the husband’s account including a series of $20,000 transactions over about a week. These, the friend said, were interest-free loans with no agreed terms but an expectation that they would be repaid. The friend could not remember how he was requested to make the loans and there were no loan documents, emails, or texts disclosed to support the loans. Around the same time as the loans were being advanced, there was evidence of the husband ‘repaying’ amounts in excess of what had been lent. In addition, documents show the husband transferred a Porsche Cayenne to his friend in Russia, said to be repayment of the loan.

Compounding the issue were the four directorships of Australian companies held by the husband, none of which had lodged tax returns. One of the companies was a seafood wholesaler, distributing the product of his father-in-law’s American registered Russian export company. The dedicated son-in-law stated that he was merely trying to develop his father-in-law’s business during 2010 and 2016, without remuneration.

ATO Audit and Objection

In 2017, a covert tax audit utilised entries in the couple’s bank accounts to assess their income tax liability and the ATO issued a default assessment based on the unexplained deposits and expenses. The couple objected to the assessment and this objection was partly allowed. A second assessment was then issued to which the couple again objected before the Administrative Appeals Tribunal (AAT) on the grounds that the assessment was excessive.

Can the Tax Commissioner really decide how much tax you should pay?

The Tax Commissioner has the power to issue a ‘default assessment’ when you haven’t filed your tax returns or activity statements on time. This means the ATO decides how much tax you owe based on their estimates, not on what you’ve reported.

The issue with a default assessment is not just the Tax Commissioner deciding how much tax you should pay – it’s the potential for a hefty penalty. For each default assessment issued, there can be an administrative penalty of 75% of the tax-related amount. In some cases, this penalty can increase to 95% if a taxpayer has a history of not complying with their tax obligations.

In this case, the couple’s challenge is proving that the money they received was a genuine gift, which wouldn’t be taxed. While genuine gifts of money are not taxable, the burden is on the taxpayer to prove that the gift is truly a gift, if the ATO asks. The AAT held that, “absent any reliable evidence…, there is no proper basis to make any findings as to whether the deposits constitute part of the applicants’ taxable income or not.”

Deficiency of proof

The couple’s stance that the deposits were either gifts from the father or loans from a friend were rejected by the AAT. This is despite an affidavit and evidence from the wife’s father stating that the amounts transferred to them were gifts. The couple did not demonstrate what their income actually was to prove the Tax Commissioner’s assessment was unreasonable, and they could not substantiate that the gifts were indeed gifts from a very generous father.

The Federal Court dismissed the couple’s appeal with costs, leaving the Tax Commissioner’s default tax assessment and penalties in place.

Conclusion

This case highlights the critical importance of maintaining clear records and documentation when receiving significant sums of money, especially from overseas. Whether funds are gifts, loans, or any other form of transfer, the burden of proof lies with the taxpayer to demonstrate the nature of these transactions to the Australian Tax Office (ATO). Failure to do so can result in substantial tax liabilities, penalties, and legal costs, as seen in this Federal Court decision.

If you are receiving money from overseas or dealing with complex financial transactions, it’s essential to seek professional advice to avoid potential pitfalls. Contact Investax Tax Specialists for expert guidance on managing your tax obligations and ensuring that your financial affairs are in order. We’re here to help you navigate these complexities and protect your financial well-being.

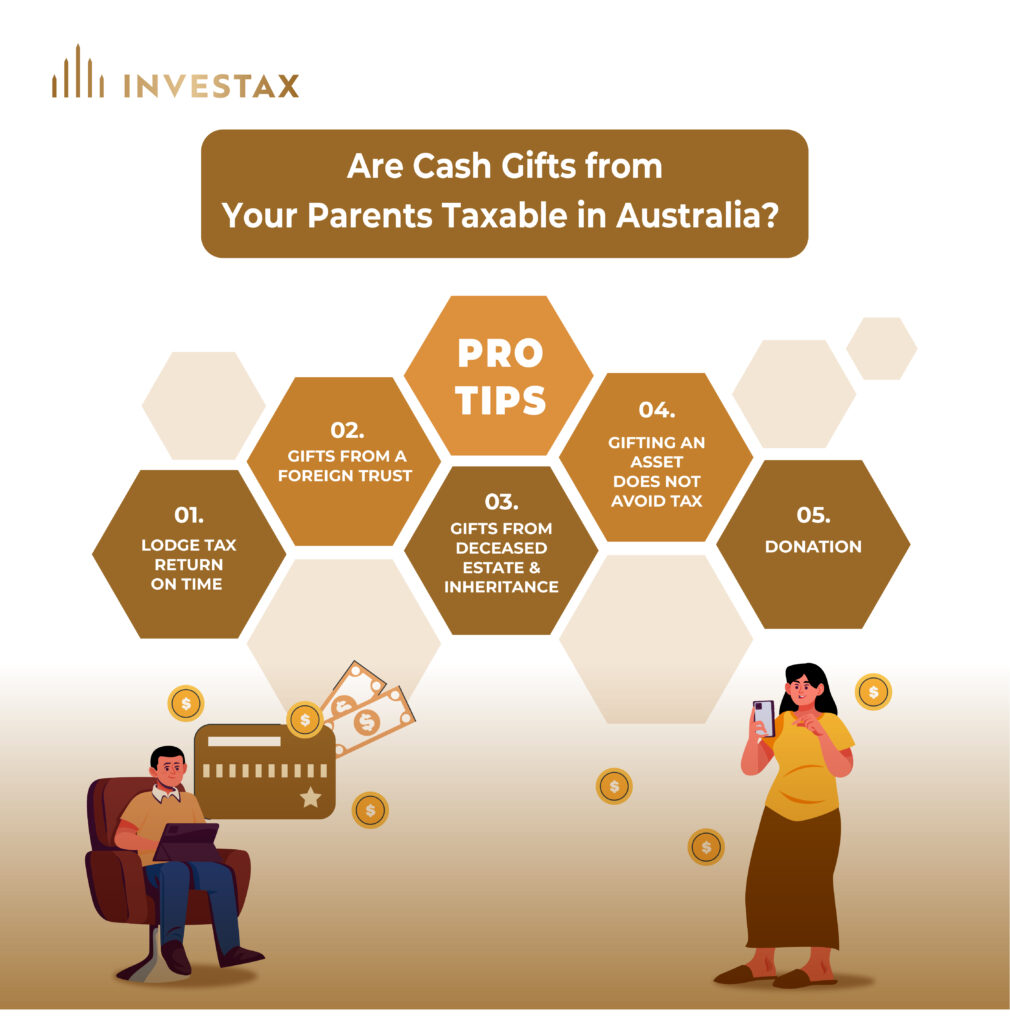

Pro Tips from Investax

A gift of money or assets from an individual is generally not taxed if the gift is given voluntarily, nothing is expected in return, and the gift giver does not materially benefit.

However, there are some circumstances where tax might apply.

1. Lodge Tax Return on Time – Lodging your tax return on time is crucial to avoid serious complications, as demonstrated in this case study. When tax returns are not filed, it raises red flags with the Australian Tax Office (ATO), increasing the likelihood of an audit. In the absence of a lodged tax return, the ATO has the authority to issue a default assessment, determining your tax liability based on their own estimates rather than your actual income. This can lead to significant tax debts, hefty penalties, and the burden of proving that the ATO’s assessment is incorrect. Filing your tax return promptly not only keeps you compliant with the law but also helps prevent the costly and stressful consequences of an ATO audit and default assessment.

2. Gifts from a foreign trust – If you are a tax resident of Australia and the beneficiary of a foreign trust, it’s possible that at least some of the amounts paid to you (or applied for your benefit) will need to be declared in your tax return. This applies even if you were not the direct beneficiary of the foreign trust, for example, a family member received money from a foreign trust and then gifted it to you. This applies to cash, loans, land, shares, etc.

3. Gifts from Deceased Estate & Inheritance – Money or property you inherit from a deceased estate is often not taxed. However, there are circumstances where capital gain tax (CGT) might apply when you dispose of an asset you inherited. For example, if you inherit your parents’ house, CGT generally does not apply if:

- The property was their main residence; and

- Your parents are Australian residents for tax purposes; and

- You sell the property within 2 years.

However, CGT is likely to apply if for example:- You sell your parents former main residence more than 2 years after you inherit it; or

- The property you inherit was not your parents’ main residence; or

- Your parents were not Australian tax residents at the time of their death.

Managing the tax implications of gifts and inheritance can quickly become complex. To ensure the best outcome for your beneficiaries and properly handle the tax aspects of an inheritance, contact Investax Tax Specialists for expert assistance. These considerations are often overlooked when drafting or updating a will.

4. Gifting an asset does not avoid tax – Gifting an asset does not avoid CGT. If you receive nothing or less than the market value of the asset, the market value substitution rule might come into play. The market value substitution rule can treat you as having received the market value of the asset you donated or gifted when calculating any CGT liability.

For example, if Mum & Dad buy a block of land then eventually gift the block of land to their daughter, the ATO will look at the value of the land at the point they gifted it. If the market value of the land is higher than the amount that Mum & Dad paid for it, then this would normally trigger a CGT liability. It does not matter that Mum & Dad did not receive any money for the land. Mum & Dad might have a CGT bill for land they gifted with nothing in return.

5. Donation – Donations of cryptocurrency might also trigger CGT. If you donate cryptocurrency to a charity, you are likely to be assessed on the market value of the crypto at the point you donated it. You can only claim a tax deduction for the donation if the charity is a deductible gift recipient and the charity is set up to accept cryptocurrency.

General Advice Warning

The material on this page and on this website has been prepared for general information purposes only and not as specific advice to any particular person. Any advice contained on this page and on this website is General Advice and does not take into account any person’s particular investment objectives, financial situation and particular needs.

Before making an investment decision based on this advice you should consider, with or without the assistance of a securities adviser, whether it is appropriate to your particular investment needs, objectives and financial circumstances. In addition, the examples provided on this page and on this website are for illustrative purposes only.

Although every effort has been made to verify the accuracy of the information contained on this page and on our website, Investax Group, its officers, representatives, employees and agents disclaim all liability [except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this website or any loss or damage suffered by any person directly or indirectly through relying on this information.